Top Shareholders Increasing Stakes Are All Small and Mid-Cap Stocks Ranked Below Top 100 by Market Cap

Leading Sectors Also Differ... Diversified Betting on Quality Companies

Travel, Leisure, and Food & Beverage Sensitive to Economy Marked as 'Sell'

The key theme for the National Pension Service's (NPS) portfolio in December 2023 was 'substance.' It traded a total of 48 stocks, with 28 being net purchases and 20 net sales. While it concentrated on buying high-quality small and mid-cap stocks, it chose to reduce holdings in domestic demand-related stocks directly linked to the economy. As of the end of Q3 2023, the NPS holds a total of KRW 137.4 trillion worth of domestic stocks, accounting for 5.5% of the combined market capitalization of KOSPI and KOSDAQ (KRW 2,494.16 trillion as of the 8th). It is the largest institutional investor in Korea, with 281 companies where it holds more than a 5% stake.

Strategic 'Betting' on Solid Small and Mid-Cap Stocks

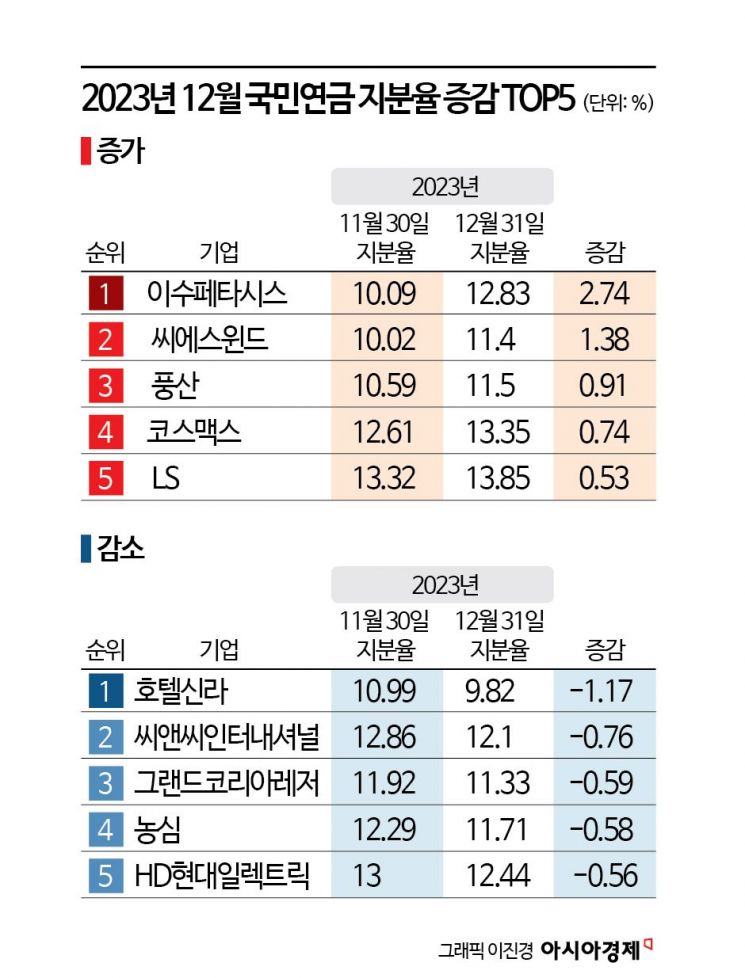

According to data from the Financial Supervisory Service's electronic disclosure system on the 9th, among the stocks in which the NPS holds more than a 5% stake, it increased its holdings in 28 stocks from the 1st to the 31st of last month. The top 10 stocks by shareholding increase rate spanned various industries, indicating a diversified approach without concentration in any single sector. The top 5 stocks with increased weight were Isu Petasys (10.09→12.83%), CS Wind (10.02→11.4%), Poongsan (10.59→11.5%), Cosmax (12.61→13.35%), and LS (13.32→13.85%). Notably, all are small and mid-cap stocks outside the top 100 by market capitalization, each with a market cap below KRW 3 trillion.

The stock that attracted the most attention from the NPS, Isu Petasys, is classified as an artificial intelligence (AI) beneficiary. It supplies multi-layer printed circuit boards (MLB) to Nvidia, Google, and Microsoft. MLB is a product made by stacking multiple printed circuit boards (PCBs), enabling rapid processing of large volumes of data. Kwon Tae-woo, a researcher at DS Investment & Securities, said, "Although earnings estimates for electrical and electronic companies have been revised downward due to a sluggish IT industry, Isu Petasys's performance remains relatively strong," adding, "Steady earnings improvement is expected due to acceleration in AI and high-bandwidth memory (HBM)."

Another stock in the NPS portfolio, CS Wind, is the world's number one manufacturer of wind turbine towers. Cosmax is also the world's leading cosmetics original design manufacturer (ODM). Poongsan, founded in 1968, is a representative domestic defense company engaged in non-ferrous metal materials and defense industries, while LS is the holding company of the LS Group. LS acts as a control tower leading future growth businesses such as electric vehicles, secondary batteries, robotics, and wind power. These selections reveal that the NPS has bet on high-quality companies with excellent performance and growth potential.

Travel, Leisure, and Food & Beverage Stocks 'Sold Off'

On the other hand, the NPS reduced its investment in 20 stocks, including Hotel Shilla (10.99→9.82%), CNC International (12.86→12.1%), Grand Korea Leisure (11.92→11.33%), Nongshim (12.29→11.71%), and HD Hyundai Electric (13→12.44%). Among the 10 stocks with the largest decrease in weight, five belonged to the travel, leisure, and food & beverage sectors, which are sensitive to economic cycles. Other food & beverage stocks such as Daesang (10.93→10.38%) and Samyang Foods (13.18→12.72%) were also removed from the portfolio.

Hotel Shilla's Q3 2022 earnings were an 'earnings shock,' with sales of KRW 1.0118 trillion and operating profit of KRW 7.7 billion, falling short of consensus (market average forecast). Losses in the duty-free business segment were a major drag. Heo Jena, a researcher at DB Financial Investment, said, "The fourth quarter is also expected to show an operating loss of KRW 7.3 billion, falling short of consensus," adding that infrastructure for the recovery of Chinese group tourism demand, such as flights, cruises, and charter flights, has not fully recovered, delaying a sales rebound in the domestic duty-free sector. The mood has completely reversed compared to a year ago when the stock was considered a beneficiary of China's reopening (economic activity resumption) expectations.

The food & beverage sector also seems unlikely to escape a slump in the near term. Ha Hee-ji, a researcher at Hyundai Motor Securities, said, "Disposable income has decreased due to inflation and a high-interest rate environment, which has affected consumption of essential goods like food and beverages," adding, "Due to the continued recession in 2024, significant growth in domestic consumption of food and beverage products is unlikely." The Bank of Korea projected a 1.9% increase in private consumption this year, noting that "the recovery will be slower than initially expected due to the continued impact of high interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.