[Asia Economy Reporter Jeong Dong-hoon] The global electric vehicle battery market reached approximately 59 trillion KRW in the first half of this year. Among this, the combined sales of the three Korean battery companies amounted to about 15 trillion KRW, accounting for around 26% of the market.

According to data compiled by SNE Research, an energy-focused market research firm, global electric vehicle (BEV·PHEV) sales in the first half of this year increased by 65% compared to the same period last year, reaching 4.35 million units.

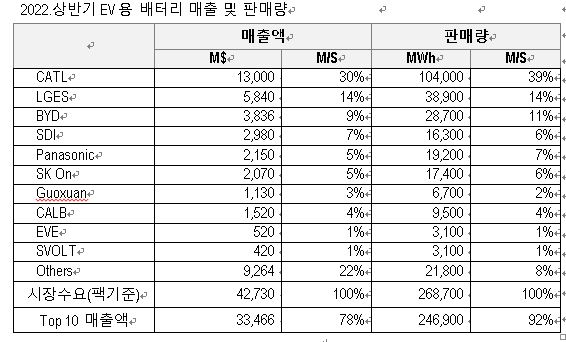

The total sales revenue of batteries for electric vehicles (based on battery packs) sold in the first half of this year was $42.73 billion (approximately 58.7 trillion KRW).

China's CATL accounted for 30% of the total market with $13 billion (about 17.9 trillion KRW). LG Energy Solution ranked second with $5.84 billion (about 8 trillion KRW), holding a 14% market share.

Following were 3rd place China BYD (5.3 trillion KRW, 9%), 4th place Samsung SDI (4.1 trillion KRW, 7%), 5th place Japan's Panasonic (3 trillion KRW, 5%), and 6th place SK On (2.8 trillion KRW, 5%).

The combined electric vehicle battery sales revenue of the three Korean battery companies?LG Energy Solution, Samsung SDI, and SK On?in the first half of this year was $10.89 billion (about 15 trillion KRW, 26%), which was less than the sales of CATL alone.

Meanwhile, Samsung SDI had the highest average battery pack price at $183 per kWh. SNE Research analyzed that this is because Samsung SDI has a relatively high sales proportion of batteries for plug-in hybrid vehicles, which have a higher average battery price. Panasonic had the lowest average price at $112 per kWh, influenced by the sales price of cylindrical batteries mainly supplied to Tesla. The average price per kWh was analyzed as $150 for LG Energy Solution, $125 for CATL, and $119 for SK On.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.