Summary of Recommendations from Two Major Proxy Advisory Firms: Neck and Neck

Introduction of Cumulative Voting System Becomes the Decisive Factor

National Pension Service Increasingly Likely to Hold the Casting Vote

The outcome of the management rights dispute at Korea Zinc has become uncertain. Ahead of the extraordinary general meeting scheduled for the 23rd, a proxy advisory firm that wields absolute influence over foreign investors issued a recommendation favorable to Chairman Choi Yoon-beom's side of Korea Zinc. This significantly reduces the possibility of the MBK-Youngpoong alliance taking control of the board, suggesting that the management rights dispute is likely to be prolonged.

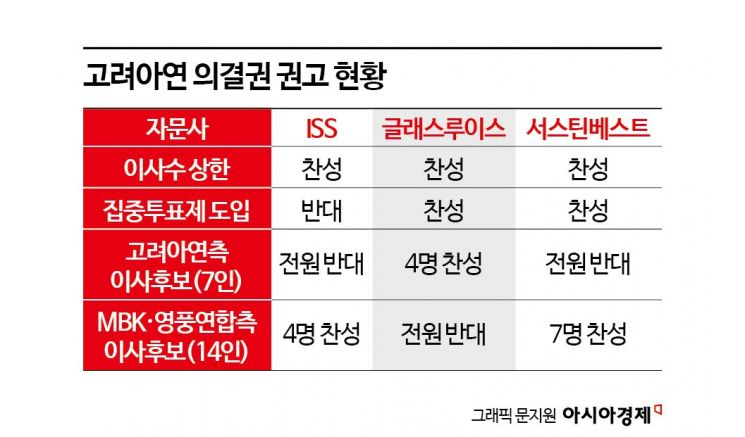

According to the investment banking (IB) industry on the 15th, the US proxy advisory firm Glass Lewis recommended approval of both the agenda to introduce cumulative voting and the agenda to limit the number of directors to 19 at Korea Zinc's extraordinary general meeting. Both agendas were proposed by Korea Zinc's side. Regarding new director candidates, Glass Lewis recommended approval only for the four candidates recommended by Korea Zinc. MBK Partners protested, saying, "It contains not only bias toward the existing management but also a logical contradiction between the reasons for supporting cumulative voting and the composition of the board." It is unusual to publicly refute recommendations from global proxy advisory firms.

This underscores the considerable influence of Glass Lewis. Together with ISS, they dominate over 90% of the global proxy advisory market. Korea Zinc's foreign shareholding ratio is about 7%, and most of these investors exercise their voting rights according to the recommendations of proxy advisory firms. In fact, recently, the California Public Employees' Retirement System decided to exercise its voting rights exactly according to ISS's recommendation.

Higher Possibility of Introducing Cumulative Voting... Lower Possibility of MBK Alliance Controlling the Board

Currently, Korea Zinc's board consists of 13 members. Except for Jang Hyung-jin, an advisor to Youngpoong Group, all are classified as personnel on Chairman Choi Yoon-beom's side. The ratio is 12 to 1. For MBK to control the majority of the board, they must overcome three hurdles: reject the introduction of cumulative voting, reject the agenda to cap the number of directors, and have their 14 recommended director candidates join the board. The MBK alliance seemed to gain the upper hand by increasing its shareholding to 40.97% through public tender offers and on-market purchases over the past few months. The gap with Chairman Choi Yoon-beom's side, estimated at around 34%, is about 7%.

However, with the positions of the two major proxy advisory firms clarified, Chairman Choi Yoon-beom's side has secured a footing to contest. Regarding new director candidates, Glass Lewis recommended approval only for the four candidates recommended by Korea Zinc, opposing all others. ISS recommended approval only for four candidates from the MBK alliance. Although ISS sided with the MBK alliance, their plan to control the majority of the board falls far short. Both proxy advisory firms recommended approval of the agenda to limit the board size to 19 members.

Regarding the introduction of cumulative voting, which has emerged as the biggest issue at this general meeting, Glass Lewis recommended approval, while ISS recommended rejection. The agenda to introduce cumulative voting, which applies the '3% rule' limiting voting rights to 3%, favors Chairman Choi Yoon-beom's side, whose shares are widely dispersed. Conversely, the MBK alliance, including Youngpoong Group and MBK Partners, whose shares are concentrated among a few, would see their voting rights drastically reduced to less than one-third. If cumulative voting passes, shareholders gain as many votes per share as the number of directors to be elected, enabling 'vote concentration' on specific candidates. In this case, it would be impossible for the MBK alliance to control the board. Sustainvest, one of Korea's top three proxy advisory firms, also recommended approval of cumulative voting, and the small shareholders' coalition 'ACT' publicly supported it.

The National Pension Service Emerging as the Casting Vote

Market attention is turning to the National Pension Service (NPS), the largest institutional investor in Korea. The NPS holds a 4.51% stake in Korea Zinc. Since Chairman Choi Yoon-beom's side can overcome the shareholding disadvantage backed by global proxy advisory firms, the National Pension Service is considered the casting vote. The combined shares of the MBK alliance, Chairman Choi Yoon-beom's side, foreign investors, and general shareholders excluding the NPS amount to less than 1%. The NPS is scheduled to hold a Stewardship Responsibility Committee meeting on the 17th to deliberate on the voting direction for Korea Zinc's general meeting.

According to guidelines on stewardship activities, the NPS is supposed to oppose the exclusion of cumulative voting and support its introduction. However, it may deviate from this principle if there are justifiable reasons. Han Seok-hoon, chairman of the Stewardship Responsibility Committee, is known as an opponent of cumulative voting, having expressed in 2018, during the amendment of the Commercial Act mandating cumulative voting, that "forcibly introducing a system that is increasingly being abolished abroad is rather anachronistic." During the recent management rights dispute at Hanmi Science's general meeting, the NPS decided to remain 'neutral' rather than for or against. Neutrality means exercising voting rights proportionally according to shareholders' approval and disapproval ratios.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![$29 Monthly Subscription AI Plant Appliance... US Startup Challenges LG [CES 2026]](https://cwcontent.asiae.co.kr/asiaresize/319/2026010819285284553_1767868133.png)