Korea Investment & Securities and NH Raise Second-Half KOSPI Targets

KB Securities: KOSPI Could Reach 3240 in First Half of Next Year

Brokerages Say "Government's Stock Market Revitalization Policies Could Push KOSPI Above 3000"

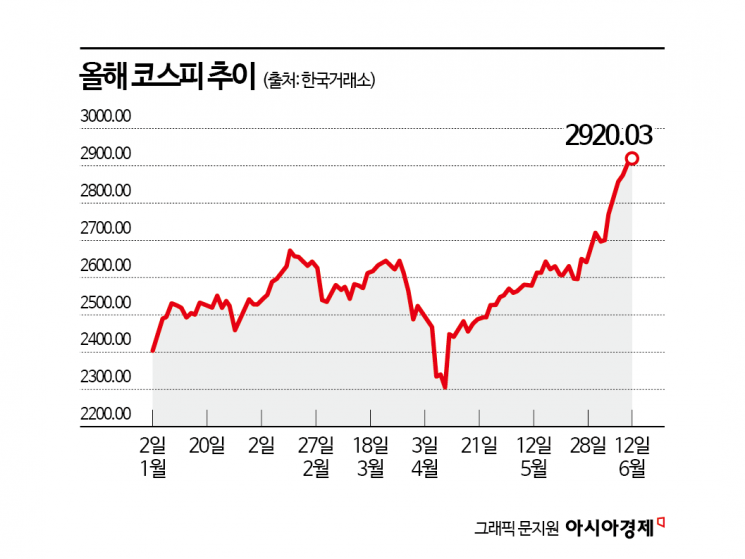

The KOSPI has risen for seven consecutive trading days, recovering to the 2920 level. As this strong upward momentum continues, securities firms are also raising their forecasts for the KOSPI to above the 3000 mark for the second half of the year. There are expectations that stock market revitalization policies under the Lee Jaemyung administration will prove effective.

According to the Korea Exchange on June 13, the KOSPI closed at 2920.03 the previous day, up 0.45% from the prior trading day. Since the beginning of June, the KOSPI has shown an unstoppable upward trend. From June 2 to June 12, the index rose for seven straight sessions, gaining more than 8% compared to the end of last month. This is the first time the KOSPI has recovered the 2900 level since January 18, 2022, about three years and five months ago. During the same period, the KOSDAQ also climbed, reaching 789.45 and approaching the 800 mark. It rose 7.50% compared to the end of last month.

With the KOSPI’s rally continuing, securities companies are raising their forecasts for the second half of the year. NH Investment & Securities had previously set its second-half KOSPI forecast at 2350 to 3000. However, it now predicts the index could climb as high as 3100. Kim Byungyeon, a researcher at NH Investment & Securities, stated, "Expectations for resolving discount factors in the Korean capital market are being accompanied by rapid net buying from foreign investors." He added, "Depending on the speed and content of legislative passage, and whether additional pending bills are realized, the forward price-to-book ratio (PBR) could reach 1.01 times, which means the 3100 level is also possible."

Korea Investment & Securities also revised its KOSPI band for the second half of the year from the previous 2400-2900 range to 2600-3150. Kim Daejun, a researcher at Korea Investment & Securities, said, "This is based on the government's stock market revitalization policies," emphasizing, "We have factored in additional increases in return on equity (ROE) due to stronger shareholder returns and improved corporate earnings in our index outlook. The index trajectory is expected to see a correction in the third quarter and a rebound in the fourth quarter."

There are also projections that the index will surpass the 3200 level in the first half of next year. KB Securities recently set its first-half target for next year at 3240 in a report. Lee Euntaek, a researcher at KB Securities, said, "Investment, which slowed in winter, is expected to pick up, and risk appetite is also likely to recover. As the Federal Reserve is expected to announce a rate cut, the market's liquidity environment should improve." He added, "Domestically, we can expect the easing of China's ban on Korean cultural content and a recovery in domestic demand, and next year, the possibility of a North Korea-U.S. summit resuming should also be considered."

On the 12th, the KOSPI index opened at 2909.99, up 2.95 points from the previous trading day. Dealers are working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. 2025.6.12. Photo by Kang Jinhyung

On the 12th, the KOSPI index opened at 2909.99, up 2.95 points from the previous trading day. Dealers are working in the dealing room at the Hana Bank headquarters in Jung-gu, Seoul. 2025.6.12. Photo by Kang Jinhyung

However, there are also views that the KOSPI has already reached its limit. iM Securities set its second-half KOSPI band at 2500-2850. Lee Woongchan, a researcher at iM Securities, said, "The issue is that corporate earnings are slowing due to declining exports, yet index valuations are rising because of improvements in corporate governance and domestic demand stimulus?an irony." He continued, "Since expectations for new government policies and the possibility of a stronger won have led to a rapid rally over the past month even before the presidential election, I believe there will be limits to further index gains."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.