Year-End Interest Rate Outlook Surges to 3.5%

[Asia Economy Reporter Seo So-jeong] Amid growing expectations that the Bank of Korea (BOK) will implement a 'big step' (a 0.50 percentage point increase in the base interest rate) this month due to the U.S.'s indication of aggressive tightening, forecasts are rapidly emerging that the BOK will take consecutive big steps at the last Monetary Policy Committee (MPC) meeting of the year in November as well.

According to the financial industry on the 4th, the expectation that the BOK will carry out consecutive big steps in the remaining two MPC meetings this year is gradually spreading. BOK Governor Lee Chang-yong hinted at the possibility of a big step in October on the 22nd of last month, following the U.S. Federal Open Market Committee (FOMC) regular meeting, stating that "the preconditions for a 0.25 percentage point base rate hike have changed significantly." As Governor Lee announced the revision of the existing 'forward guidance,' the market began to raise the possibility of a big step at the last MPC meeting in November this year.

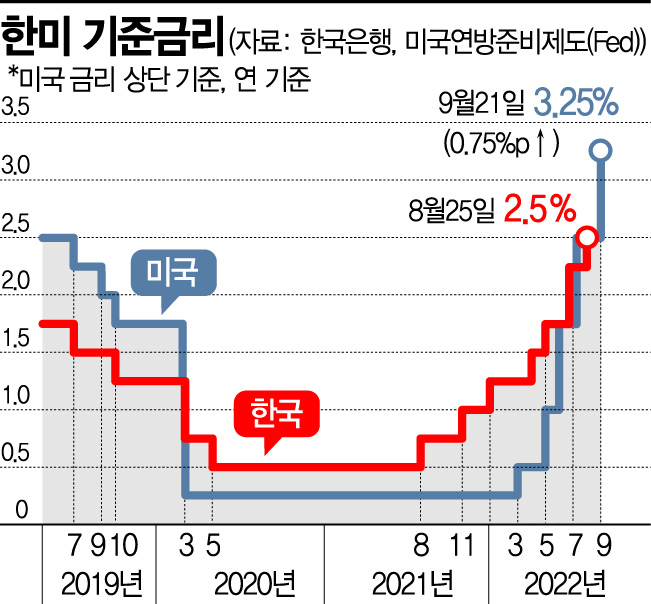

With the U.S. Federal Reserve (Fed) likely to raise interest rates by 0.75 percentage points and 0.50 percentage points in the remaining two meetings, pushing the year-end rate ceiling to 4.5%, if the interest rate gap between Korea and the U.S. widens further, foreign capital outflows could accelerate. If Korea raises rates by 0.50 percentage points each in October and November, the rate will reach 3.5%, creating a 1.0 percentage point gap with U.S. rates. However, if the MPC raises rates by 0.25 percentage points in both October and November, the rate will remain at 3.00%, widening the Korea-U.S. interest rate gap to a maximum of 1.5 percentage points.

During the last three rate hike cycles by the Fed, the policy rates between Korea and the U.S. were all reversed, with the maximum reversal gap reaching 1.5 percentage points. The first period of Korea-U.S. rate inversion was from June 1999 to March 2001. At that time, the stock market overheated due to the 'dot-com bubble,' and the Fed raised the base rate to 6.5% to cool the bubble, while Korea's base rate, just after the foreign exchange crisis, was between 4.75% and 5.25%, resulting in an interest rate gap of up to 1.5 percentage points. During this first inversion period, foreign securities investment funds saw an inflow of $20.9 billion in the stock market and an outflow of $4.1 billion in the bond market.

The BOK has previously cautioned against excessive concern, noting that foreign securities investment funds actually saw a net inflow of $16.9 billion to $40.3 billion during past Korea-U.S. rate inversion periods, but recently, net outflows have continued, mainly in stock funds. Since the Fed's rate hike in March, foreign securities investment funds have recorded a net outflow of $1.77 billion, mainly from stocks. Bond funds have generally continued net inflows, but the scale has significantly decreased compared to last year, with a net outflow of $1.31 billion recorded last month. If U.S. rates rise above Korea's, foreign investors may move funds in pursuit of higher returns, which could cause the won-dollar exchange rate to rise even faster.

Recently, the won-dollar exchange rate has repeatedly hit new highs, breaking its record 11 times in September alone. According to the Seoul foreign exchange market, the won-dollar exchange rate surpassed 1,440 won on the 28th of last month, reaching its highest level in 13 years and 6 months since March 16, 2009 (1,488.0 won). The persistent strong dollar trend, along with sharp declines in major currencies such as the British pound and Chinese yuan, has prevented these currencies from avoiding a simultaneous weakening.

Shin Young Securities researcher Jo Yong-gu said, "The BOK appears to be reluctant to allow an interest rate gap exceeding 1 percentage point, using the Fed's monetary policy as a major premise against the backdrop of won depreciation," and predicted, "The possibility of consecutive big steps at the October and November meetings has increased." Dongbu Securities researcher Gong Dong-rak also forecasted, "The won-dollar exchange rate is rising sharply, and global monetary authorities are expanding the magnitude of base rate changes compared to before," adding, "Following October, another big step rate hike is expected again in November."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.