[Asia Economy Sejong=Reporters Kim Hyewon and Lee Dongwoo] China has begun easing COVID-19 restrictions earlier than initially expected, which is anticipated to have a positive impact on the South Korean economy, highly dependent on China. China's shift to a de facto 'With COVID' phase was influenced by the 'blank protest' but also reflects a response to the rapidly deteriorating economic situation in China. The easing of lockdowns is expected to normalize production and supply chains, and combined with pent-up demand during the economic recovery phase, South Korea is expected to reap indirect benefits. The U.S. Wall Street Journal (WSJ) also analyzed that the global economic recovery hinges on China ending its 'Zero COVID' policy.

Until now, China's stringent lockdown policies have suppressed not only the global economy but also its own economic growth. Starting with Shanghai in April this year, China intensified lockdown measures, causing the second-quarter economic growth rate to fall to 0.4%, the lowest since the first quarter of 2020 (-6.8%). In October this year, exports contracted for the first time in 29 months (-0.4%), and in November, the export decline widened to 8.7%. The stricter the lockdowns, the more consumption shrank within China, and production also contracted.

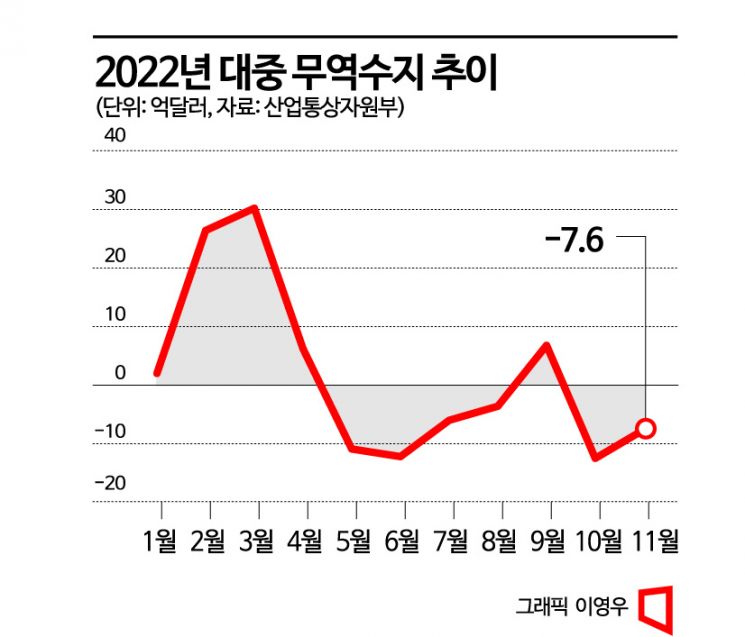

The economic slowdown in China adversely affected South Korea's economy, which has a high dependency on China. From the beginning of this year through November, cumulative exports to China totaled $144.6 billion, a 2.0% decrease compared to the same period last year. This contrasts with export increases to major countries such as the U.S. (15.3%), the European Union (7.3%), ASEAN (18.5%), the Middle East (13.1%), and Japan (3.1%) during the same period.

Exports to China in November amounted to $11.38 billion, plunging 25.5% year-on-year and falling below the monthly average of $12 billion for the first time this year. Semiconductors, which hold the largest share in exports to China, were hit hardest. Semiconductor exports to China in November were $2.77 billion, down 36.1% compared to the same period last year. Key export items such as petrochemicals (-26.2%), petroleum products (-21.1%), and displays (-18.0%) all saw double-digit declines. The Ministry of Trade, Industry and Energy explained, "The price drop of memory semiconductors and decreased demand for data centers in China combined to significantly reduce semiconductor exports to China." Conversely, if China recovers demand by easing lockdowns, South Korean exports are expected to rebound quickly due to the base effect.

Experts are particularly focusing on the revival of China's domestic market, as it is expected to invigorate South Korea's intermediate goods exports. Regarding South Korea's exports to China, the ratio of domestic consumption to re-export has shifted from 60:40 in 2007 to 80:20 last year. Exports of machinery (90.6%), non-metallic minerals (88.8%), coal and petroleum (85.2%), and transportation equipment (83.5%), which had a high domestic consumption ratio last year, are expected to recover rapidly.

Jang Sang-sik, Head of Trend Analysis at the Korea International Trade Association's International Trade and Commerce Research Institute, said, "Since over 80% of South Korea's exports to China are for domestic consumption, easing lockdowns will act as a positive factor for South Korean exports. Considering that lockdowns significantly influenced international oil prices, petroleum products are expected to be the first to rebound in exports to China."

Professor Jeong In-gyo of Inha University's Department of International Trade said, "China's lockdowns have been a burden on the East Asian and global economies. China has also suffered economic devastation due to stringent lockdowns, and significant economic recovery is expected with the recent easing measures." He added, "If the economy of China, South Korea's largest trading partner, recovers, the trade deficit with China will also be resolved through increased exports to China."

However, some opinions suggest that even if China's economy recovers in the medium to long term, it will be difficult to expand the trade surplus to pre-2008 financial crisis levels. This is because China is shifting from being the 'world's factory' to strengthening domestic demand-centered growth, reducing the import share of South Korean medium- to low-technology products. Therefore, there is a need for a strategy to expand exports from mainly intermediate goods to higher technology products and diversify the portfolio to include new export categories such as consumer goods and food products.

There is also analysis that China's easing of Zero COVID will positively affect the South Korean financial market. Ha Geon-hyung, a researcher at Shinhan Investment Corp., said, "Foreign investors tend to view South Korea, which is geographically and economically close to China, as a proxy for China. The South Korean financial market has experienced foreign capital outflows due to downward pressure on the economy from China's lockdowns, but during China's economic recovery, capital inflows into South Korea could intensify."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.