67% of VC Investments Concentrated in Preferred Shares Like RCPS

Redemption Rights and Refixing... Hidden Risks of RCPS

Accounting Standards Cause Optical Illusions, Undermining Credibility

8 billion won in capital impairment. Judging by its financial statements alone, there was a company once engulfed in rumors that it could go bankrupt at any moment. However, within just one year, this company recorded over 200 billion won in net assets (equity), making a remarkable turnaround to become a sound business. It also achieved its first-ever operating profit since its founding in 2014. This is the story of Bucketplace, which operates the interior design platform "Ohouse."

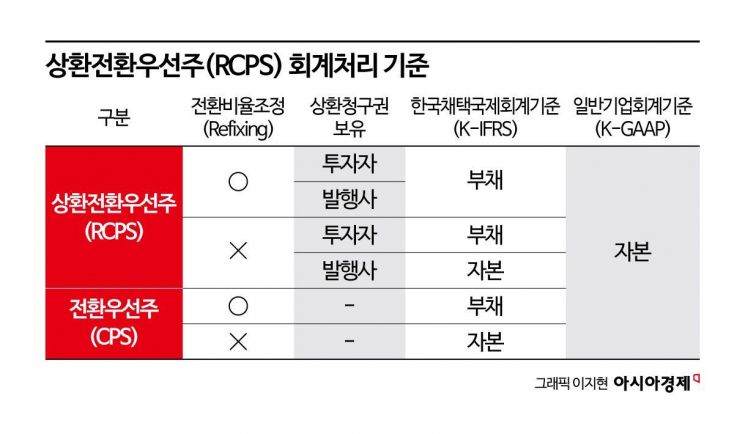

According to the Financial Supervisory Service's electronic disclosure system on May 13, Bucketplace changed its accounting standards last year from Korean International Financial Reporting Standards (K-IFRS) to Korean Generally Accepted Accounting Principles (K-GAAP). As a result, its net assets, which stood at minus 794.6 billion won at the end of 2023, rebounded to 224.3 billion won at the end of last year. This turnaround was due to recognizing redeemable convertible preferred shares (RCPS) as equity rather than debt, which increased capital surplus by 300 billion won and eliminated 820 billion won in derivative liabilities.

As the company's reputation shifted dramatically due to a change in accounting standards, fundamental issues surrounding the RCPS investment method have resurfaced. This is because RCPS, which is widely used in venture capital (VC) investments, can place increasing financial burdens on startups over time, and may also negatively impact initial public offerings (IPOs).

RCPS are shares that have redemption rights, conversion rights, and preferred rights. Unlisted startups typically issue them to raise funds instead of issuing corporate bonds or new shares. Investors can convert them into common shares if the company grows, thereby realizing gains. If the company underperforms, they can exercise redemption rights to recover their principal and interest, making RCPS a relatively safe investment vehicle.

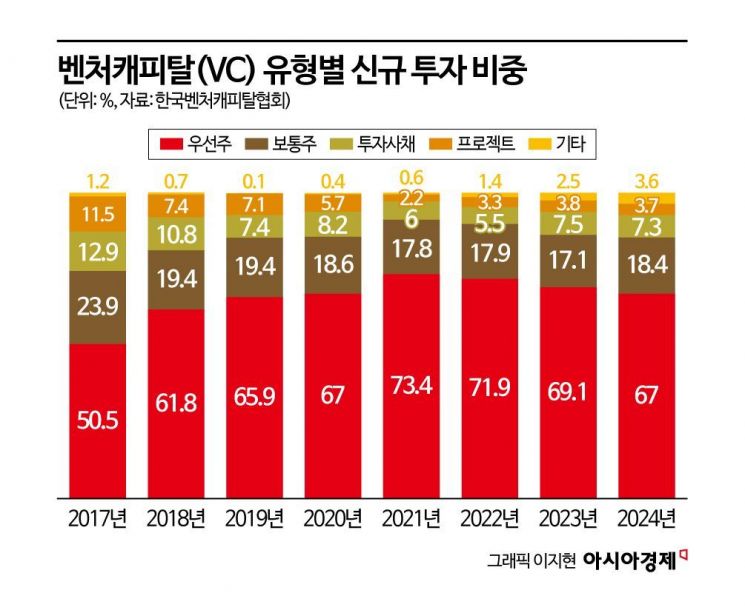

According to the Korea Venture Capital Association, preferred shares accounted for 67% of new VC investments last year. After rising from 50.5% in 2017 to 73.4% in 2021, the proportion has slightly decreased, but investments in preferred shares, including RCPS, still dominate the market. Industry experts believe that since RCPS is the most common form of startup investment, the majority of preferred share investments are likely RCPS.

In particular, the conversion right (C), which is the core feature of RCPS, provides investors with a powerful safety net. Generally, preferred shares are converted into common shares at a 1:1 ratio, but if there is a "refixing" clause, investors can secure a larger stake. For example, even if an investor puts in 100 million won to receive 10,000 common shares, if the company's valuation drops, the conversion ratio could be adjusted to 1:2, giving them 20,000 shares. As a result, startup founders may have to give up twice as much equity, and in their attempt to expand rapidly, they may experience financial deterioration. This is a major concern.

The redemption right (R) can also place a significant burden on startups. Companies like Bucketplace, which are pursuing overseas expansion or attracting global investment, try to enhance transparency and gain market trust by switching to K-IFRS. However, since RCPS are recognized as debt under K-IFRS, this can create the illusion that financial soundness has deteriorated, thereby damaging trust.

Viva Republica, which operates Toss, faced a similar issue. In 2019, when it was seeking to enter the internet banking and securities industries, 75% of the company's capital consisted of RCPS. Financial authorities regarded these as actual debt, raising concerns about capital stability. Viva Republica subsequently held an extraordinary shareholders' meeting to remove the redemption right and convert RCPS into convertible preferred shares (CPS). CPS are recognized as equity under K-IFRS. This allowed the company to obtain regulatory approval and successfully launch Toss Bank in 2021.

In addition, listed companies or companies planning to go public are required to apply K-IFRS, under which RCPS are likely to be recognized as debt, unlike under K-GAAP, where they are considered equity. This is because the redemption right guarantees the return of investment, making its economic substance similar to debt. For this reason, the Korea Exchange recommends converting RCPS into common shares during the preliminary review process for listing. If a company goes public while maintaining RCPS, a change in accounting standards or the recognition of more debt after listing could rapidly undermine its financial soundness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.