A Total of 93,842 Cases... Most Complaints from People in Their 30s and 40s

Last year, financial complaints increased in banks, card companies, and savings banks, but decreased in insurance.

According to the Financial Supervisory Service on the 22nd, the total number of financial complaints in the financial sector last year was 93,842, an increase of 7.7% (6,729 cases) compared to the previous year (87,113 cases). During the same period, financial consultations decreased by 4.6% (17,027 cases) to 349,190, while heir inquiries increased by 5.9% (15,769 cases) to 283,029.

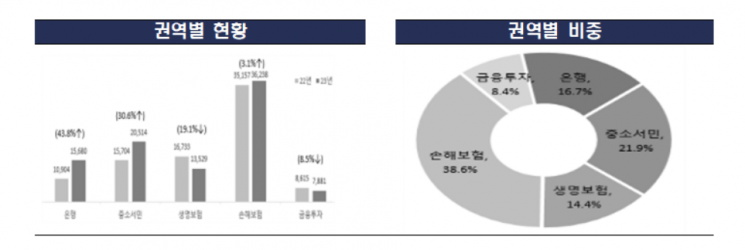

Looking at financial complaints by sector, banks recorded 15,680 cases last year, a 43.8% increase from the previous year. By type, the proportions were loans (49.4%), voice phishing (9.6%), deposits and savings (8.9%), credit cards (4.2%), bancassurance and funds (2.6%), in that order. Complaints related to loan interest rates, such as dissatisfaction with high loan interest rates (up 2,343 cases), and complaints related to loan handling such as new loans and maturity extensions (up 1,270 cases) increased significantly.

Number and Proportion of Financial Complaints by Industry Sector. [Source=Financial Supervisory Service]

Number and Proportion of Financial Complaints by Industry Sector. [Source=Financial Supervisory Service]

Financial complaints in card companies increased by 38.7% to 9,323 cases compared to the previous year. Savings banks and loan businesses saw increases of 41.4% and 11.8%, respectively. In the case of credit cards, there were many complaints related to installment payment restrictions. Credit information companies experienced an increase in complaints related to unfair debt collection, and savings banks saw an increase in complaints related to loan interest rates and loan handling.

In insurance, financial complaints decreased by 4.1% to 49,767 cases compared to the previous year. This was due to a 3.1% increase in non-life insurance complaints but a 19.1% decrease in life insurance complaints. In life insurance, the largest proportions of complaints were related to insurance solicitation (42.3%), insurance claim calculation and payment (21.8%), liability decision (13.6%), and contract formation and cancellation (6.2%). In non-life insurance, the proportions were insurance claim calculation and payment (53.8%), liability decision (10.4%), and contract formation and cancellation (7.3%).

Regarding financial consultations, banks and small and low-income sectors (cards, savings banks, loans, etc.) recorded 57,077 cases last year, a 2.4% decrease from the previous year. In insurance, consultations decreased by 1% to 57,512 cases.

By age group, the average annualized number of complaints per 100,000 people was 151.2 cases. The 30s and 40s, who are economically active, had the highest annualized complaint numbers at 286 and 223.8 cases, respectively. They were followed by the 50s (143.1 cases), 20s (112.4 cases), and 60s (99.0 cases). By sector, the 30s had the highest number of complaints in banks, small and low-income sectors, and insurance, while the 40s had the highest in the financial investment sector.

For incomplete sales complaints, the annualized complaint numbers were highest in the 30s (27.8 cases), followed by the 40s (17.3 cases), 20s (13.3 cases), and 50s (12.1 cases). In the insurance sector, the 30s and 40s had many complaints, whereas in banks, small and low-income sectors, and financial investment sectors, the 50s and 60s had relatively more complaints.

Last year, 97,098 financial complaints were processed, an 11% increase from the previous year. General complaints and dispute complaints were processed at 58,250 and 38,848 cases, respectively, increasing by 10.4% and 12% compared to the previous year. The average processing period for financial complaints was 48.2 days, 1.1 days shorter than the previous year's 49.3 days. The complaint acceptance rate increased by 3.1 percentage points to 36.6% from 33.5% the previous year.

A Financial Supervisory Service official stated, "We will continue to provide dispute-related information to financial consumers through case analysis to prevent disputes from occurring," and added, "We will also continuously improve the efficiency of dispute handling to ensure that consumer damage relief is promptly achieved."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.