Advancing Corporate Finance Platforms

Enhancing Services for Small Business Owners and Individual Entrepreneurs

Focused on High-Quality Corporate Lending for RWA Management

Sufficient Capital Ratio Enables Participation in "Productive Finance" Emphasized by President Lee

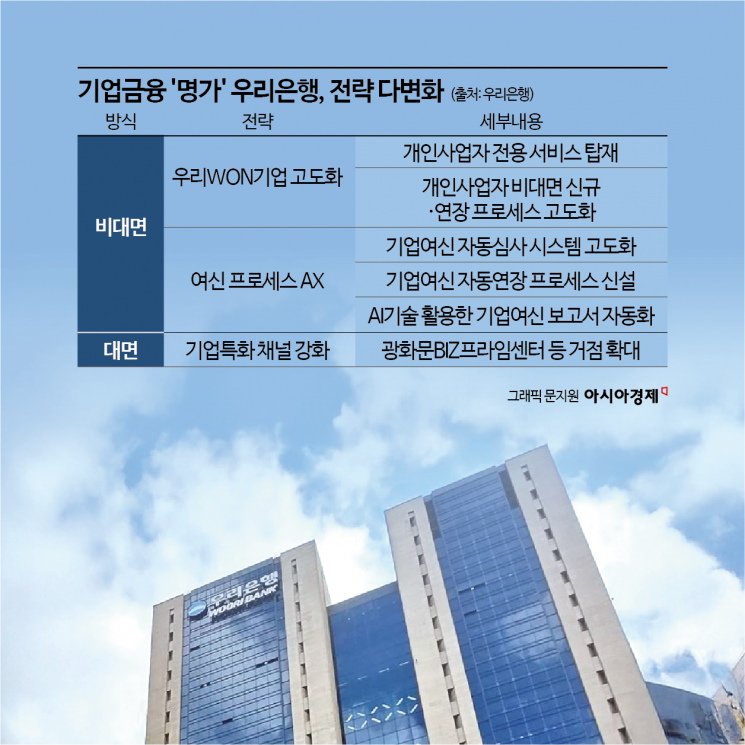

According to the financial sector on August 11, Woori Bank has recently begun revamping its corporate finance platform, "Woori WON Enterprise." The bank plans to significantly expand services related to individual entrepreneurs, including small business owners. A Woori Bank representative stated, "We are undertaking this upgrade to vitalize support for small business owners." Specifically, the bank will invest approximately KRW 3 billion to improve the user interface (UI) and user experience (UX) of its mobile webpage and application, while establishing an integrated page for individual entrepreneurs. In addition to enhancing accessibility through branch integration and partnerships, the bank will also introduce dedicated non-financial services for individual entrepreneurs. Plans are also in place to strengthen the processes for new and renewed non-face-to-face loans for individual entrepreneurs.

The bank is also reviewing improvements across all aspects of corporate lending and considering the integration of artificial intelligence (AI) technology. Initiatives include upgrading the automated corporate loan screening system, introducing an automated renewal process, automating the acquisition and registration of corporate loan application information, and utilizing AI technologies such as ChatGPT to automate corporate loan reports.

In-person business is also being reinforced. On July 30, Woori Bank opened the "Gwanghwamun Biz Prime Center," a channel specialized in corporate clients. This center, which is the 13th branch in a network expanding across major industrial complexes nationwide, serves as a strategic base not only in Seoul's three main business districts?Gwanghwamun/Jongno, Gangnam, and Yeouido?but also in Seongsu, which is emerging as an IT industry hub. Through this, the bank aims to maximize synergies between corporate finance and asset management.

Woori Bank's focus on corporate lending is due to increased lending capacity resulting from asset rebalancing. The bank has been managing its risk-weighted assets (RWA) to raise its Common Equity Tier 1 (CET1) ratio. Corporate loans require a higher capital buffer than household or real estate loans due to higher risk weights, especially for loans to small and medium-sized enterprises (SMEs) or individual entrepreneurs with lower credit ratings, which carry even higher risk weights.

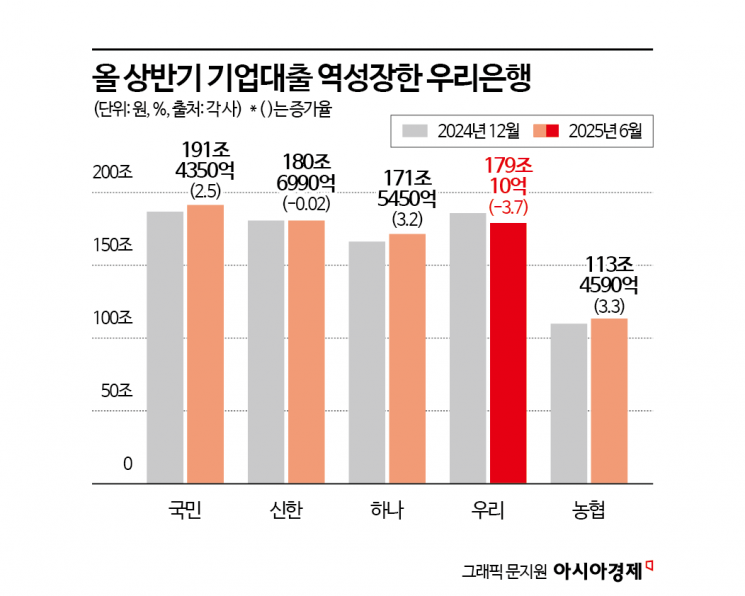

Woori Bank has chosen to supply loans primarily to high-quality companies, thereby lowering its RWA. As a result, the bank's CET1 ratio increased from 13.05% at the end of last year to 14.15% in the first half of this year. However, Woori Bank was the only one among the five major banks (KB Kookmin, Shinhan, Hana, Woori, NH Nonghyup) to experience negative growth in corporate lending, which led to a decrease in SME lending. As of the end of last year, Woori Bank's outstanding corporate loans stood at KRW 185.859 trillion, but this figure dropped to KRW 179.01 trillion in the first half of this year, a decrease of approximately 3.7%. In contrast, KB Kookmin Bank (2.5%), Hana Bank (3.2%), and Nonghyup Bank (3.3%) all saw increases. Shinhan Bank's corporate loans decreased slightly from KRW 180.749 trillion to KRW 180.699 trillion, but the decline was only 0.02%. Woori Bank's outstanding SME loans fell from KRW 133.436 trillion to KRW 126.101 trillion over the same period, a decrease of about 5.5%.

There is also analysis that the bank quickly adjusted its strategy as financial authorities accelerated RWA system reforms. Recently, President Lee Jaemyung criticized the financial sector for "profiteering from interest" and emphasized that funds should flow into productive sectors such as businesses and venture capital, rather than households and real estate. Accordingly, the Financial Services Commission is considering raising the risk weight for mortgage loans and lowering it for corporate loans. The reform plan may be announced as early as the end of August, and once implemented, a strategy of expanding corporate loans will become more advantageous from a capital soundness perspective.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.