69 Cases of Unrefundable Refunds Last Year

Repeated Consumer Harm, Lack of Safety Measures

Recently, incidents of gyms and Pilates businesses taking prepaid fees and then disappearing have been occurring repeatedly due to the economic downturn in Gyeonggi Province. There are calls for practical measures, such as mandating guarantee insurance enrollment for sports facility businesses, to prevent consumer damage.

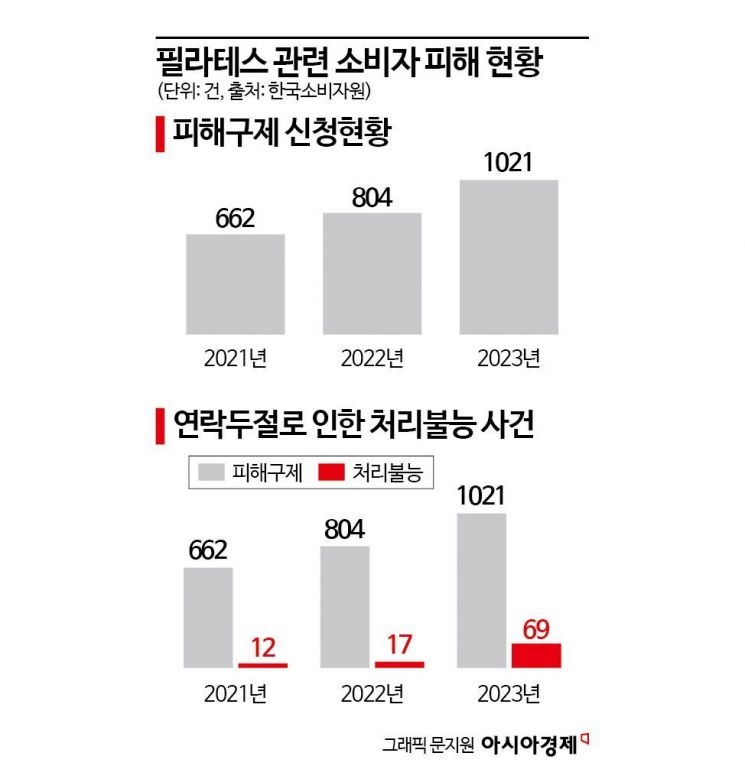

According to the Korea Consumer Agency on the 19th, the number of consumer damage relief cases related to Pilates businesses last year totaled 1,021, a 27% increase compared to the previous year. In particular, 'unresolvable' cases reported due to sudden closures and loss of contact, resulting in consumers not receiving refunds, surged from 12 cases in 2021 to 17 in 2022, and 69 last year. The proportion of unresolvable cases among all damage relief reports jumped more than threefold from 2.1% in 2022 to 6.8% last year.

Refund issues involving sports facility businesses are escalating into criminal cases. In June last year, in Gimpo, Gyeonggi Province, a well-known chain gym with 28 branches nationwide suddenly closed, leading to a flood of reports from consumers who could not get refunds, prompting police investigations. The amount of damage is known to range from as little as 500,000 won to several million won.

Last month in Gwangju, a large gym abruptly ceased operations without notice, leading consumers to file a complaint against the owner, Mr. A, with the police. The gym reportedly had about 800 members, including Pilates and Zumba dance class participants.

Despite repeated consumer damages, safety measures are lacking. Although consumers can apply for a payment order through the courts, this requires knowing the debtor’s address, so if the owner disappears, there is little recourse. A 'Health Club Eat-and-Run Prevention Act' mandating guarantee insurance enrollment for sports facility businesses receiving prepaid fees was proposed in the last National Assembly but was discarded due to other pressing issues and the expiration of the legislative term.

Guarantee insurance is a system where, if a business suddenly closes or fails to fulfill contracts with consumers, the guarantee insurance company compensates the financial damages with insurance payouts. Currently, electronic financial service providers offering simple payment and remittance services are required by Financial Supervisory Service guidelines to entrust prepaid funds to external institutions or enroll mandatorily in payment guarantee insurance. However, sports facility businesses are not currently subject to mandatory enrollment.

Choi Woosung, Secretary-General of the Korea Consumer Organization Council, said, "If sports facility businesses enroll in guarantee insurance, it can partially prevent prepaid fee eat-and-run damages. Since gyms and Pilates businesses are small-scale merchants, they may find it difficult to pay a year’s worth of guarantee insurance premiums upfront before starting operations. Government support will be necessary if a mandatory guarantee insurance enrollment system is introduced."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.