US Fund Establishes Venezuelan Crude Oil Development Venture... Also Permits Crude Oil Exports to Europe

[Asia Economy Reporter Park Byung-hee] Expectations are growing that the U.S. government will lift restrictions on Venezuelan crude oil exports as two U.S. funds establish a joint venture for gas and oil development off the eastern coast of Venezuela. It has also been confirmed that the U.S. State Department has already allowed some Venezuelan crude oil exports to Europe.

According to major foreign media on the 6th (local time), Gramercy Fund Management and Amos Global Energy announced the establishment of a joint venture for investment in Venezuela's oil industry. The two funds added that the joint venture will cooperate with a subsidiary of Venezuela's Inelectra Group. The Inelectra Group holds stakes in the oil field development project discovered in 2001 in the Paria Gulf in eastern Venezuela.

Foreign media described this as a clear sign that relations between the U.S. and Venezuela are improving.

The funds did not disclose the scale of the investment. They also explained that approvals from both the U.S. and Venezuelan governments are required for the development. Matt Maroni, a partner at Gramercy, said, "The joint venture will benefit the U.S. by lowering energy costs for American consumers."

Amos Global Energy is a fund established in 2019 by Ali Mosiri, who served as an executive at the U.S. refining company Chevron and was in charge of South American investments. Gramercy is also a fund that mainly invests in emerging markets.

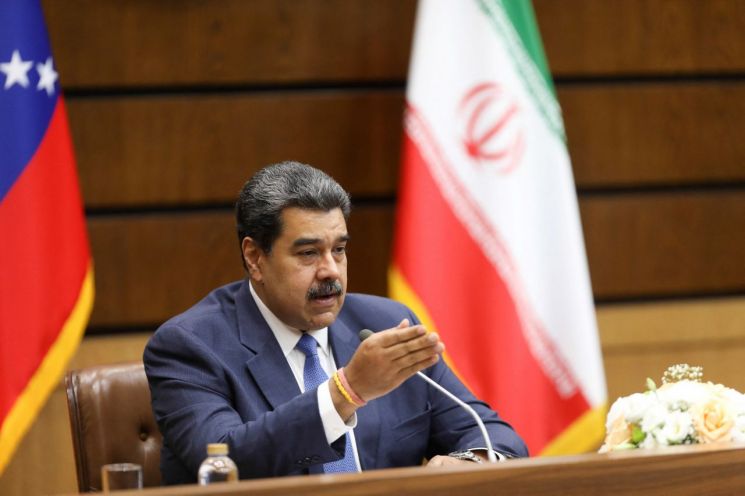

Relations between the U.S. and Venezuela deteriorated to their worst after incumbent President Nicolas Maduro won re-election in Venezuela's May 2018 presidential election. At that time, the U.S. argued that the election was unfair as opposition candidates were placed under house arrest or imprisoned, and therefore could not recognize Maduro's victory and demanded his resignation. The following year, diplomatic relations between the U.S. and Venezuela were severed, and the U.S. imposed crude oil export sanctions to pressure President Maduro. However, after the energy costs surged following the Ukraine war this year, the U.S. has shown signs of improving relations with Venezuela. In March, a senior White House official visited Caracas and met with Venezuelan government officials.

The U.S. State Department has recently confirmed that it has also allowed Venezuelan crude oil exports to Europe. According to sources, Spanish refining company Repsol and Italian oil and gas company Eni are expected to start transporting Venezuelan crude oil to Europe as early as this month. Venezuela is repaying its debts with crude oil. This marks the first export of Venezuelan crude oil to Europe in two years.

President Maduro of Venezuela described the U.S. government's approval for Eni, Repsol, and Chevron to utilize Venezuela's oil and gas as a small but meaningful progress. Regarding Chevron, the U.S. government has allowed the resumption of business in Venezuela but has not yet approved crude oil exports to the U.S.

According to foreign media, President Biden hopes that Venezuelan crude oil will help Europe reduce its dependence on Russia and also hopes that Venezuelan crude oil heading to China will be redirected to Europe. However, citing sources, it was added that the volume of crude oil supplied through Repsol and Eni is not large, so the impact on the crude oil market will not be significant.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.