Issuance of 50 Billion KRW Perpetual Convertible Bonds to Improve Financial Structure

Profit Expected to Rise on Increased Sales of High Value-Added Products Such as GDDR7

The stock price of Simmtech, a company specializing in printed circuit boards (PCBs) for semiconductors, is showing signs of movement. Despite the issuance of convertible bonds (CB) worth 50 billion KRW, market sentiment remains favorable. This is because the CB is a perpetual bond recognized as equity, which is expected to lower interest expenses and improve the company's financial structure. Additionally, there is growing anticipation that Simmtech, which had underperformed until the first quarter of this year, will see a turnaround starting from the second quarter.

According to the Financial Supervisory Service's electronic disclosure system on June 13, Simmtech announced on June 11 that it would issue 50 billion KRW worth of bearer, coupon, unsecured, perpetual private convertible bonds. The subscriber is a fund managed by KB Asset Management. Both the coupon rate and maturity interest rate are set at 4%. The maturity date is June 20, 2055, which is 30 years from the issuance date, giving the bond a perpetual nature.

The conversion price is 21,556 KRW. The number of shares to be issued upon conversion is 2,319,539, which accounts for 7.28% of the total number of shares. There is no refixing (conversion price adjustment) clause in case of a decline in market price. The conversion request period is from June 20, 2026, which is one year after the payment date, to October 22, 2028.

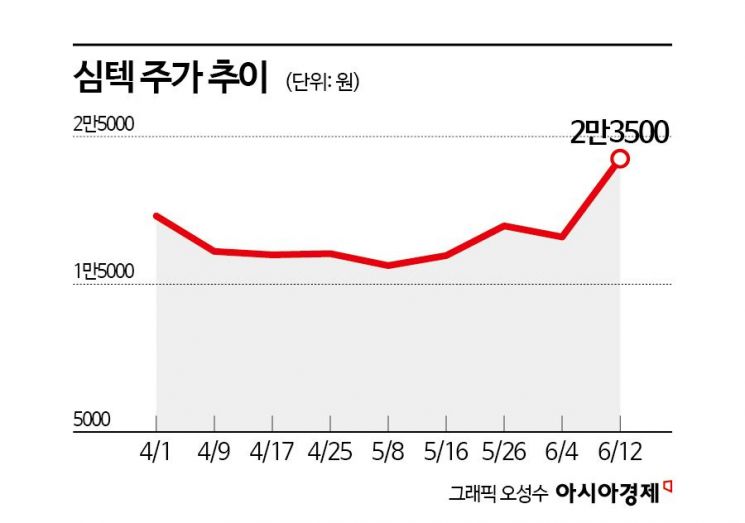

Typically, CBs pose a risk of diluting existing stock prices if converted to shares in the future, which is generally unwelcome by current investors. However, in Simmtech's case, the stock price actually rose following the CB issuance announcement. According to the Korea Exchange, Simmtech closed at 23,500 KRW the previous day, up 0.86% from the day before.

This is analyzed to be because the CB will be recognized as equity. As of the end of March, Simmtech's debt ratio stood at 250%, increasing its interest burden. As a result, Simmtech plans to use the funds raised from this 50 billion KRW CB issuance to repay existing debt. The interest rate on the existing loans is between 4% and 4.9%, so refinancing with the CB is expected to reduce interest expenses. In addition, the debt ratio is expected to decrease, thereby strengthening financial soundness.

At the same time, expectations that Simmtech will achieve a turnaround in the second quarter of this year are also being reflected in the stock price. Since Simmtech announced its first-quarter results on May 8, the stock price has been on an upward trend. Simmtech reported an operating loss of 16.3 billion KRW on a consolidated basis in the first quarter of this year. Net loss for the period was 36.2 billion KRW, with the deficit widening compared to the same period last year.

Kim Sowon, a researcher at Kiwoom Securities, explained, "Simmtech's monthly order volume has continued to rebound since bottoming out in the fourth quarter of last year, and the increase in orders accelerated further last month. As major customers are now nearing the end of inventory adjustments, earnings visibility for the second half of the year has improved." She also analyzed that profitability is expected to improve due to a decrease in the proportion of low-margin products and an increase in the share of high-margin products such as graphic DDR7 (GDDR7) and system-in-package (SiP).

Cho Hyunji, a researcher at DB Financial Investment, commented, "Concerns over funding have been partially resolved with the CB issuance. Although operating profit in the second quarter is expected to be at the break-even point, it is anticipated to increase each quarter, and expectations for the expansion of the GDDR7 market are likely to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.