Toss Bank, which marks its fourth anniversary, announced on October 20 that it has surpassed 13.75 million customers.

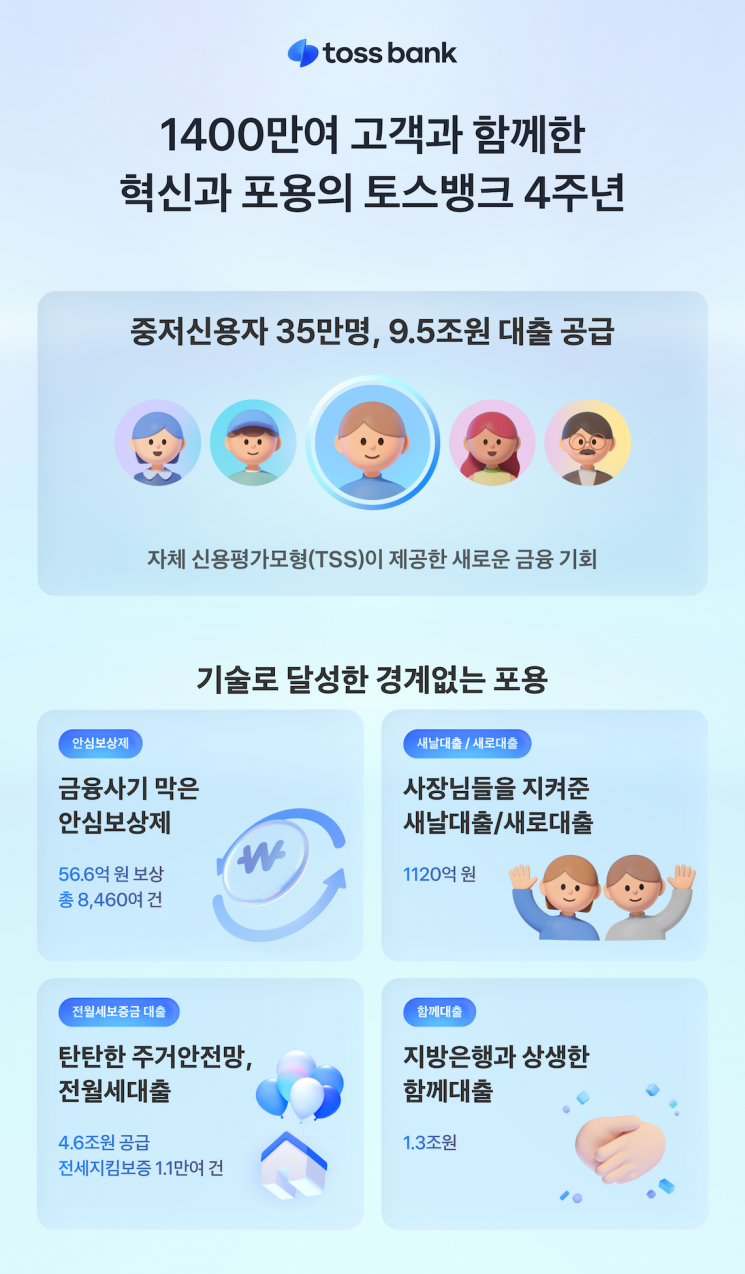

According to Toss Bank, its own monthly active users (MAU) have reached 10 million, and over the past four years, it has provided approximately 950 billion won in loans to 350,000 individuals with mid- to low-credit scores. Additionally, the bank has implemented inclusive finance initiatives, such as introducing the first non-face-to-face banking service for foreign residents in Korea among internet banks, and launching a braille check card for the visually impaired.

Furthermore, Toss Bank was the first in the banking sector to introduce the 'Safe Compensation Program,' which compensates phishing victims up to 50 million won and secondhand transaction fraud victims up to 500,000 won. To date, 8,466 customers have received compensation through this program.

Toss Bank also utilizes artificial intelligence (AI) to identify self-employed individuals at high risk of delinquency early and provides tailored debt adjustment programs. Through products such as 'New Loan for Business Owners' and 'New Day Loan for Business Owners,' 3,438 self-employed individuals have overcome the risk of delinquency.

A Toss Bank representative stated, "We will continue to break down the boundaries of finance through technology and strive to ensure that more people can experience financial opportunities tailored to them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![15-Year Veteran Field Mechanic Becomes AI Talent... Korean Air's Experiment [AI Era, Jobs Are Changing]](https://cwcontent.asiae.co.kr/asiaresize/319/2025121111232252273_1765419802.jpg)