The apartment sales market is struggling to recover from a severe transaction freeze, with the number of unsold listings on the market rapidly increasing. Outside of Seoul, most regions nationwide have accumulated more listings than the level seen in June 2020, when false listings were rampant. The buying momentum from the 2030 generation, which had driven the real estate boom, has completely dried up, and the pre-sale market has also lost all vitality.

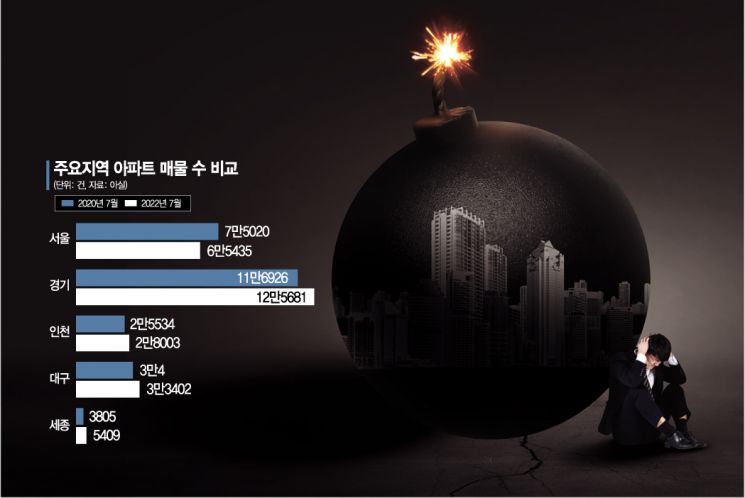

According to real estate big data company Asil on the 6th, the number of apartment listings in Gyeonggi Province was recorded at 125,681 as of that day. The number of apartment sale listings in Gyeonggi peaked at around 120,000 in June 2020, then began to sharply decline following the crackdown on false online real estate listings in August 2020. By January of the following year, listings had halved to about 60,000. Listings, which had rarely increased due to supply shortages and rising real estate sentiment, began to surge sharply from August last year. As interest rate hikes and loan regulations intensified, listings rose from about 60,000 in August to over 100,000, surpassing 120,000 in July and approaching 130,000.

The situation where listings exceed those during the ‘false listings era’ is seen in virtually all regions except Seoul, including Daegu, Incheon, Gwangju, Daejeon, Ulsan, Sejong, Chungbuk, Chungnam, Jeonbuk, Jeonnam, Gyeongbuk, and Gyeongnam. Incheon’s listings increased from 25,534 on July 6, 2020, to 28,003 on this day; Daegu’s rose from 30,004 to 33,402; and Sejong’s from 3,805 to 5,409.

The general outlook is that the rapid increase in listings is likely to continue. Concerns over interest rate hikes and falling home prices have sharply dampened even the buying sentiment in the metropolitan area. According to the Korea Real Estate Board, the apartment sales supply-demand index in the metropolitan area recorded 89.8 last week, falling below 90. The lower the index is below the baseline (100), the more sellers there are compared to buyers, and this is the first time in 2 years and 10 months since the survey on August 12, 2019 (89.6) that the figure has dropped below 90. The buying momentum of the 2030 generation, who had driven the real estate upswing through ‘all-in’ investments, has also stopped. From January to May this year, the proportion of buyers aged 30 or younger in Seoul apartment transactions was 38.7%. This is the first time since the second half of 2020 that this proportion has fallen below 40%.

The government has taken measures such as lifting regulations in 17 local areas with weak real estate markets to ensure a soft landing for the real estate market, but these are assessed as unlikely to affect the overall trend. Following the easing of regulation zones, the ‘Beomeo Xi’ pre-sale in Daegu on the 4th saw under-subscription in most unit types in the first-priority local application. Even the most preferred 84C type had a competition rate of only 0.6 to 1. A sales official said, "The recruitment announcement was made before the regulation easing took effect, so direct benefits were not received," but added, "Even considering this, the results are somewhat disappointing."

With interest rate hikes, transaction freezes, and growing theories of a housing price peak, volatility in the real estate market is expected to increase further. Kim Seong-hwan, a senior researcher at the Korea Construction Industry Research Institute, said, "With multiple factors such as financial regulations and interest rate hikes overlapping, the momentum to maintain the current (high) housing price level has weakened," adding, "The market is expected to be more difficult in the second half of the year than in the first half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.