Samsung Electronics Falls to 6.8% Market Share,

Down 0.5 Percentage Points from Previous Quarter

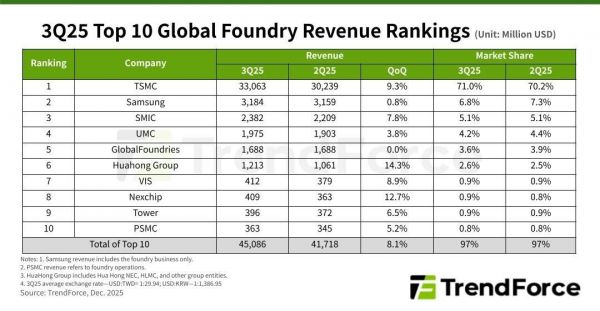

This year, Taiwan's TSMC continued its dominance in the global foundry (semiconductor contract manufacturing) market, recording a 71% market share. Samsung Electronics, in second place, saw a slight increase in sales compared to the previous quarter, but its market share fell to the 6% range, widening the gap between the two companies.

According to market research firm TrendForce on December 12, the combined revenue of the top 10 global foundry companies in the third quarter of this year reached $45.1 billion, up 8.1% from the previous quarter.

TrendForce analyzed that steady demand for artificial intelligence (AI) chips in the high-performance computing (HPC) sector, as well as new consumer electronic chips and IC devices, drove overall revenue growth. Advanced processes at 7-nanometer nodes and below, along with high value-added wafers, were also key contributors.

By company, TSMC posted $33.063 billion in revenue in the third quarter of this year, accounting for 71% of the market share. This figure represents a 0.8 percentage point increase from the previous quarter.

TrendForce stated, "TSMC saw both wafer shipments and average selling price (ASP) increase quarter-on-quarter, driven by aggressive inventory buildup for Apple's new iPhones and the full-scale mass production of Nvidia's Blackwell platform."

During the same period, Samsung Electronics recorded a 6.8% market share, down 0.5 percentage points from the previous quarter. Its revenue reached $3.184 billion, supported by a slight rebound in utilization rates compared to the previous quarter.

As a result, the market share gap between the two companies widened from 62.9 percentage points in the second quarter to 64.2 percentage points in the third quarter.

China's SMIC, in third place, maintained a 5.1% market share, unchanged from the previous quarter.

TrendForce analyzed, "The demand outlook for 2026 is becoming more cautious due to geopolitical risks. The increase in foundry utilization rates in the fourth quarter of this year is expected to be limited, and as a result, the revenue growth of the top 10 companies in the fourth quarter will likely slow significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.