KB Insurance 3Q Net Profit Down 42.9% QoQ

Mostly Declining... Illusion Effect Resolved by Regulatory Guideline Application

"Impact of Insurers Leading Earnings Rally Likely Greater"

The net profits of major insurance companies sharply declined compared to the previous quarter. As the 'illusion effect' caused by changes in accounting standards subsided, the era of record-breaking earnings celebrations ended, revealing the true strength and capabilities of the companies.

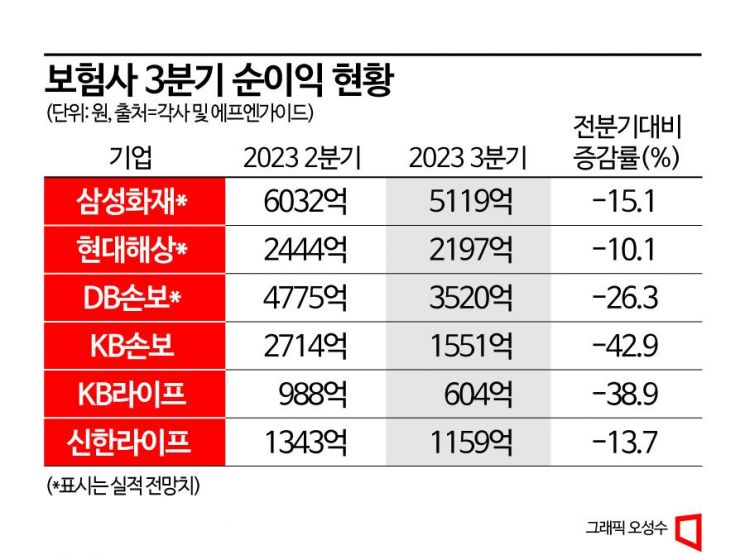

According to industry sources on the 30th, KB Insurance recorded a net profit of 155.1 billion KRW in the third quarter of this year. This is a 42.9% (116.3 billion KRW) decrease from 271.4 billion KRW in the previous quarter. The net profit of KB Life Insurance, part of the same holding company group, also fell by 38.9% to 60.4 billion KRW from 98.8 billion KRW in the second quarter of this year. Shinhan Life's net profit was also recorded at 115.9 billion KRW, down 13.7% from the previous quarter.

The earnings outlook for major large non-life insurers, which had shown record-breaking performance rallies despite the high interest rate and high inflation recession, follows a similar trend. According to financial information analysis firm FnGuide, the market consensus for Samsung Fire & Marine Insurance's net profit in the third quarter of this year is 511.9 billion KRW, a 15.1% decrease from the previous quarter. Hyundai Marine & Fire Insurance and DB Insurance are also estimated to see net profits decrease by 10.1% and 26.3%, respectively. The 'Big 4' non-life insurers, which had been celebrating strong earnings throughout the first half of this year, are all facing a sudden decline in net profits.

It is widely analyzed that the significant impact comes from the new accounting standards (IFRS 17) and actuarial assumption guidelines implemented by financial authorities starting from the third quarter of this year. Since the introduction of IFRS 17 this year, controversies over 'earnings inflation' have continued, prompting the Financial Supervisory Service to establish guidelines for assumptions used in calculating loss ratios for indemnity health insurance and lapse rates for no-surrender and low-surrender insurance policies. This was to prevent insurers from inflating earnings by making overly optimistic assumptions. With these guidelines applied from the third quarter earnings onward, the 'illusion effect' on results has disappeared. In particular, the impact of the Financial Supervisory Service's guidelines is expected to be greater on non-life insurers that had maintained a streak of strong performance this year.

Additionally, overall loss ratios (the ratio of claims paid to premiums received) have risen, leading to reduced profits. Auto insurance loss ratios are a representative example. As of August, the auto insurance loss ratios of the 'Big 4' companies mostly rose into the 80% range. Samsung Fire & Marine Insurance had the highest at 82.8%, followed by KB Insurance (80.8%), DB Insurance (80.0%), and Hyundai Marine & Fire Insurance (79.9%). Considering that the average loss ratio in the second quarter was between 76.8% and 77.3%, it is explained that the seasonal factor of the summer vacation period also contributes to the inevitable reduction in auto insurance profits in the third quarter.

Although there may be some confusion for the time being, as the earnings 'bubble' dissipates, it is expected that the fundamental strength and capabilities of each insurer will become more apparent. Youngjun Ahn, a researcher at Hana Securities, said, "With the incorporation of actuarial assumption guidelines, the uncertainty in financial statements will be alleviated, increasing the reliability and comparability of earnings," adding, "It will now be possible to evaluate the value of individual companies and compare insurers."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.