In January, when bonuses are paid, credit loans have typically seen sharp declines,

but this time, the decrease was limited to 223 billion won.

Meanwhile, margin loans at securities firms surged by nearly 3 trillion won.

While 22.4 trillion won i

The long-standing pattern of office workers using their year-beginning bonuses to pay off loans in January has been broken. Over the past month, the outstanding balance of unsecured loans at major commercial banks decreased by 223 billion won, marking the smallest decline in the past five years. In contrast, investors’ deposits-funds set aside for stock investments-rose by nearly 16 trillion won during the same period, and margin loans from securities companies increased by almost 3 trillion won. Analysts say that, amid the ongoing boom in the domestic stock market, even bonus funds are now flowing into the stock market.

Less Repayment of Unsecured Loans in January Compared to Previous Years... 22.4 Trillion Won in Demand Deposits Withdrawn

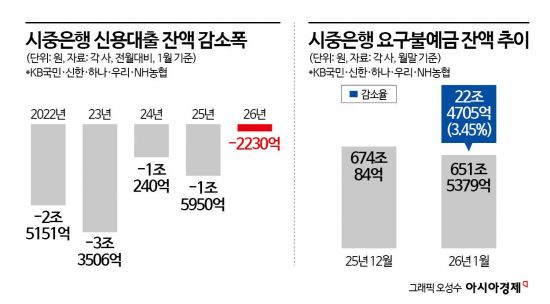

According to the financial sector on February 3, the outstanding balance of household unsecured loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at 104.7455 trillion won at the end of January, a decrease of 223 billion won (0.21%) over the month.

Typically, January is a period when many office workers use their bonuses to pay off unsecured loans, leading to a significant drop in such loans. However, this year, the decrease was limited to about 200 billion won. Looking at the time series since 2022, this is the smallest decline for January in the past five years. The decreases were ▲2.5151 trillion won in 2022, ▲3.3506 trillion won in 2023, ▲1.024 trillion won in 2024, and ▲1.595 trillion won in 2025, a stark contrast to the trillion-won scale declines seen in previous years. A commercial bank official explained, "If you look closely, new loans did not increase significantly. The main factor was that households repaid less of their loans compared to previous years."

The funds did not flow into demand deposits, either, which are considered standby funds at banks. In fact, demand deposits saw a clear outflow. As of the end of January, the five major banks’ demand deposit balance was 651.5379 trillion won, down 22.4705 trillion won (3.45%) in just one month. Typically, demand deposits decline in January, mainly among corporations, due to VAT payments and bonus distributions. However, during the same period last year, the decrease was only about 3.83 trillion won, making this year’s drop much larger. This indicates that the traditional pattern of bonus funds flowing into banks in January is changing.

Funds Leaving Banks Move to Stock Market... Standby Funds at Securities Firms Increase by 15.8 Trillion Won

The financial sector believes these funds have moved into the stock market. In fact, with the KOSPI surpassing the 5,000 mark this year and maintaining its strength, the trend of funds flowing directly from banks to the capital market is becoming more pronounced.

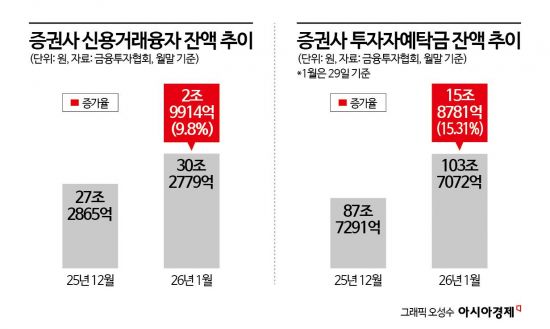

Investors’ deposits at securities firms, which serve as standby funds for stock investments, reached 103.7072 trillion won as of January 29, an increase of 15.8781 trillion won (15.31%) over the month. The reduced decline in bank unsecured loans and the decrease in demand deposits have been offset by a surge in investors’ deposits at securities firms.

Notably, while the outstanding balance of bank unsecured loans barely decreased, margin loans-where investors borrow money from securities firms using stocks or other assets as collateral-increased. The outstanding balance of margin loans at securities firms stood at 30.2779 trillion won at the end of January, up 2.9914 trillion won (9.8%) over the month. This indicates a growing trend of investors maintaining their bank loans while additionally borrowing from securities firms.

A financial industry official said, "With the strong performance of the domestic stock market, individuals are increasingly eager to invest in stocks, and the time that liquid funds remain in banks is rapidly decreasing. This trend is especially evident at the beginning of the year, when liquidity increases due to bonuses and other factors."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)