Construction Company Credit Enhancement PF-ABCP Double-Digit Interest Rates

Small and Medium Securities Firms Raise Short-Term Funds at High Rates

Below A-Rated Construction and Securities Firms Face Difficulty Accessing Capital Markets

[Asia Economy Reporter Lim Jeong-su] As market interest rates stabilize, the bond market is showing signs of returning to its pre-Legoland incident state. However, small and medium-sized securities firms with significant contingent liabilities from construction companies and real estate project financing (PF) are still experiencing a harsh winter in terms of fundraising. Some construction companies and small to mid-sized securities firms are raising funds at high interest rates around 10%. Even then, construction companies and securities firms with low credit ratings are struggling to find investors and face difficulties in raising funds.

Daewoo Construction and Lotte Construction’s Credit-Enhanced ABCP Also at Double-Digit Interest Rates

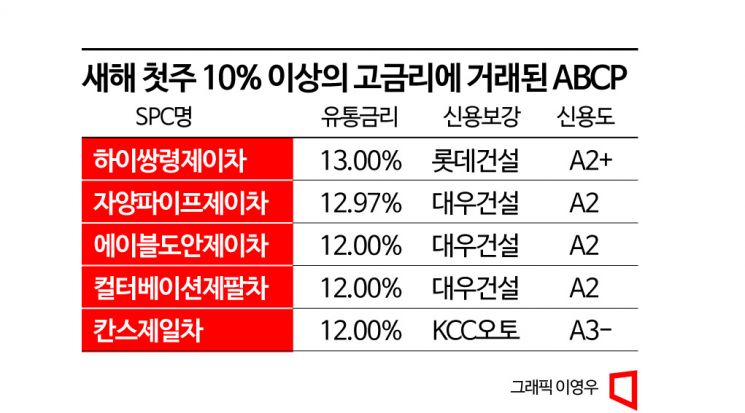

During the first week of the new year, project financing (PF) asset-backed commercial papers (ABCP) with credit enhancements issued by construction companies such as Daewoo Construction and Lotte Construction traded at high interest rates exceeding 10%.

According to the bond market on the 9th, PF-ABCPs issued by special purpose companies (SPCs) ’Jayang Five J Cha’ and ‘High Ssangryeong J Cha’, established for development projects, traded at an interest rate of 13%. Both SPCs were set up to raise funds for development projects. Jayang Five J Cha was created by ‘Jayang Five PFV’, established for the redevelopment project of Jayang 5 District in Gwangjin-gu, Seoul, to raise construction costs and other funds. High Ssangryeong J Cha was established to finance the development project in Ssangryeong-dong, Gwangju-si, Gyeonggi-do.

Both SPCs received credit enhancements from Daewoo Construction and Lotte Construction. If the SPCs fail to repay borrowings due to cash flow deterioration, Daewoo Construction and Lotte Construction are responsible for repayment on behalf of the SPCs. In effect, the ABCP issued is backed by the creditworthiness of Daewoo Construction and Lotte Construction. This implies that the short-term CP interest rate issued under the credit of these two construction companies is approaching 13%.

ABCPs issued by Able Doan J Cha and Cultivation Je Pal Cha, which received credit enhancements from Daewoo Construction, also traded at 12%. Able Doan J Cha was established to raise funds for the development project in Doan 2 District, Daejeon Metropolitan City, and Cultivation Je Pal Cha is an SPC established by Hyundai Card to securitize card usage payments from Daewoo Construction. Daewoo Construction is responsible for principal and interest repayment in all cases.

Construction companies with credit ratings below A grade are either burdened with high interest rates or unable to raise necessary funds. Seohui Construction reportedly failed to raise PF securitization funds for a recently completed project. An investment banking industry insider said, "Some large construction companies and small to mid-sized construction companies with heavy PF contingent liabilities are struggling to raise market-based funds," adding, "Liquidity for construction companies rated A2 or below continues to deteriorate."

Construction companies with credit ratings of A+ or A2 or below include Lotte Construction (A+, A2+), Daewoo Construction (A2), as well as Taeyoung Construction (A, A2), Hanshin Engineering & Construction (BBB+, A3+), Shinsegae Construction (A2), DL Construction (A2-), SK Ecoplant (A2-), Kolon Global (A3+), HL D&I Halla (A3+), Hanyang (A3+), IS Dongseo (A3), Ssangyong Construction (A3), and Doosan Construction (B).

Small and mid-sized securities firms with large PF contingent liabilities are also facing cold treatment in the funding market. Eugene Investment & Securities is currently pushing to issue 3-month electronic short-term bonds (STB), but investors are reportedly demanding interest rates above 8%. A financial company official said, "Eugene Investment & Securities, which initially aimed to issue short-term STBs below 8%, raised the interest rate to 8.4% to secure investor demand," adding, "It seems issuance will occur at 8.4% or higher."

Eugene Investment & Securities has a credit rating of AA+, with a short-term credit rating one notch below the highest A1, at A2+. Securities firms with similar or lower credit ratings are either forced to accept high interest rates or find it difficult to secure funds even with high rates.

A credit rating agency official said, "Securities firms are expected to see an overall decline in credit ratings this year due to the realization of PF contingent liabilities from unsold inventory and a sharp drop in IB division profits," adding, "Especially securities firms with a high PF ratio are more likely to experience credit rating downgrades."

High PF Ratio Securities Firms Face Greater Risk of Credit Rating Downgrades

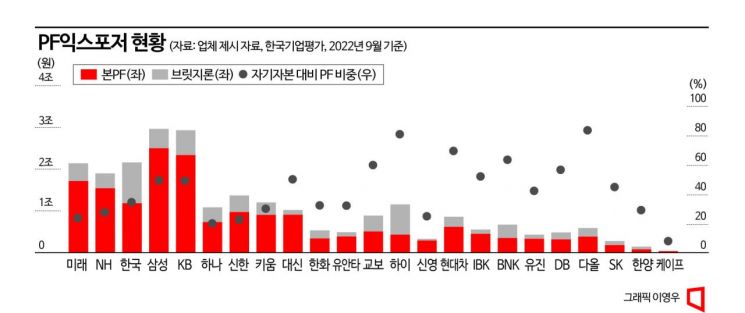

According to Korea Ratings, as of the end of September last year, securities firms with PF ratios exceeding 50% relative to equity capital include Samsung Securities (50%), Kyobo Securities (60%), Hi Investment & Securities (81%), Hyundai Motor Securities (69%), IBK Investment & Securities (52%), BNK Investment & Securities (63%), and DB Investment & Securities (57%). Daol Investment & Securities stands out with an overwhelming 84%. Securities firms with PF ratios above 40% but below 50% include KB Securities (49%), Eugene Investment & Securities (42%), and SK Securities (45%).

Jung Hyo-seop, a senior researcher at Korea Ratings, evaluated, "Although liquidity burdens for securities firms have somewhat eased due to liquidity support from financial authorities and affiliate support, PF securitization refinancing rates remain considerably high," adding, "Securities firms with large PF contingent liabilities or bridge loan ratios, or those not affiliated with financial holding companies, are expected to face difficulties in maintaining liquidity response capabilities."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.