Carrie Lam, Hong Kong Chief Executive, and 11 Other Sanctioned Individuals Face New Account Restrictions

Impact on International Dollar Transactions Cannot Be Ignored...Fear of Secondary Boycotts

Banco Delta Asia Bankrupt in 2005 After Becoming Subject to North Korea Sanctions

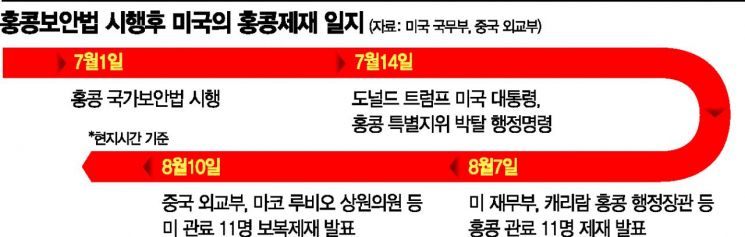

[Asia Economy Reporter Hyunwoo Lee] Chinese state-owned banks in Hong Kong have joined the U.S. in imposing sanctions on Hong Kong, leaving the relevant authorities bewildered. Despite pressure from Hong Kong financial authorities, these banks have not wavered in their intention to restrict financial services to sanctioned individuals such as Carrie Lam, the Chief Executive of Hong Kong.

On the 12th (local time), Bloomberg News reported, citing local sources in Hong Kong, that Chinese state-owned banks in Hong Kong, including Bank of China, China Construction Bank, and Industrial and Commercial Bank of China (ICBC), are cautiously considering restricting the opening of new accounts for 11 U.S.-sanctioned Hong Kong officials, including Chief Executive Carrie Lam. According to sources, at least one of these banks is expected to implement restrictions on new account openings for individuals targeted by U.S. sanctions. Foreign banks in Hong Kong, such as Citibank, have already suspended accounts of sanctioned individuals and intensified investigations on their clients.

It is highly unusual for Chinese state-owned banks to join U.S. sanctions on Hong Kong. This move is particularly notable given that Hong Kong financial authorities have requested banks not to comply with U.S. sanctions. The Hong Kong Monetary Authority (HKMA) stated on the 9th that U.S. government sanctions do not correspond to United Nations international sanctions and have no legal effect in Hong Kong.

The participation of Chinese state-owned banks in U.S. sanctions is analyzed as a result of fear of U.S. secondary boycotts (third-party sanctions). In 2005, the U.S. government froze North Korean accounts at Banco Delta Asia (BDA) as part of sanctions against North Korea and placed BDA on the secondary boycott blacklist. Subsequently, BDA went bankrupt due to massive withdrawals by customers and avoidance of transactions by financial institutions.

Although the U.S. dollar has been weakening recently, its position in international settlements remains dominant. There is significant concern that failure to comply with U.S. sanctions could lead to exclusion from the international settlement system. According to Bloomberg's data, the dollar-denominated liabilities of China's four major banks (Bank of China, China Construction Bank, Industrial and Commercial Bank of China, and Agricultural Bank of China) amounted to $1.1 trillion at the end of last year, and China's holdings of U.S. Treasury securities reached $1.0718 trillion. If the U.S. imposes additional sanctions restricting Hong Kong-based banks' dollar purchases, it could deal a fatal blow to the Chinese economy.

According to the Hong Kong South China Morning Post (SCMP), Yu Yongding, former member of the Monetary Policy Committee of the People's Bank of China, warned at a discussion hosted by the Chinese state media Xinjingbao that "The U.S. can impose financial sanctions in any form, so the Chinese government must prepare for the worst-case scenario worse than the current situation," adding, "The U.S. will not only sanction Chinese banks but may also seize Chinese assets overseas."

He explained, "The 2012 case where Kunlun Bank, a subsidiary of China National Petroleum Corporation (CNPC), was cut off from the dollar payment system due to transactions with Iran could be repeated," and "If additional financial sanctions are imposed, China's options to counter them will be limited."

In 2012, the Barack Obama administration sanctioned Kunlun Bank for making approximately $100 million in profits through transactions with Iran's Tejarat Bank, along with dealings with six Iranian banks and facilitating payments for the Islamic Revolutionary Guard Corps (IRGC). China protested, but Kunlun Bank eventually announced the suspension of transactions with Iran in 2018.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.