Sharp Increase in Short-Term Funding by NPL Specialized Firms

Rise in Sales Due to Financial Company Insolvencies

Recovery Rates Decline Amid Real Estate Slump

Profitability Worsens, Borrowing Burden Intensifies

Short-term funding for specialized non-performing loan (NPL) companies such as United Asset Management Co. (UAMCO) and Daishin F&I is rapidly increasing. As the number of bad loans at financial institutions rises exponentially, the sale of NPLs has surged, leading to increased short-term funding to acquire these NPLs. However, with the real estate market downturn causing a decline in NPL recovery rates, the actual performance of NPL companies has significantly deteriorated. Worsening cash flow has turned the previously increased short-term borrowings into a financial burden. Concerns are emerging that as financial institutions offload their bad loans, even NPL companies?used as a means of debt restructuring?may become insolvent.

UAMCO and Daishin F&I Increase Short-Term Borrowings for NPL Purchases

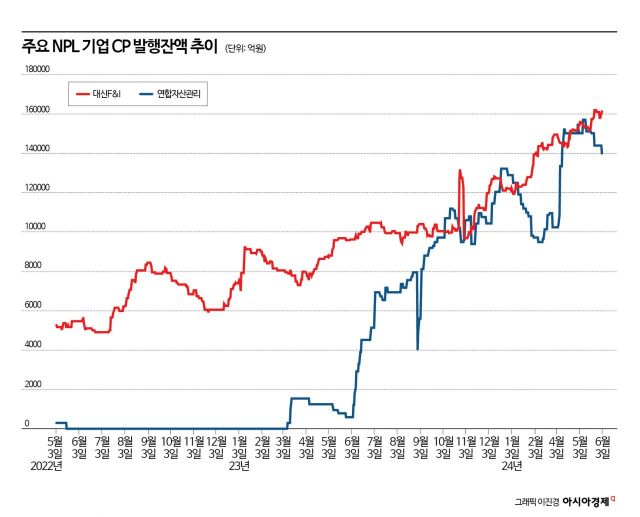

According to the investment banking (IB) industry on the 7th, UAMCO, an NPL specialist company jointly established by banks, has increased its commercial paper (CP, including electronic short-term bonds) balance to 1.4 trillion KRW. Considering that the CP balance was only 60 billion KRW in May last year, the CP issuance balance has increased more than 20 times in one year. It reached a record high of 1.57 trillion KRW around the end of April before net repaying about 170 billion KRW. Daishin F&I, a specialized NPL company affiliated with Daishin Financial Group, also increased its CP balance from the 800 billion KRW range to 1.6 trillion KRW during the same period.

The increase in funding by NPL companies is to competitively purchase NPLs. The delinquency rates of banks and other financial institutions have risen, and the sale of NPLs by financial companies aiming to control delinquency and bad loan ratios has surged. According to Korea Ratings, the amount of NPL sales through competitive bidding by banks last year was about 5.5 trillion KRW based on outstanding principal balance (OPB), a 126% increase compared to 2022. Quarterly, NPL sales exceeded 1 trillion KRW in the third quarter of last year and surged to 2.2 trillion KRW in the fourth quarter, just before the annual closing.

The competitive bidding market for bank NPLs is dominated by five specialized NPL companies?UAMCO, Daishin F&I, Hana F&I, Woori F&I, and Kiwoom F&I?holding over 95% of the market share. These five companies purchase about 5 trillion KRW worth of NPLs annually and recover the loans through auctions and public sales. The higher the recovery rate, the greater the profitability, but if the recovery rate falls, losses must be absorbed.

Among them, UAMCO has maintained the top position for a long time with a market share (MS) of 39.6%. UAMCO purchased NPLs worth 1.9033 trillion KRW through competitive bidding by banks last year. The second-ranked company, Hana F&I, aggressively purchased NPLs, raising its market share to 23.7%, with purchases amounting to 1.1418 trillion KRW last year.

Declining NPL Recovery Rates Due to Real Estate Slump... Concerns Over Insolvency Amid Prolonged High Interest Rates

Although NPL sales and purchases are rapidly increasing, the profitability of NPL companies has deteriorated. They competitively purchased NPLs by borrowing short-term funds, but the recovery rates of purchased NPLs are falling due to the real estate market slump. UAMCO posted an operating profit of 17.3 billion KRW last year, a decrease of over 150 billion KRW from 172.1 billion KRW in 2022. Net profit also plunged from 127.6 billion KRW to 9.7 billion KRW. Daishin F&I’s operating profit shrank from 172.7 billion KRW in 2022 to 38.9 billion KRW last year. A UAMCO official stated, "The decrease in net profit last year was due to reflecting a 52.8 billion KRW loss on loan valuation caused by interest rate fluctuations."

Along with the decline in recovery rates, interest expenses from external borrowings are also contributing to worsening profitability. Daishin F&I’s CP funding interest rate rose to around 5% for a 6-month maturity. Even assuming an annual average CP balance of 1 trillion KRW, interest expenses reach 50 billion KRW per year. UAMCO’s CP funding interest rate is in the high 3% range. Assuming a CP balance similar to Daishin F&I’s, annual interest expenses amount to 30 to 40 billion KRW. Including other borrowings beyond CP, interest expenses increase further.

As performance deteriorates and high interest rates persist, worsening cash flow has turned the previously increased short-term borrowings into a financial burden for NPL companies. Short-term borrowings with maturities of 3 months to 1 year are continuously maturing, and with delayed NPL recoveries, companies are busy managing their borrowings. If the recovery rate does not improve due to economic conditions or interest rates do not fall, the borrowing burden will inevitably increase.

However, with signs of prolonged high interest rates and a real estate market slump, concerns are growing over the insolvency of NPL companies. An industry insider said, "UAMCO and Daishin F&I have significantly increased CP issuance by relying on short-term funds for NPL purchase financing," diagnosing that "the bad loans of financial institutions are leading to the insolvency of specialized NPL companies."

A UAMCO official said, "The increase in short-term borrowings was inevitable due to the rise in bank NPL sales, and this is a common phenomenon among all specialized NPL companies." The official added, "In January this year, we issued 400 billion KRW worth of corporate bonds to convert short-term borrowings into long-term debt, and we plan to issue corporate bonds in June to secure investment funds for the second quarter, so there is no possibility of UAMCO becoming insolvent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.