Strong Determination to Chase AI Semiconductors like HBM

Attention on Performance Improvement of General-Purpose Memory as Well

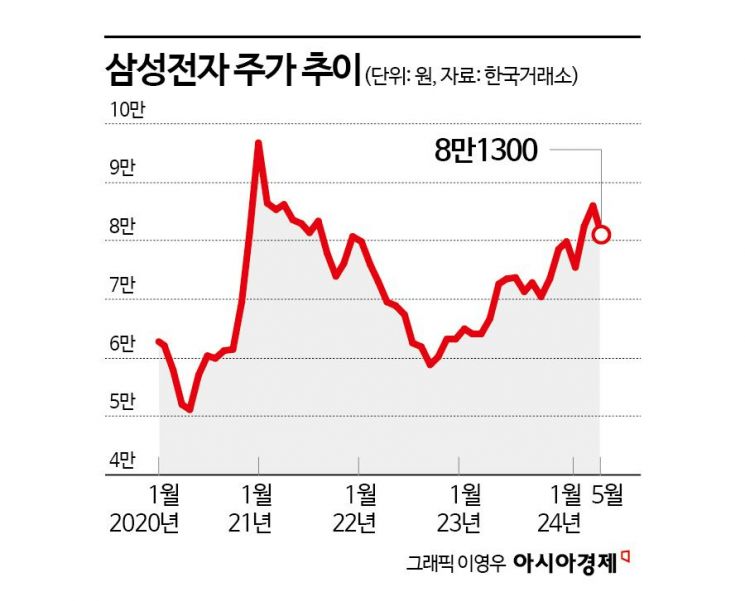

As Samsung Electronics returns to the '80,000 won stock price' level, market attention is focused on breaking its previous high. The securities industry is offering positive outlooks, noting that Samsung is narrowing the gap with competitors in artificial intelligence (AI) semiconductors and expecting improvements in general-purpose memory performance.

According to the Korea Exchange on the 8th, Samsung Electronics recorded a closing price of 81,300 won on the 7th, up 4.77% from the previous day. Although it briefly rose to 86,000 won during trading last month, setting a 52-week high, it fluctuated amid volatility caused by Middle East risks and fell to 75,100 won before successfully rebounding.

Recently, the securities industry's outlook on Samsung Electronics has been optimistic. According to financial information provider FnGuide, securities firms have set an average target price of 103,800 won for Samsung Electronics, approximately 28% higher than the previous closing price.

On the 30th of last month, Samsung Electronics announced in its Q1 earnings report the long-awaited news of memory turning profitable. Operating profit on a consolidated basis increased by 932% year-on-year to 6.6 trillion won. This was largely due to a significant rise in DRAM and NAND prices and the reversal of inventory valuation loss provisions. Notably, NAND returned to profitability after six quarters, driven by a surge in demand for high-capacity enterprise solid-state drives (eSSD), continuing from the previous quarter.

Furthermore, during the Q1 earnings presentation, Samsung Electronics revealed a strong commitment to high-bandwidth memory (HBM), stating that supply will triple in bit terms this year and at least double by 2025. Specifically, for HBM3E, they plan for it to account for more than two-thirds of HBM shipments by the end of this year. As global big tech companies accelerate AI infrastructure investments, Samsung aims to secure market share by timely responding to the sharp increase in AI demand in the second half of the year.

The securities industry has been increasingly highlighting that Samsung Electronics, previously undervalued compared to competitor SK Hynix in the AI market, is regaining attention. Kim Kwang-jin, a researcher at Hanwha Investment & Securities, stated, "Last year, Samsung struggled due to a disadvantage in the HBM market compared to competitors, but its competitiveness in the HBM3E market is gradually strengthening, rapidly narrowing the gap." He added, "Currently, the gap in HBM3E 8-stack products is estimated to have narrowed to about three months, and there is a possibility of superiority in 12-stack products." He also forecasted, "Competitiveness in the eSSD market will also be highlighted. Currently, eSSD is undergoing a structural turning point due to increased demand for AI servers, with expansion centered on quadruple-level cell (QLC) SSDs. The lineup of these products is expected to increase from the second half of the year."

Additionally, amid intensifying encroachment on DRAM production capacity (CAPA) to prioritize HBM production, Samsung Electronics is analyzed to have a relatively superior DRAM production response capability compared to competitors. Ryu Hyung-geun, a researcher at Samsung Securities, said, "HBM production is estimated to increase fourfold this year compared to last year, and the proportion of HBM within total DRAM CAPA is expected to reach 21% by the end of this year, up 13 percentage points year-on-year." He added, "Some companies, excluding Samsung Electronics which has capacity flexibility, are attempting to build new factories." He further noted, "Some companies may have weaker capabilities to respond to low-power double data rate (LPDDR) 5, which requires application of DRAM processes."

Lee Soo-rim, a researcher at DS Investment & Securities, also predicted, "As semiconductor suppliers prioritize CAPA for HBM, supply increases for both DRAM and NAND will be limited. Considering Samsung's high market share in the existing general-purpose semiconductor market, the outlook for profit improvement due to rising memory prices is bright."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.