[Asia Economy Sejong=Reporter Kim Hyewon] All employees with earned income last year (excluding daily workers) must complete their year-end tax settlement by the time they receive their February salary this year.

On the 4th, the National Tax Service announced, "Employees and companies should check this year's year-end tax settlement schedule and tax law amendments to prepare in advance for the year-end tax settlement so that no deduction amounts are omitted."

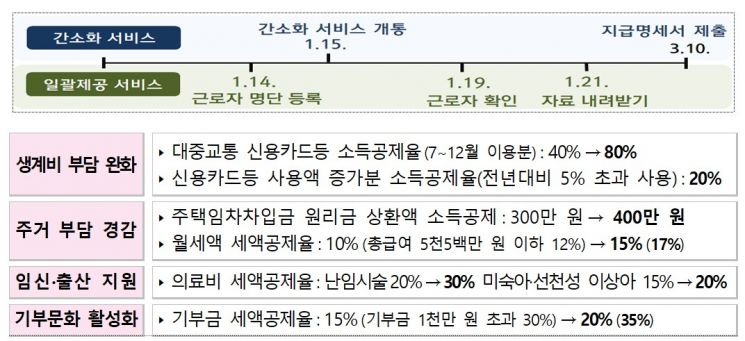

The simplified service is scheduled to open on the 15th. Companies using the 'Bulk Provision Service for Simplified Data' must register their employee list on Hometax by the 14th, and employees must check (consent) on Hometax by the 19th.

If this service is not used, the year-end tax settlement can be done using the simplified service, which opens on the 15th, as before.

Various deduction items will also change according to the tax law amendments. The deduction rate for public transportation expenses incurred from July to December last year has been temporarily doubled from 40% to 80%. The income deduction for increased spending on credit cards and other means continues to apply, and an income deduction for increased spending at traditional markets has been added. Both increased spending on credit cards and traditional markets allow a 20% income deduction each, and an additional deduction can be received up to a limit of 1 million KRW for the combined increased spending at both places.

The deduction limit for funds borrowed by a non-homeowner household head employee to rent a house has been expanded from the existing 3 million KRW to 4 million KRW. The tax credit rate for monthly rent expenses paid by non-homeowner employees with total salary of 70 million KRW or less has been raised from the previous 10% or 12% (for total salary 55 million KRW or less) to 15% or 17%.

The deduction rate for infertility treatment expenses has increased from 20% to 30%, and the deduction rate for medical expenses incurred for premature or congenital abnormal infants has increased from 15% to 20%. The tax credit rate for donations has risen from 15% to 20%. For donation amounts exceeding 10 million KRW, a 35% tax credit can be received.

The National Tax Service has prepared a service that provides disability certification data collected by the Ministry of Health and Welfare and the Ministry of Patriots and Veterans Affairs as simplified data to improve convenience for persons with disabilities in year-end tax settlement.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.