Since April, 4 Departments Collaborate on Climate Change Response TF

Aiming to Report Climate Change Measures to the Monetary Policy Committee Within the Year

[Asia Economy Reporter Eunbyeol Kim] As the Earth suffers from extreme weather events such as heatwaves and large wildfires in the United States, floods in China and Western Europe, central banks are also rushing to respond to climate change. Following the United States, Europe, and Japan, the Bank of Korea, South Korea's central bank, has established a climate change response organization and is conducting related research. This reflects a trend where central banks, traditionally known as 'inflation fighters' prioritizing 'price stability,' are expanding their scope to various issues including climate change, employment and inequality, and central bank digital currencies (CBDCs).

Bank of Korea Launches 'Climate Change Response Task Force'

According to the Bank of Korea on the 26th, since April, the bank has been operating a 'Climate Change Response Task Force (TF)' involving four departments: the Financial Stability Department, the Research Department, the Monetary Policy Department, and the Foreign Exchange Operations Center. The Director of the Financial Stability Department serves as the secretary, and the Deputy Governor in charge leads the TF. Since April, they have held regular monthly meetings and have completed the third meeting. Within this year, the various climate change response measures assigned to each department will be consolidated into a report to be submitted to the Monetary Policy Committee. Whether the report will be made public has not yet been decided.

The reason the Financial Stability Department serves as the TF secretary is that conducting a 'stress test' is essential to developing climate change response measures. The Bank for International Settlements (BIS), the Basel Committee on Banking Supervision (BCBS), and others refer to climate change risk as a 'Green Swan' and recommend that banks and financial supervisory authorities measure climate risks. They have also released methodologies to measure climate change risks according to global standards. Therefore, it was deemed important for the Financial Stability Department to lead climate change risk stress testing and assess how vulnerable South Korea is to climate change issues.

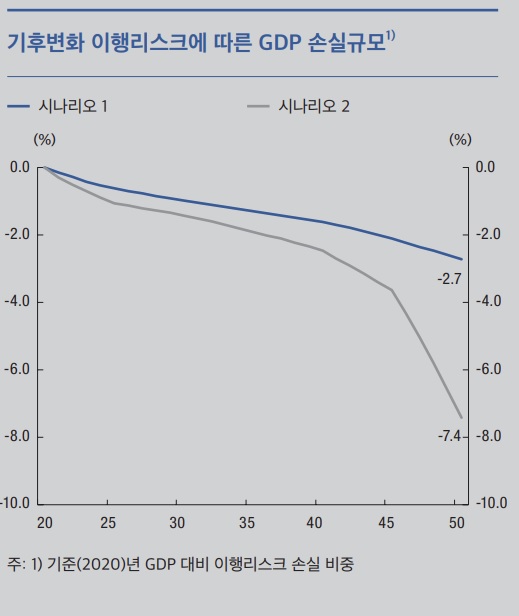

In the financial stability report released last month, the Bank of Korea also announced the results of a 'bank sector stress test considering climate change transition risks.' The test estimated that due to climate change transition risks, the gross domestic product (GDP) could decrease by up to 7.4% by around 2050 compared to 2020. Under scenarios that limit the global average temperature rise to between 1.5 and 2.0℃, the GDP in 2050 is estimated to shrink by 7.4% compared to 2020, and if limited to below 1.5℃, it is expected to fall by 2.7%. Under the same conditions, the BIS ratio of domestic banks is expected to deteriorate by 5.8 percentage points and 2.6 percentage points, respectively. Since the transition to a low-carbon economy could impact high-carbon industries, the report points out the need for policy responses such as industrial structure transformation.

The Research Department mainly analyzes the impact of climate change on South Korea's industrial structure and macroeconomy. It is responsible for understanding how the economy and prices will be affected as industries shrink while reducing the share of high-carbon industries and as traditional high-carbon energy sources decline. It is also monitoring what climate change measures major overseas central banks are implementing. The department studies how the financial system changes with industrial restructuring, and based on these results, the Financial Stability Department also researches the damage to the financial system. According to the financial stability report released by the Bank of Korea in March, the exposure of domestic financial companies (banks, insurance companies, securities firms, asset managers, pension funds, etc.) to nine high-carbon industries was estimated at around 411 trillion won as of the end of last year. This amount includes loans, bonds, and equity investments in high-carbon industries. The Bank of Korea pointed out that "while carbon neutrality policies are accelerating and Environmental, Social, and Governance (ESG) practices are spreading, financial companies' responses remain insufficient."

The Monetary Policy Department is identifying what direct monetary policies can be introduced to respond to climate change. Climate-related monetary policies discussed in academia include ▲ changes to financial institution lending systems ▲ preferential treatment for financial institutions with large ESG exposure ▲ financial support (financial intermediation support loans) for ESG-related companies. However, since definitions of what constitutes green industries, ESG-related companies, and the Bank of Korea's responsibilities are not yet established, foundational work is needed. A Bank of Korea official said, "It is easy to say that the central bank will provide more funds to ESG companies in words, but it is necessary to select and define which companies qualify as ESG companies," adding, "Policies must be crafted precisely." Additionally, the Foreign Exchange Operations Center is considering investment methods related to ESG companies.

US, Japan, Europe... Overseas Central Banks Also Actively Respond to Climate Change

Discussions on climate change responses are also active overseas. The Bank of Japan (BOJ) has established a climate change response support system. At the Monetary Policy Meeting held on the 15th and 16th, BOJ decided to provide funds at near-zero interest rates to financial institutions that contribute to decarbonization through investments and loans. It plans to purchase foreign currency green bonds and analyze scenarios for financial institutions.

The European Central Bank (ECB) is considered the first among central banks to introduce climate change policies. The ECB is considering reflecting climate risks in economic analyses during bond purchase programs. This can be interpreted as the central bank taking the lead in providing more financial support to companies classified in the ESG sector. Specifically, the ECB is building statistical data for climate change response and has been conducting stress tests since 2022. From 2023, it plans to disclose climate-related information in corporate bond purchases (CSPP).

The US Federal Reserve (Fed) prioritizes climate change stress testing and has requested information from large banks. Fed Chair Jerome Powell stated at a Senate hearing on the 15th that they are considering using climate change stress scenarios to enhance banks' awareness and resilience to extreme weather events.

Bank of Korea officials collectively noted that discussions on central banks' climate change measures have become a regular topic at recent international organization events. Climate change issues cannot be resolved by any single country alone, and unlike during the Donald Trump administration, the US has shifted to showing interest in climate change issues.

A Bank of Korea official said, "Reducing carbon emissions may immediately impact Korean companies economically, but the damage from not reducing emissions is equally significant, so various ripple effects must be studied together," adding, "Climate change issues are often mentioned in summer but discussions on countermeasures tend to fade in autumn. Since shocks from climate change are no longer distant, the Bank of Korea, government, and related institutions must work together."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.