[Tech War, Birth of Advanced Nations] ①Reducing Dependence on Overseas Raw Materials

②Producing Blockbuster-Level Pharmaceuticals

③Government Support for Technology and Policy Financing

The COVID-19 pandemic has further highlighted the importance of the pharmaceutical and bio industries. As the ability to develop, produce, and supply vaccines and treatments has become a matter of national competitiveness, governments worldwide have actively supported the pharmaceutical and bio sectors, while companies are accelerating competition by hastening new drug research and development (R&D) and investment.

Domestic companies, represented by 'K-Bio,' have also entered this competition and are achieving tangible results. Samsung Biologics is currently contract manufacturing Moderna's messenger RNA (mRNA) COVID-19 vaccine using its own facilities, SK Bioscience has developed a synthetic antigen-based vaccine and is on the verge of commercialization, and Celltrion's COVID-19 antibody treatment has already received product approval both domestically and internationally.

Domestic pharmaceutical and bio companies are leveraging this momentum to devise new strategies to leap into global enterprises. The government has also proposed growing the pharmaceutical and bio industry as the 'second semiconductor' to lead the future national economy and become a pharmaceutical and bio powerhouse. However, there are calls for the government to provide full support and remove regulations so that domestic pharmaceutical and bio companies can grow into globally competitive enterprises by emphasizing entrepreneurial spirit.

Technology Exports More Than 2.5 Times Growth in 3 Years

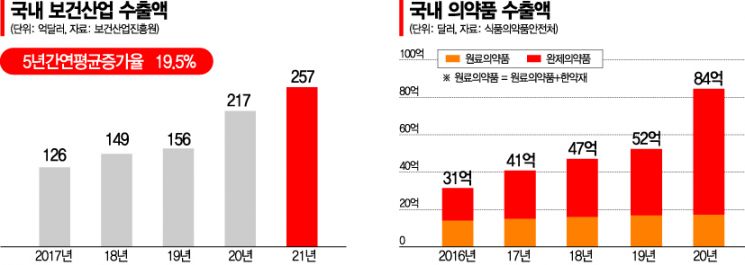

According to the Korea Health Industry Development Institute on the 21st, last year, South Korea's pharmaceutical exports reached $9.915 billion (approximately 12.8 trillion KRW), recording an average annual growth rate of 24.6% over the past five years. Medical device exports also increased to $6.639 billion, with an average annual growth rate of 17.0% during the same period. Two years ago, in 2020, pharmaceutical exports were $8.428 billion, a 62.6% increase from $5.184 billion in 2019, while medical devices surged 44.0% from $3.96 billion to $5.73 billion in the same period. Including cosmetics, total health industry exports last year amounted to $25.7 billion, surpassing shipbuilding, auto parts, and display industries to rank as the 7th largest export industry in South Korea.

Technology export performance in the pharmaceutical and bio industry has also been increasing annually. According to the Korea Pharmaceutical and Bio-Pharma Manufacturers Association, excluding undisclosed amounts such as contract fees, the scale of domestic pharmaceutical and bio technology exports grew from 5.3706 trillion KRW in 2018 to 8.5165 trillion KRW in 2019, and 10.1488 trillion KRW in 2020, nearly doubling in two years, then further increasing significantly to 13.372 trillion KRW last year. This year, seven technology export deals reported through April alone amount to approximately 2.8974 trillion KRW publicly disclosed. The active technology exports indicate that global major pharmaceutical companies are securing competitive new drug pipelines from domestic companies at early development stages.

In February this year, the World Health Organization (WHO) designated South Korea as a 'Global Bio Workforce Training Hub.' This project provides education and training on biopharmaceutical manufacturing processes to middle- and low-income countries (developing countries) to promote vaccine self-sufficiency. WHO expects that domestic bio companies, which rank second worldwide with an annual biopharmaceutical production capacity exceeding 600,000 liters and have experience contract manufacturing five types of COVID vaccines, will play a significant role not only in resolving global vaccine inequality but also in establishing a global health security network.

However, there are many challenges to overcome to leap into an advanced pharmaceutical and bio powerhouse. The most urgent is reducing dependence on overseas raw materials and increasing self-sufficiency. In 2020, the proportion of domestically sourced raw materials used by Korean pharmaceutical companies was only 14%, far below Europe’s 33%, the U.S.’s 30%, and Japan’s 37%. Most raw materials are imported from China (37.5% as of 2019) and India (16.3%), making the industry highly sensitive to conditions in these countries. Recently, prolonged lockdowns in Shanghai due to COVID-19 and rising prices caused by the Russia-Ukraine war have directly impacted domestic pharmaceutical and bio companies.

The absence of ‘global blockbuster-level’ drugs with annual sales exceeding 1 trillion KRW is also a limitation. Despite large-scale technology export achievements, domestic companies have not produced such major new drugs because they cannot even attempt global clinical trials, which require enormous costs ranging from 200 billion KRW to as much as 1 trillion KRW. Professor Kim Sang-eun of Seoul National University College of Medicine (CEO of BIKE Therapeutics) pointed out, "As of 2020, only six new drugs in Korea have production amounts exceeding 10 billion KRW, and only one exceeds 50 billion KRW. Without a substantial breakthrough, it is still a long way to becoming a pharmaceutical powerhouse."

To move beyond merely satisfying with technology exports and to secure global blockbuster-level new drugs independently, the industry voices the need for comprehensive support measures from the government, including institutional and administrative support for technology development, approval, and production facility establishment, as well as policy finance such as fund or foundation creation.

Won Hee-mok, chairman of the Korea Pharmaceutical and Bio-Pharma Manufacturers Association, emphasized, "The U.S. government invested trillions of won in Pfizer, enabling it to dominate the global market, and Moderna also grew into a global company through such government support. Domestic companies are only exporting technology at the preclinical and phase 1 clinical stages due to funding issues, but to complete phases 2 and 3 clinical trials and create world-class blockbuster drugs, government support is essential."

Lee Seung-gyu, vice chairman of the Korea Bio Association, stated, "The Chinese government is much more aggressive in bio industry investment than Korea and promotes technology adoption through early market entry and later regulation at the provincial level, leading to rapid development. Our government must also modernize regulations suited to innovative technologies based on infrastructure support and create a structure that naturally attracts private capital for sustainable development."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.