[Asia Economy Reporter Ji Yeon-jin] Recently, as the KRW-USD exchange rate has soared, Samsung Biologics, which has a high proportion of dollar-denominated sales, is emerging as a beneficiary. This is because most of the sales in the biopharmaceutical contract development and manufacturing organization (CDMO) business are in dollars, while production costs are mostly based on Korean won. Additionally, since raw materials are structured to be reimbursed, the impact of the dollar is limited.

According to the financial investment industry on the 8th, the KRW-USD exchange rate recorded 1,205 won in the first quarter of this year, up 8.2% from the previous year, and rose 12.5% to 1,261 won in the second quarter. The rate surged to 1,384 won the day before, and there are forecasts that it could break 1,400 won this year.

Generally, when the dollar value soars, sales in the U.S. or dollar-based sales increase due to exchange rate effects, but the prices of imported raw materials also rise, which can increase manufacturing costs. Overseas branches have seen increased labor costs, and global clinical trial costs and new drug development expenses have also risen. Therefore, companies with a high proportion of dollar-based sales but a low proportion of dollar-based costs are considered advantageous when the exchange rate rises.

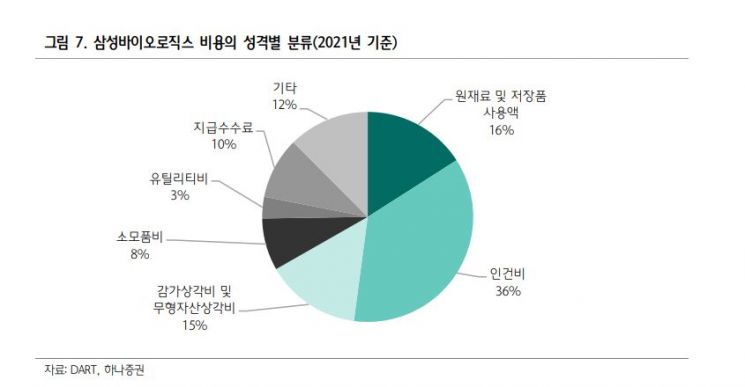

Jae-kyung Park, a researcher at Hana Securities, said, "Among domestic pharmaceutical and bio companies, Samsung Biologics is the most advantageous during a rising KRW-USD exchange rate period." He added, "Since most CDMO contracts are conducted in dollars, the majority of Samsung Biologics' sales are dollar-based, and all of Samsung Biologics' factories are located in Korea, so labor costs and depreciation expenses occur in Korean won." He also mentioned that while the prices of raw materials imported from overseas are affected by the exchange rate, due to the nature of CDMO contracts, Samsung Biologics is reimbursed for raw material and incidental costs from clients, so the impact of exchange rate fluctuations is less significant.

Celltrion Healthcare also generates most of its sales overseas, with about 50% of sales in dollars. Daewoong Pharmaceutical exports the botulinum toxin 'Nabota' to the U.S., making it one of the pharmaceutical companies with a high dollar proportion. Daewoong Pharmaceutical's U.S. Nabota sales are expected to reach 113 billion won this year, accounting for approximately 8.8% of total sales.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.