Confirmed Downside Rigidity Around Daily Average Trading Value of 21 Trillion Won

Limited Possibility of Further Decline... Minimal Impact on Coin Market

[Asia Economy Reporter Minwoo Lee] As the average daily trading volume in the domestic stock market decreases, expectations for securities stocks seem to be somewhat subdued. Although there are concerns that the market has shrunk due to the growth of the virtual currency (cryptocurrency) market, this is limited, and rather, it is analyzed that the market has moved according to traditional macroeconomic and market indicators.

On the 26th, Korea Investment & Securities maintained an overweight opinion on representative securities stocks such as Mirae Asset Securities, Samsung Securities, NH Investment & Securities, and Kiwoom Securities against this background.

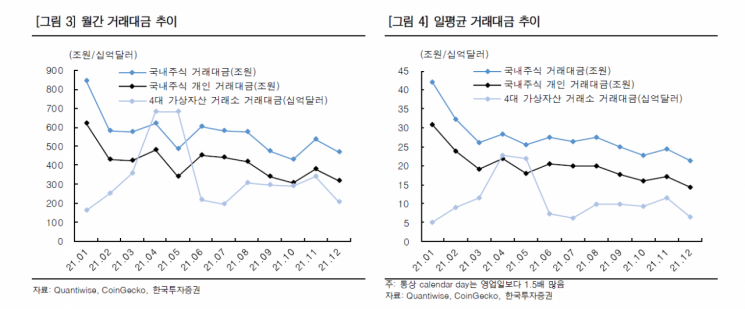

Securities stocks have recently been trending downward as the trading volume in the domestic stock market has decreased. Based on the period from the 1st to the 23rd, the average daily trading volume in the domestic stock market, excluding Exchange-Traded Funds (ETFs), Exchange-Traded Notes (ETNs), and the KONEX market, was about 21.2 trillion KRW. This is a significant decrease compared to 42.1 trillion KRW in January. As brokerage indicators have slowed, stock prices appear to be preemptively reflecting concerns about profit declines next year. Although the combined net profit of the four leading securities firms this year is expected to increase by 60% compared to the previous year, the average return based on the closing price of the previous trading day is only about 5.67%. During the same period, the KOSPI return was 4.84%.

Baek Doosan, a researcher at Korea Investment & Securities, explained, "Considering that net profit in 2022 is still expected to be 31% larger than in 2020, the decline in multiples has also occurred," adding, "The main factor is the overall slowdown in earnings momentum."

However, considering quantitative indicators such as the number of investors, accounts, and investment amounts, the average daily trading volume is evaluated to have confirmed a 'bottom' at around 21 trillion KRW. The change in the investor base is rather considered the key point. At the end of 2019, 6.19 million people held 2,936 active accounts, whereas currently, it is estimated that 15.81 million to 18.92 million people hold 55.35 million active accounts. Additionally, as of the end of June, the domestic stock holdings of individual investors amounted to 968 trillion KRW, an increase of 372 trillion KRW compared to the end of 2019 (estimated net purchases of 127 trillion KRW and valuation gains of 245 trillion KRW). During this period, the overseas stock holdings of 'non-financial corporations, etc.,' which make up most individuals, also increased by 64 trillion KRW, up 51 trillion KRW (estimated net purchases of 39 trillion KRW and valuation gains of 12 trillion KRW) over the same period.

Meanwhile, the scale of virtual asset transactions has steadily increased. This year, individual stock trading volume is expected to reach 493.6 trillion KRW, with an average daily volume of about 19.9 trillion KRW. The four major domestic virtual asset exchanges have an annual trading volume of 4 trillion USD (4,750 trillion KRW) and an average daily volume of 10.9 billion USD. It is estimated that individual virtual asset holdings increased by about 50 trillion KRW compared to the end of last year. In terms of scale, this can be seen as a competitive relationship with the regulated stock market.

However, overall, the trends in stock and virtual asset trading volumes have moved together. Rather than funds being transferred from the stock market to virtual assets, the trading volumes tend to move together due to a common factor of changes in individuals' risk preferences as similar risk asset groups. Researcher Baek said, "From the perspective of individual asset portfolios, the growth of the virtual asset market seems to be linked more to the building of safe assets than to domestic stocks," adding, "Ultimately, in the medium to short term, the direction of stock market trading volume will be determined more by traditional macroeconomic and market indicators than by the supply and demand of the virtual asset market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.