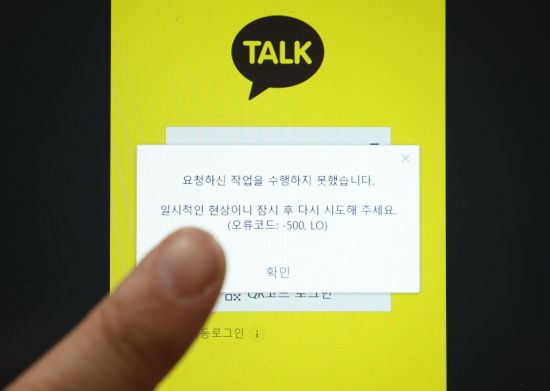

[Asia Economy Reporters Eunju Lee and Seungseop Song] Concerns are being raised both inside and outside that KakaoPay's business model has hit structural limits. In particular, following the ‘Kakao blackout’ incident, the regulatory environment surrounding KakaoPay has worsened, casting doubt on the growth potential of its major business models.

According to financial circles on the 8th, concerns about the sustainability of KakaoPay's business model are being raised both inside and outside Kakao. Several insiders familiar with Kakao stated, “There are voices expressing concerns about Pay's growth potential,” adding, “Due to the recent Kakao blackout incident, Pay was excluded from deposit product brokerage, and the possibility of easing regulations on insurance product sales has become slim.” They also noted, “In the case of the loan brokerage model, many companies have similar models, so it is difficult to say that KakaoPay has secured any special competitiveness, leading to considerable concerns about the business model.”

KakaoPay's main business model is to increase revenue by brokering various financial products. In other words, it is a structure that can secure growth potential by increasing commission income through brokering more products. The problem is that after the ‘Kakao blackout’ incident, the regulatory environment surrounding KakaoPay has also become challenging. The market expansion that would enable more brokerage is likely to be structurally limited for the time being. Inside Kakao, it is widely expected that at least until next year, regulatory easing favorable to Kakao will be difficult following the Kakao blackout incident.

Deposit Brokerage Service Excluded... Insurance Faces Traditional Industry Opposition, Loan Brokerage Competition Intensifies

Last month, KakaoPay was excluded from the financial authorities' easing of regulations on deposit brokerage services. The Financial Services Commission allowed nine fintech and financial companies not only to compare deposit products but also to recommend them tailored to consumers. Companies designated as innovative financial services, such as Shinhan Bank and Naver Financial, will be able to provide customized recommendations using customer data and financial information to offer preferential interest rates starting from the second quarter of next year. In contrast, KakaoPay cannot provide such ‘recommendations.’ It is limited to simply comparing and displaying products using publicly disclosed interest rate data. Consequently, its service competitiveness is relatively weaker.

The expansion of insurance products that KakaoPay can broker is also expected to be limited. The Financial Services Commission plans to introduce comparison recommendation services for big tech platforms within the year, but the existing insurance industry strongly opposes this. Major non-life insurance companies believe that if big tech platforms can compare and recommend products like auto insurance, the livelihood of insurance agents will be threatened. Additionally, the financial authorities have stated that products with complex structures, such as whole life, variable, and foreign currency insurance, will be excluded from comparison recommendation services. A representative from a big tech company explained, “The opposition due to protests by insurance agents is strong, and the financial authorities are mindful of this, creating a business environment unfavorable to Kakao.”

Regarding loan brokerage services, the market competition is intensifying, making the situation challenging. Especially, fintech companies brokering loan products have very similar basic business models, making it difficult for KakaoPay to find any unique competitiveness. Moreover, recently, the ‘giant’ Naver has officially entered the loan comparison market, which is expected to cause a significant shift in the competitive landscape composed of Toss, KakaoPay, Finda, and others. A financial industry insider pointed out, “KakaoPay has not discovered new business models and is merely following existing brokerage models,” adding, “Since the essence of the financial industry involves strong regulation, regulatory tightening should have been anticipated, and executives need to take responsibility for the business model’s limitations.”

A KakaoPay representative explained, “KakaoPay recorded a profit in the third quarter based on separate standards,” and added, “KakaoPay is creating new changes by gathering traffic through payments and remittances and connecting consumers with necessary user-friendly services.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.