Sharp Rise in Non-Performing Loans at Banks

Driven by Domestic Industries such as Real Estate, Wholesale and Retail, and Services

Urgent Need to Revitalize the Economy through Swift Supplementary Budget Execution

The economic recession chill has swept through the Gangnam commercial district as well. One of the representative hot places in Gangnam, the Garosugil shops in Sinsa-dong, have become desolate and empty. As of the fourth quarter of last year, the vacancy rate is a staggering 41.2%. Photo by Kang Jinhyung

The economic recession chill has swept through the Gangnam commercial district as well. One of the representative hot places in Gangnam, the Garosugil shops in Sinsa-dong, have become desolate and empty. As of the fourth quarter of last year, the vacancy rate is a staggering 41.2%. Photo by Kang Jinhyung

As the economic downturn continues, the volume of non-performing loans (NPLs)?classified as substandard or below?at major banks has surged significantly over the past two years. This increase is primarily attributed to a sharp rise in non-performing loans within domestic demand-driven industries, including real estate, wholesale and retail, and service sectors. With the prolonged slump in domestic demand, there are growing calls for urgent measures such as the rapid execution of an additional supplementary budget.

Non-performing loans surge led by domestic industries such as real estate, wholesale and retail, and services

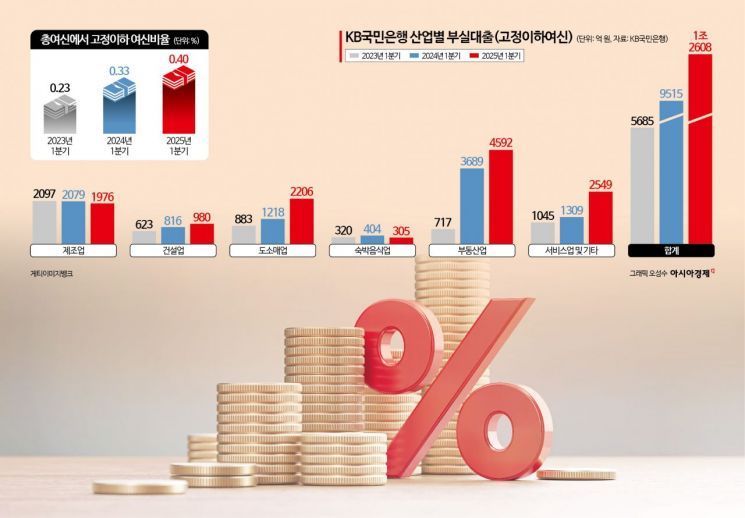

According to the financial sector on June 12, the ratio of substandard or below loans to total loans at KB Kookmin Bank in the first quarter was 0.40%, a sharp increase of 0.17 percentage points from 0.23% in the first quarter of 2023 over the past two years. Over the same period, Shinhan Bank’s NPL ratio rose from 0.28% to 0.34%, Hana Bank’s from 0.21% to 0.29%, Woori Bank’s from 0.19% to 0.32%, and NH Nonghyup Bank’s from 0.30% to 0.56%.

Non-performing loans refer to loans that financial institutions consider unlikely to be recovered due to low credit quality. Over the past two years, both individuals and companies unable to repay their bank loans have increased dramatically.

When broken down by industry, non-performing loans have risen most steeply in sectors closely tied to the domestic downturn, such as real estate, wholesale and retail, and services. At KB Kookmin Bank, which has the largest loan portfolio, the total volume of non-performing loans across all industries jumped from KRW 568.5 billion in the first quarter of 2023 to KRW 1.2608 trillion in the first quarter of this year, a 121.7% increase.

In the first quarter of this year, the real estate sector accounted for the largest share of non-performing loans at KB Kookmin Bank, reaching KRW 459.2 billion. In the first quarter of 2023, non-performing loans in real estate stood at just KRW 71.7 billion, but over two years, the figure soared by 540%. Two years ago, manufacturing had the highest volume of non-performing loans at KRW 209.7 billion, but this ranking has been overturned. Non-performing loans in manufacturing actually declined over two years, reaching KRW 197.6 billion in the first quarter of this year. In construction, non-performing loans increased from KRW 62.3 billion to KRW 98 billion over the same period.

This surge in non-performing loans in real estate and construction is attributed to the ongoing economic downturn and prolonged domestic demand slump, which have caused the real estate market to cool rapidly. According to the Bank of Korea, South Korea’s real GDP growth rate in the first quarter of this year was -0.2%, indicating negative growth, with construction investment dragging the growth rate down by 0.4 percentage points?a sign of severe weakness in the sector. Private consumption also pulled down GDP growth by 0.1 percentage points in the first quarter, further highlighting the prolonged domestic slump.

With non-performing loans in real estate and construction rising sharply, banks are cutting back on related lending. The Bank of Korea reports that at the end of the first quarter, loans to the real estate sector by domestic deposit-taking institutions totaled KRW 470.978 trillion, down KRW 2.5 trillion from the previous quarter. This is the first decline in real estate sector loans since the first quarter of 2013, marking a 12-year interval. A Bank of Korea official explained, "Due to weak demand for industrial real estate in regional areas and restructuring of real estate project financing (PF) by financial authorities, the sale and write-off of non-performing assets has led to a reduction in loans."

Following real estate, the largest increases in non-performing loans were observed in service industries and wholesale and retail sectors, all closely tied to domestic consumption. For example, at KB Kookmin Bank, non-performing loans in the service sector rose from KRW 104.5 billion in the first quarter of 2023 to KRW 254.9 billion in the first quarter of this year. Over the same period, non-performing loans in wholesale and retail increased from KRW 88.3 billion to KRW 220.6 billion. While the scale varies, other major banks reported similar trends. The prolonged domestic slump is believed to have driven up non-performing loans in these sectors.

Urgent need to revive domestic demand through swift supplementary budget execution

Experts believe that to overcome the severe domestic slump and revive the economy, the government must swiftly execute a supplementary budget and implement measures to boost the construction sector. Hyundai Research Institute has analyzed that the prolonged downturn in construction is holding back the Korean economy and that this issue must be addressed. Joo Won, head of economic research at Hyundai Research Institute, stated, "Unless we prevent the excessive downturn in construction, which is currently leading negative growth and instability in the job market, it will be difficult to expect meaningful economic improvement," adding, "The government should make supply-driven efforts to revitalize the construction sector, such as expanding investment in social overhead capital (SOC), within a range that does not trigger a real estate market bubble."

There are also opinions that a supplementary budget is essential to improve the business environment for self-employed people and to overcome the domestic slump. On this day, the Bank of Korea submitted an opinion to the National Assembly regarding the supplementary budget, stating, "It is crucial to promptly implement the supplementary budget and raise the actual execution rate in response to the domestic slump," while also noting, "However, the size of the supplementary budget should be determined through consultation between the National Assembly and the government, taking into account the economic situation and fiscal conditions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.