[Asia Economy Reporter Kim Eun-byeol] The Chinese yuan, which had been strong since the second half of last year, may shift to a weakening trend, raising concerns about increased volatility in the Asian currency markets.

According to the report titled "Assessment of Recent Yuan Exchange Rate Trends and Future Outlook," released on the 3rd by Lee Sang-won, Deputy Specialist, and Kim Sun-kyung, Researcher at the International Finance Center, expectations for yuan strength that had deeply rooted in the foreign exchange market since the second half of last year may somewhat weaken.

The report stated, "The middle of this year marks a turning point where the main drivers in the foreign exchange market shift from economic differentiation to inflation and monetary policy differentiation. At such a time, if the yuan, which influences the direction of Asian emerging market currencies, changes its course, volatility could increase."

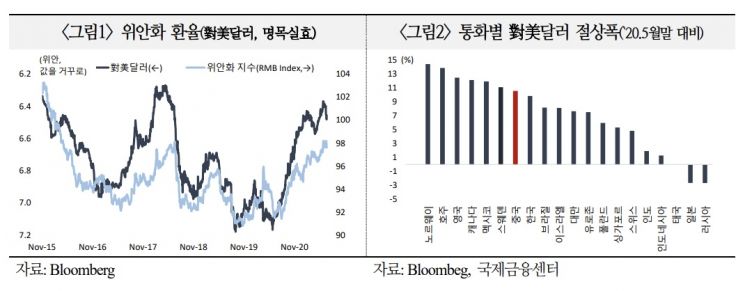

The yuan-dollar exchange rate fell from around 7.1 yuan per dollar in May last year to about 6.4 yuan per dollar recently, indicating a strong yuan trend. Since the COVID-19 outbreak, the yuan has appreciated by an exceptional 10.5% against the US dollar as a managed floating currency, compared to other countries' currencies.

However, the deputy specialist and others noted, "Considering the economic slowdown and seasonal supply-demand factors in the second half of this year, it is difficult to expect the clear conditions for yuan strength seen in the second quarter to be maintained. This marks a point where the strong yuan expectations deeply rooted in the foreign exchange market since the second half of last year may somewhat weaken."

In particular, despite the COVID-19 crisis last year, China entered an economic recovery phase earlier than other regions, so the slowdown phase is expected to arrive quickly, which is likely to lead to a weaker yuan, the report pointed out.

The International Finance Center found that overseas investment banks' growth forecasts for China drop from 8.1% in the second quarter to 6.3% in the third quarter and 5.2% in the fourth quarter this year.

The center noted that if the US dollar continues to weaken in the international financial market and the proportion of Chinese companies converting export proceeds into yuan increases, conditions for yuan strength could persist, but the likelihood of this happening is low.

First, after the June Federal Open Market Committee (FOMC) meeting of the US Federal Reserve, the dollar index, which measures the value of the dollar, rose from 89.829 on the 31st of last month to 91.899 on the 21st of this month.

Also, the proportion of Chinese export companies converting dollars into yuan exceeded 60% until the first quarter of this year but dropped to around 50% in April and May. Export companies' currency conversion tends to induce dollar weakness.

Based on this analysis, the two researchers stated, "The outlook for major currencies with significant influence in the global foreign exchange market, such as the US dollar and the yuan, may shift. Attention should be paid to the possibility of increased exchange rate volatility."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)