LG Innotek Rises for Nine Consecutive Trading Days, Hits 52-Week High

LG Household & Health Care Falls for Four Straight Days, Marks 52-Week Low

Among LG Group Stocks, Innotek Sees Biggest Gain This Year... Household & Health Care Lags the Most

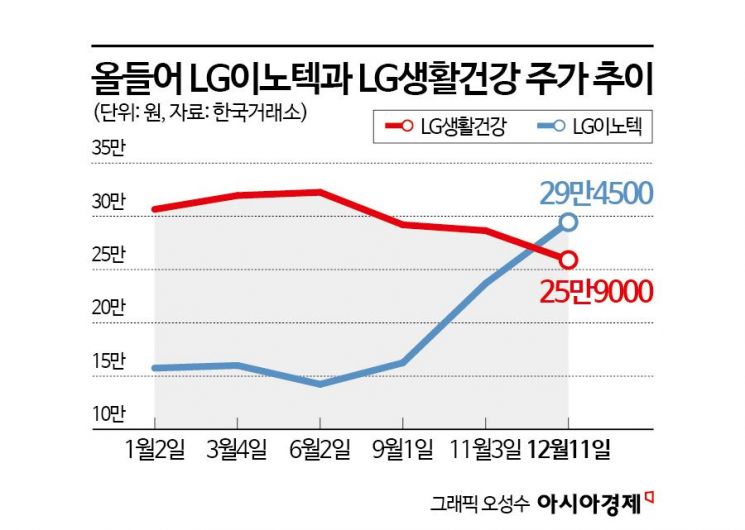

Last year, both LG Innotek and LG Household & Health Care experienced simultaneous downturns, but this year, their trajectories have diverged. LG Innotek has continued its upward trend, with its stock price approaching the 300,000 won mark, while LG Household & Health Care has fallen below 260,000 won. While LG Innotek is expected to maintain its performance improvement, LG Household & Health Care is likely to continue struggling for the time being, suggesting that the contrasting trends in their stock prices will persist.

According to the Korea Exchange on December 12, LG Innotek reached an intraday high of 299,500 won the previous day, setting a new 52-week high. It closed at 294,500 won, up 1.9%. The stock has risen for nine consecutive trading days, bringing it close to recovering the 300,000 won level.

In contrast, LG Household & Health Care fell to an intraday low of 258,000 won, marking a new 52-week low. It closed at 259,000 won, down 1.52%. The stock has declined for four consecutive days, dropping from the 270,000 won range to the 250,000 won range.

Last year, both stocks suffered from poor performance, resulting in a simultaneous decline in their stock prices. In 2024, LG Innotek fell by 32.36%, and LG Household & Health Care dropped by 14.08%. This year, LG Household & Health Care has continued its sluggish trend, falling by 15.08%, while LG Innotek has surged by 81.79%-the largest increase among LG Group stocks.

Performance has been the key factor driving the divergence in stock prices. LG Innotek has continued to recover, while LG Household & Health Care remains mired in a slump.

In the third quarter of this year, LG Innotek posted sales of 5.3694 trillion won and operating profit of 203.7 billion won. While sales decreased by 5.6% compared to the same period last year, operating profit increased by 56.2%. There are expectations that the company will move out of negative growth this year and see expanded performance growth from next year. Park Kangho, a researcher at Daishin Securities, stated, "Operating profit is expected to reach 748.6 billion won in 2025, marking a shift from negative growth to expansion in 2026 and 2027. The upward revision of fourth-quarter 2025 operating profit will result in three consecutive years (2025-2027) of growth, highlighting the current undervaluation of the stock." Daishin Securities estimates LG Innotek's fourth-quarter operating profit this year at 408.4 billion won, significantly exceeding both the previous estimate (342 billion won) and the market consensus (340.8 billion won). Operating profit for 2026 and 2027 is forecast to grow by 6.1% and 11.1% year-on-year, respectively.

Reflecting the improved performance, securities firms have been raising their target prices for LG Innotek. Korea Investment & Securities raised its target from 268,000 won to 344,000 won, NH Investment & Securities from 280,000 won to 340,000 won, and Daishin Securities from 280,000 won to 350,000 won.

Meanwhile, LG Household & Health Care continues to struggle. In the third quarter of this year, the company recorded sales of 1.58 trillion won and operating profit of 46.2 billion won, down 7.8% and 56.5%, respectively, compared to the same period last year. The beauty (cosmetics) division posted an operating loss of 58.8 billion won, continuing its deficit from the second quarter. Improvement is unlikely in the fourth quarter. According to financial information provider FnGuide, the consensus for LG Household & Health Care's fourth-quarter results is sales of 1.5537 trillion won (down 3.5%) and operating profit of 16.1 billion won (down 62.9%). Park Jongdae, a researcher at Meritz Securities, commented, "The company is in a restructuring period, and fourth-quarter operating profit is expected to be just 5.4 billion won. One-off costs are likely to increase due to workforce optimization in the cosmetics division both domestically and overseas. Although the company plans to complete adjustments to duty-free cosmetics volume in the first half of next year, the lack of a clear growth strategy after restructuring remains an issue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.