Samsung Electronics Launches First Automotive Image Sensor Brand

ISOCELL Auto 4AC to Supply Automakers in Second Half of Year

Automotive Image Sensor Market Surpasses Mobile Growth

Rapid Demand Growth Expected for Automotive Image Sensors in Autonomous Vehicles

[Asia Economy Reporters Su-yeon Woo and Hyun-jin Jeong] Samsung Electronics has announced its full-scale entry into the market by launching a new vehicle image sensor product. The company plans to strengthen its automotive electronics business through vehicle image sensors, a core component of autonomous vehicles, while expanding its market share in the non-memory semiconductor sector.

On the 13th, Samsung Electronics released the cutting-edge vehicle image sensor ‘ISOCELL Auto 4AC’. An image sensor is a system semiconductor that converts external images captured by a camera into digital signals, acting as the visual nerve of a vehicle.

The ISOCELL Auto 4AC is the first product launched since Samsung Electronics introduced the vehicle image sensor brand ‘ISOCELL Auto’ in 2018. It is scheduled to be installed in surround view monitors and rear cameras of new models from global automakers launching in the second half of this year.

Samsung ISOCELL Auto 4AC: Enhanced Visibility and Minimized Blind Spots

This product features improved visibility of the road and surrounding environment in real time and enables precise object identification. To achieve this, it incorporates 1.2 million pixels into a 3.7-megapixel 1/3-inch optical format. The optical format refers to the area in the camera module where the image sensor receives the image formed through the external lens.

Samsung Electronics applied its ‘Corner Pixel’ technology for the first time in this product. Corner Pixel is a vehicle image sensor-specific pixel design technology that places a large 3.0-micrometer (μm; 1 μm = one-millionth of a meter) photodiode for low light and a small 1.0 μm photodiode for high light within a single pixel.

It provides 120dB HDR high-definition images without afterimages even in environments with significant brightness differences, such as dark tunnels or underground parking exits. By adjusting the sensor’s exposure time longer, it mitigates the ‘LED flicker’ phenomenon, allowing accurate recognition of traffic information displayed by LED headlights and traffic signals.

Vehicle Image Sensor Market Growing Rapidly at 11% CAGR

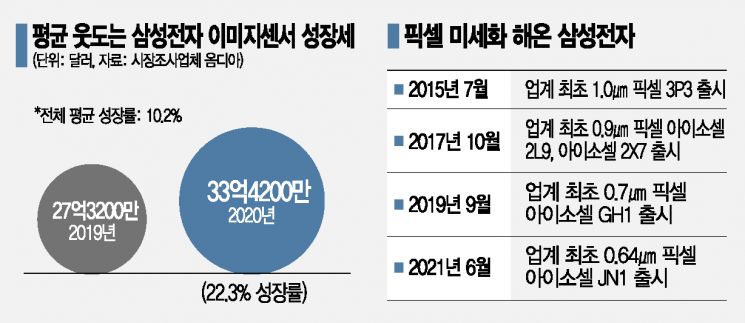

Samsung Electronics has realized this technology in vehicle image sensors based on its expertise developed in mobile image sensor development. As of last year, Samsung holds the second position in the mobile image sensor market, closely trailing industry leader Sony.

According to market research firm TSR, the global image sensor market this year is overwhelmingly dominated by mobile devices, accounting for 78.6% ($16.043 billion), while vehicle image sensors make up only 7.7% ($1.572 billion). However, the compound annual growth rate (CAGR) from 2021 to 2024 shows vehicle image sensors growing at 11%, compared to 6.8% for mobile, indicating the vehicle image sensor market’s superiority in growth speed and potential.

This is due to the expected increase in the number and performance of camera sensors installed in future autonomous vehicles, driving demand for vehicle image sensors. Recently, automakers have been trending toward autonomous driving technologies that exclude expensive LiDAR and radar, instead increasing the use of camera sensors. Tesla, a leader in autonomous driving technology, has declared its intention to implement ‘Pure Vision’ technology using only pure camera sensor technology for next-generation autonomous driving.

Generally, automotive components are directly linked to human safety and thus require more rigorous testing. They must meet strict standards for quality, durability, and lifespan, which entails significant development time and cost. Although the entry barrier is high, once a product contract is secured, it guarantees a stable and large-scale demand base.

Additionally, vehicle image sensors have higher added value than mobile products, making this market essential for increasing overall image sensor semiconductor market share. As of last year, the market leader by volume is U.S. semiconductor company Onsemi-Aptina with a 38.3% share, followed by OmniVision (18.8%) and Sony (9.7%).

Samsung Continues to Expand Vehicle Semiconductor Lineup, Strengthening Automotive Business

Samsung Electronics plans to accelerate its automotive electronics business by continuously launching new products under the vehicle image sensor brand ‘ISOCELL Auto’ and expanding its lineup of vehicle semiconductors including memory, processors, and LEDs. Especially, by gaining recognition for product performance and safety from automakers with stringent supply standards, Samsung can speed up collaboration with domestic and international automakers.

Previously, Samsung Electronics succeeded in mass-producing the world’s first 128Gb embedded memory semiconductor (eUFS) for vehicles in 2017, and in 2019 supplied the next-generation infotainment system processor ‘Exynos Auto’ to German automaker Audi. In April, it also launched the intelligent headlamp ‘Pixel LED’ for future vehicles.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.