[Asia Economy Reporter Yoo Hyun-seok] Courier companies that experienced rapid growth due to COVID-19 are expected to face a difficult period this year. With the easing of COVID-19 restrictions, consumers are returning to offline stores, and the economic slowdown is causing a consumption slump, signaling a slowdown in the growth rate of general parcel deliveries.

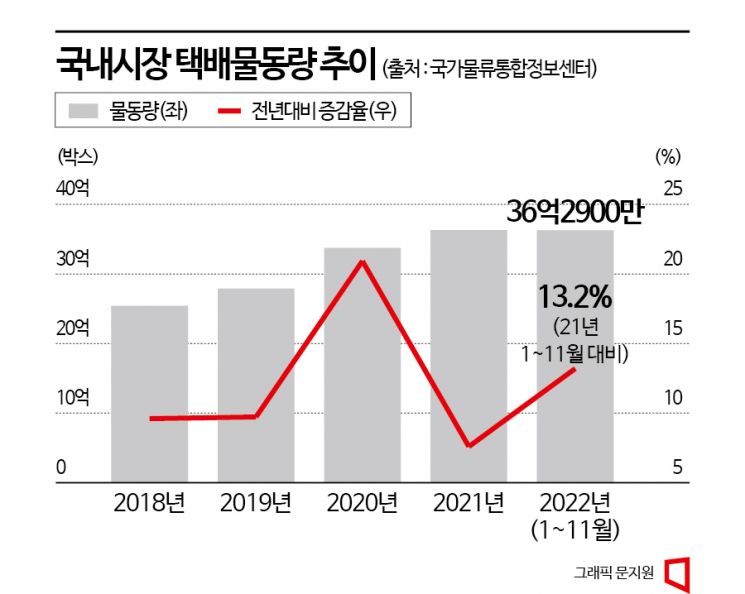

Domestic parcel volumes surged sharply due to COVID-19. As outdoor activities were restricted, more consumers shopped online, and parcels could be received contactlessly. According to the Korea Integrated Logistics Association, domestic parcel volumes were 2.789 billion boxes in 2019, increasing to 3.373 billion boxes in 2020, and 3.629 billion boxes in 2021. Although the total volume for last year has not yet been tallied, parcel volumes from January to November reached 3.73285 billion boxes, a 13.2% increase compared to the same period the previous year.

The increase in parcel volumes led to strong performances by CJ Logistics and Hanjin. Last year, CJ Logistics reported consolidated sales and operating profit of KRW 3.1134 trillion and KRW 411.8 billion, up 6.9% and 19.7% respectively from the previous year. Hanjin also saw increases, with sales of KRW 2.8493 trillion and operating profit of KRW 114.7 billion, up 13.8% and 15.4% respectively.

However, the details reveal a less optimistic picture. CJ Logistics’ parcel volume in the fourth quarter of last year was 426 million boxes, down 7.0% from the same period the previous year. Sales and operating profit were KRW 3.0234 trillion and KRW 112.3 billion, with sales decreasing by 1.1% year-on-year but operating profit increasing by 12.5%. Hanjin has not yet disclosed its fourth-quarter parcel volume. However, fourth-quarter sales rose 2.7% to KRW 720.6 billion, while operating profit fell 7.6% to KRW 23.2 billion. Both companies have seen their performance growth slow down.

This year is expected to be challenging. First, with the easing of COVID-19 restrictions, consumption is likely to shift from online back to offline. Additionally, the economic slowdown is expected to dampen the growth rate of general parcel deliveries.

Another burden is the intensifying competition in parcel delivery as Coupang expands its direct delivery business. Coupang obtained courier transport operator qualifications from the Ministry of Land, Infrastructure and Transport in 2021. Since June last year, it has been transferring volumes from existing courier companies to its delivery-specialized subsidiary, Coupang Logistics.

CJ Logistics and Hanjin plan to continue growing through customer diversification and overseas business expansion. Domestically, they aim to increase their parcel market share by expanding their customer base, while strengthening competitiveness in overseas markets where they are actively entering.

Last year, CJ Logistics unveiled the Gunpo Smart Fulfillment Center, equipped with advanced robotics and AI technologies. They have also expanded the application of these advanced technologies to overseas subsidiaries in Southeast Asia and India. A company representative explained, "As the cross-border e-commerce logistics market for international electronic commerce is rapidly growing, we are expanding the iHerb Global Zone Logistics Center and the international express center within the Incheon Airport Free Trade Zone."

Hanjin aims to increase its parcel market share to 20% this year. To achieve this, it is investing a total of KRW 285 billion to build the Daejeon Smart Mega Hub Terminal. It is also strengthening efforts to attract new customers. A Hanjin representative said, "We will attract volumes by expanding existing customer volumes and participating in specialized and new markets. We plan to reduce operating costs through capacity expansion such as the Daejeon Smart Mega Hub and increased investment in automation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.