'Salaryman Legend' Yoon Seokgeum Makes Another Bold Move at Eighty

Aims to Restore Reputation with Preed Life... Will He End the "M&A Tragedy"?

Now Faces Off Against "Child-like" Coway in the Funeral Service Market

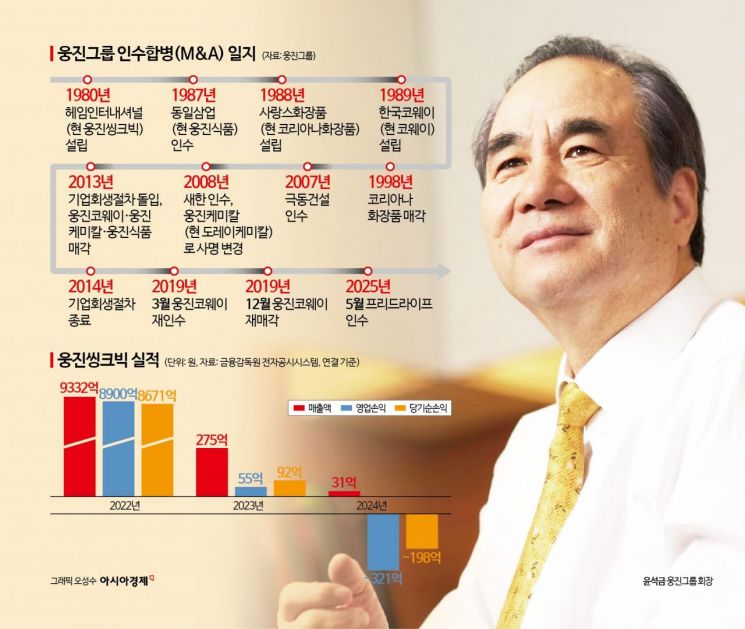

When it comes to "game-changing moves," Yoon Seokgeum, Chairman of Woongjin Group, is a name that comes to mind. Now, at the age of eighty, he has once again embarked on a major merger and acquisition (M&A). Although Chairman Yoon has always attracted attention on the M&A stage, the shadow of his failures has been just as prominent, giving rise to the phrase "M&A tragedy." Now, he is seeking to restore his reputation by acquiring the nation's leading funeral service provider, Preed Life, for 883 billion won.

According to industry sources on May 7, Chairman Yoon's latest decision is rooted in the reality that the group's growth engine has rapidly diminished. Woongjin Group surpassed 1 trillion won in sales in 2022, but its core affiliate, Woongjin ThinkBig, which accounts for 60 to 70 percent of total revenue, has seen its performance decline. On a consolidated basis, revenue dropped from 933.2 billion won in 2022 to 867.1 billion won last year, while operating profit fell from 27.5 billion won to 9.2 billion won. Net profit turned from a 3.1 billion won surplus to a 19.8 billion won deficit.

Woongjin ThinkBig has been directly impacted by the declining birthrate and shrinking school-age population. Woongjin sought a breakthrough by entering the adult education market, taking into account this structural change, but its business model, centered on education and publishing, faced limitations. As a result, the company turned its attention to the funeral service market.

Despite concerns over raising large-scale acquisition funds, Woongjin signed a contract on April 29 with private equity firm VIG Partners to acquire a 99.77 percent stake in Preed Life for 883 billion won. The market response was mixed. In particular, minority shareholders of Woongjin ThinkBig, whose payment guarantees were used in the deal, staged a protest the day after the contract was signed, voicing their opposition.

Analysts say these reactions are closely related to Chairman Yoon's past M&A history. In 2007, he acquired Kukdong Construction for 660 billion won, twice the market's expected price, but was hit hard the following year by a construction market slump triggered by the U.S.-led financial crisis. In an effort to save Kukdong Construction from management difficulties, he continued to inject funds, but ultimately, in 2012, both Kukdong Construction and holding company Woongjin Holdings entered court receivership, shaking the entire group. In the process, Woongjin lost core affiliates such as Woongjin Coway, Woongjin Chemical, and Woongjin Foods.

Four years after graduating from court receivership, in October 2018, Chairman Yoon was again in the media spotlight when he officially announced plans to bring Coway, which he described as "like a child," back into the group. He declared, "I want to send a message of hope that someone as poor and challenged as I am can try again. I will succeed no matter what." However, he ultimately faced the situation of having to sell Coway once more. The "salaryman success story" was tarnished again, and investor trust was damaged.

Chairman Yoon Seokgeum is attending the opening ceremony of the 'Woongjin History Museum' to commemorate the 42nd anniversary of the founding of Woongjin Group. Woongjin Group

Chairman Yoon Seokgeum is attending the opening ceremony of the 'Woongjin History Museum' to commemorate the 42nd anniversary of the founding of Woongjin Group. Woongjin Group

Because of these precedents, there are concerns that the acquisition of Preed Life could repeat past mistakes. In particular, it has been pointed out that most of the acquisition funds are being raised through borrowing. Woongjin plans to secure 600 billion won in acquisition financing, and on April 10, issued perpetual bonds worth 100 billion won at an annual interest rate of 5.8 percent through DB Securities and Woori Financial Capital. Woongjin's consolidated debt ratio last year stood at 414 percent, indicating weak financial stability, and interest expenses increased from 20.9 billion won in 2022 to 24.3 billion won last year, further adding to the financial burden.

Woongjin maintains that "this time is different." A Woongjin official explained, "In raising acquisition funds, we prioritized not worsening the company's financial structure, not burdening the market, and, above all, not diminishing shareholder value." According to an investment industry source, Chairman Yoon is focusing on creating synergy with existing affiliates, as well as developing funeral service products and business models. Amidst both concern and anticipation, Woongjin's stock price hit the daily upper limit on April 30, the day after the acquisition contract was signed.

Another interesting aspect of Chairman Yoon's recent moves is that Coway, formerly a Woongjin affiliate, is also preparing to enter the funeral service market. Coway plans to launch its funeral service business in earnest within the first half of this year through its subsidiary "Coway Life Solution," established in October last year. As both companies prepare to compete head-to-head under the banner of "total life care," attention is focused on whether Chairman Yoon's M&A tragedy will finally come to an end.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.