Number of Franchise Brands Declines for the First Time Since Statistics Began

Average Sales per Store Increase Slightly Despite Economic Downturn

Due to the impact of the economic downturn, the number of franchise brands in the dining-out sector decreased last year for the first time since related statistics began to be published. Despite high inflation and economic recession, the average sales per franchise store slightly increased, maintaining a relatively stable growth trend compared to the average sales of small business owners.

According to the 2024 Franchise Business Status Statistics released by the Korea Fair Trade Commission on the 9th, the number of franchise brands nationwide as of the end of last year was 12,377, a 0.4% decrease from the previous year (12,429). This is the first decline since the statistics began to be published in 2019.

The growth in the number of franchisors and franchise stores also slowed. The number of franchisors increased by 0.5%, and the number of franchise stores increased by 3.4% last year, but the growth rates decreased by 6.5 percentage points and 1.8 percentage points respectively compared to the previous year.

The Fair Trade Commission interpreted the slowdown in the franchise industry's external growth as "due to delayed recovery of the domestic economy caused by high inflation and high interest rates, and worsening business conditions for self-employed individuals."

The average sales per franchise store amounted to 350 million KRW (as of the end of 2023), a 3.9% increase from the previous year (340 million KRW). Compared to the average sales of small business owners, which decreased by 30 million KRW (14.9%) from 230 million KRW to 200 million KRW during the same period, franchise store sales maintained a relatively stable growth trend, the Fair Trade Commission evaluated.

The average sales per franchise store increased across all major detailed sectors. The growth rates were highest in services (4.6%), wholesale and retail (3.5%), and dining-out (3.0%) sectors, in that order.

In the dining-out sector, the average sales amounted to 323 million KRW, a 3.0% increase from the previous year (314 million KRW). The average amount paid by franchise stores as differential franchise fees was 23 million KRW, a decrease of 5 million KRW from the previous year (28 million KRW).

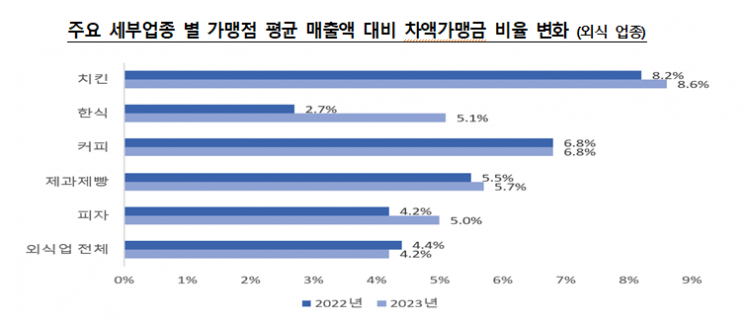

The ratio of the average differential franchise fee to the average sales per franchise store also slightly decreased to 4.2% from 4.4% the previous year. By detailed sector, the chicken sector had the highest ratio at 8.6%. This was followed by coffee (6.8%), bakery and confectionery (5.7%), Korean food (5.1%), and pizza (5.0%) sectors.

The differential franchise fee refers to the amount paid regularly or irregularly by franchise store operators to franchisors for goods, raw materials, ingredients, equipment, and real estate rent supplied by the franchisor, exceeding the appropriate wholesale price, and corresponds to a type of distribution margin.

The average sales per franchise store in the service sector was approximately 186 million KRW, a 4.6% increase from 178 million KRW the previous year. The proportion of brands with average sales per franchise store exceeding 300 million KRW was 26.1%, up 1.2 percentage points from the previous year, while the proportion of brands with average sales below 100 million KRW also increased by 1.9 percentage points to 40.4%.

The average sales per franchise store in the wholesale and retail sector, including convenience stores, was 560 million KRW, a 3.5% increase from 540 million KRW the previous year. The proportion of brands with average sales per franchise store exceeding 300 million KRW decreased by 1.0 percentage point to 33.3%, while the proportion of brands with average sales below 100 million KRW remained largely unchanged at 27.0%.

The top franchisors by average sales per sector were identified as Kyochon Chicken (chicken), So Plus (Korean food), A Twosome Place (coffee), Tous Les Jours (bakery and confectionery), No More Pizza (pizza), U2M (curriculum education), Chahong Room (beauty and hairdressing), Cleantopia (laundry), GS25 (convenience store), Innisfree (cosmetics), and Jeong Kwan Jang (health supplements).

The Fair Trade Commission stated, "Given the delayed domestic recovery due to accumulated high inflation and other factors, it is a crucial time for solid growth through improving the management environment of franchise store owners rather than simple external expansion of the franchise industry." It added, "We plan to continue monitoring the implementation status to ensure that this year's institutional improvements related to essential items are properly established in the field."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.