300 Ready-to-Eat Home Meal Kits from Restaurants

Ssg.com Product Sales Increase by 760%

Popular for Being Cheaper Than Restaurants

Also Released as Meal Kits in Collaboration with Retailers

[Asia Economy Reporter Lim Hye-seon] Seoul’s Samgakji restaurant ‘Montan’ collaborated with Hyundai Department Store to create a home meal replacement (HMR) version of its signature dish, ‘Udae Galbi Jipbul Gui’ (grilled premium ribs over straw fire). The response has been explosive. Since its first release in August last year, the ‘Montan Jipbul Gui Feast Set’ has been offered every Thursday with 500 sets, selling out within 5 minutes each time. Even after increasing to 1,000 sets, it continues to sell out. Traditional restaurants like Yongsan’s Yongmun Haejangguk and Jongno’s Imun Seolleongtang are also now available for easy home enjoyment.

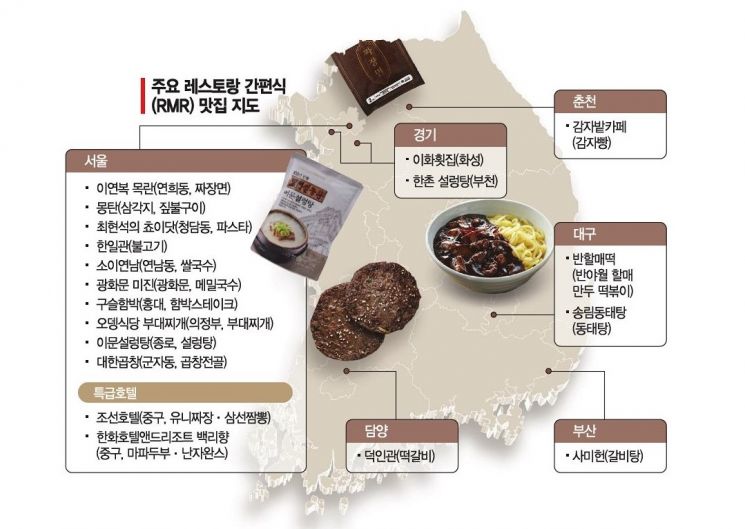

300 Popular Restaurant Menu Items Now Available as HMR

According to the distribution industry on the 27th, as of January, the number of restaurant home meal replacement (RMR) products sold domestically has surpassed 300. Market Kurly offers about 220 RMR products, a 44% increase compared to January last year. The total sales volume of RMR products throughout last year increased by 144% compared to the previous year. SSG.com also sells over 50 products nationwide. From July to December last year, RMR product sales increased by 760% compared to the same period the previous year.

Well-known restaurants line up on the list. These include ‘Gwanghwamun Mijin’, with over 60 years of tradition; Chef Lee Yeon-bok’s ‘Mokran’; the famous Myeongdong eatery ‘Geumsan Jemyunso’; Pyongyang cold noodle specialist ‘Bongpiyang’; and the Vietnamese restaurant ‘Le Hoi’ in Itaewon. Franchise brands such as ‘Gangnam Myeonok’, ‘Two Plus Deungsim’, ‘Seokgwan-dong Tteokbokki’, and ‘VIPS’ are also featured. Popular items include ‘Samihen’ galbitang from Busan, marinated pork neck grilled from Incheon’s representative meat restaurant ‘Sungui Garden’, and grilled beef panini from Itaewon’s Italian restaurant ‘La Cucina’. Prices tend to be 10-20% cheaper than dining in the restaurant, making them somewhat expensive for HMR but highly popular due to the convenience of enjoying famous restaurant dishes at home.

Distribution Industry Accelerates Collaboration with Popular Restaurants

There are also products launched through collaborations between distributors and popular restaurants. Emart’s Peacock brand is a prime example. Starting in 2013 with Peacock’s collaboration on Samwon Garden’s Baektang and Hongtang soups, the Peacock collaboration products have steadily introduced new items each year, now totaling about 70 varieties. Approximately 25 restaurants have partnered with Peacock, including Choma, Jackson Pizza, Odeng Sikdang, Jinjin, and Dowroom. Emart has also developed meal kits featuring famous restaurant dishes such as ‘Matichina Jjajangmyeon’, ‘Peacock Odeng Sikdang Budae Jjigae’, ‘Yuno Chubo Chadol Udon’, and ‘Sichuan Mala Beef Hot Pot’.

Michelin Guide-listed fine dining restaurants have also released HMR products. Chef Lee Jun of Restaurant Swanie introduced ‘Dowroom Carbonara’. Chef Choi Hyun-seok’s ‘Choi Dot’ signature dish, ‘Truffle Cream Ravioli’, sold out quickly with over 5,000 units in the first shipment.

Products launched by luxury hotels are also gaining attention. Shilla Stay’s Unijjajang and Samseon Jjamppong surpassed 250,000 units sold within five months of release. Walkerhill Hotel & Resort’s ‘Myeongwolgwan Galbitang’ and ‘Ondal Yukgaejang’ sales more than doubled last year compared to the previous year.

Restaurants that once required lining up to dine have entered the home meal replacement market due to social distancing measures limiting in-store operations, making survival through offline sales difficult. The Ministry of Agriculture, Food and Rural Affairs forecasts that the domestic HMR market will expand from 32.164 trillion won in 2018 to 50 trillion won by 2022. A distribution industry official explained, "Home meal replacements will become more segmented and evolve, ranging from gourmet foods to health foods."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.