Bloomberg Commodity Index Rises Over 90% Since March Last Year... Crude Oil Prices Hit Highest Level in 7 Years

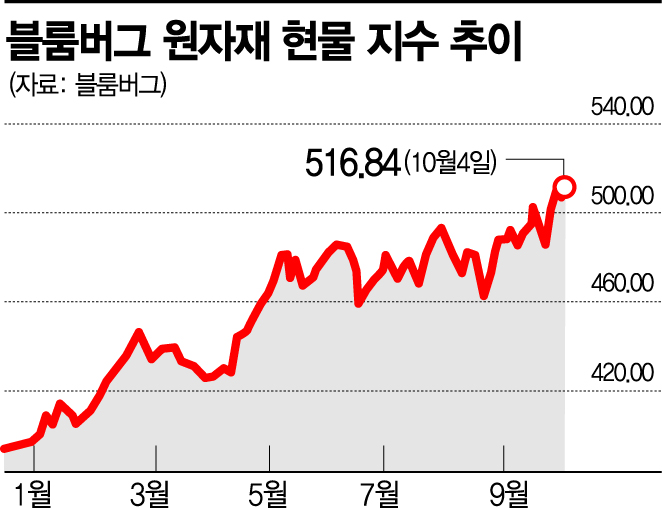

[Asia Economy Reporters Byunghee Park and Hyunui Cho] The Bloomberg Commodity Spot Index, which reflects the prices of 23 commodities including energy, metals, and grains, hit an all-time high on the 4th (local time). This indicates that inflation and the energy crisis occurring worldwide are intensifying. International crude oil prices reached their highest level in seven years.

On this day, the Bloomberg Commodity Spot Index rose 1.1% from the previous day to 516.84, surpassing the previous all-time high recorded in 2011, Bloomberg News reported.

The index had fallen to a four-year low in March last year due to the spread of COVID-19 but has since risen more than 90%, setting a new record.

With the U.S. Federal Reserve's tapering (reduction of asset purchases) imminent and China's power shortages, global economic uncertainty has increased, and the rising trend in commodity prices continues, raising concerns that the risk of stagflation has further increased.

The commodities with the largest price increases were concentrated in the energy sector. Natural gas prices, the cause of Europe's power shortage, rose 129% this year alone, recording the highest increase among the 23 commodities. Diesel, heating oil, gasoline, and crude oil also recorded increases in the 60% range.

Aluminum (47%) and copper (20%) prices rose due to supply shortages, and droughts in Brazil pushed coffee (56%) and sugar prices (27%) higher. Cotton futures prices surged to a 10-year high last week, signaling future increases in clothing prices.

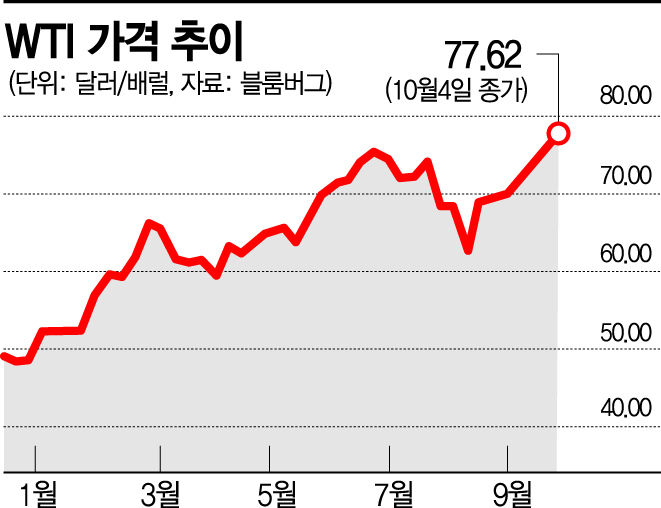

Meanwhile, on the New York Mercantile Exchange (NYMEX), November West Texas Intermediate (WTI) crude oil prices closed at $77.62 per barrel, up $1.74 (2.3%) from the previous trading day, marking the highest level since 2014. December Brent crude also closed at $81.26, up $1.98 (2.50%), reaching a three-year high.

Despite increased demand, news that oil-producing countries are not pursuing large-scale production increases pushed oil prices higher on this day. OPEC+ (the Organization of the Petroleum Exporting Countries (OPEC) member countries and non-OPEC allies) decided at a ministerial meeting to maintain the existing agreement to increase production by 400,000 barrels per day.

Opinions are divided on whether the upward trend in commodity prices will continue.

Optimists argue that the commodity market has entered a long-term boom phase known as a ‘supercycle,’ and that the energy transition from fossil fuels to eco-friendly fuels will create new demand, continuing the upward trend centered on copper, nickel, and others.

On the other hand, some predict that the upward momentum in commodity prices may ease as the low-interest-rate environment that underpinned the price increases fades. With the Fed expected to begin tapering within the year, the dollar index is at its highest level in a year. Typically, when the dollar rises, settlement costs increase, causing commodity prices to fall.

There is also a forecast of a paradoxical situation where prices that have risen too much trigger increased production, leading to higher supply and ultimately causing commodity prices to decline.

Commodity trading company Glencore plans to resume operations at the Mutanda mine in the Democratic Republic of Congo, which had been suspended for two years, by the end of this year after consultations with the Congolese government, aiming to increase copper and cobalt production. China's economy, suffering from power shortages, is also a variable. If steel production decreases due to factory shutdowns, demand for iron ore could weaken.

Fatigue from rapid price increases is already appearing in some commodities. Copper prices have risen about 20% this year but have fallen about 13% from the peak in May.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.