Approval of 3 Companies Including Zethema and Protox

Competition Among Over 10 Companies Including Existing Manufacturers

Medytoks, Hugel, Daewoong Pharmaceutical, etc.

Striving to Widen Gap with Latecomers

Market Size Expected to Reach 200 Billion KRW Next Year

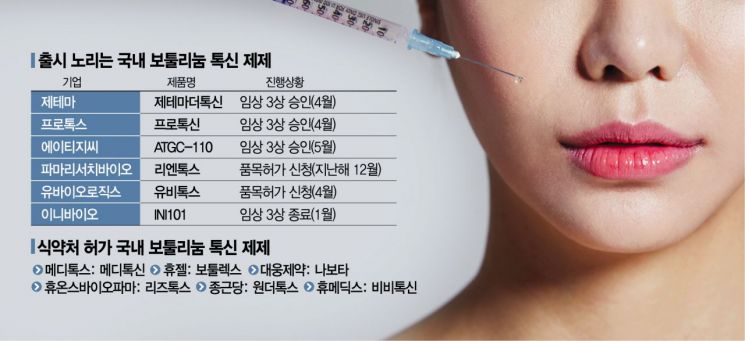

[Asia Economy Reporter Lee Gwan-joo] The domestic botulinum toxin (Botox) market is becoming increasingly competitive. In the past two months alone, three companies have received approval from the Ministry of Food and Drug Safety (MFDS) for Phase 3 clinical trials. Including existing toxin manufacturers and those who have completed Phase 3 trials and are pursuing product approval, about ten pharmaceutical and biotech companies are expected to compete fiercely in the near future.

Three New Companies Receive Phase 3 Clinical Trial Approval

According to the MFDS’s Drug Safety Korea on the 10th, three companies?Jetema, Protox, and ATGC?were approved for Phase 3 clinical trials of botulinum toxin products between April and May.

Jetema plans to conduct a Phase 3 clinical trial comparing the efficacy and safety of ‘Jetema Derma Toxin Injection 100U’ with Allergan’s Botox Injection in adults requiring improvement of moderate to severe glabellar lines. The trials will be conducted at Seoul Asan Medical Center, Konkuk University Medical Center, and Chung-Ang University Hospital. Jetema received export product approval from the MFDS in June 2020 and signed a local clinical trial and supply contract worth 144 billion KRW in Brazil. Along with the domestic Phase 3 trial, the company aims to apply for Phase 1 clinical trial approval in China within this year.

Protox also received approval for Phase 3 clinical trials of its botulinum toxin product ‘Protox’ and plans to conduct the trials at Chung-Ang University Hospital. In 2019, Protox invested 32 billion KRW in a Good Manufacturing Practice (GMP) facility in the pharmaceutical complex in Hyangnam, Hwaseong-si, Gyeonggi Province, obtained pharmaceutical manufacturing licenses, and has been conducting clinical trials on Protox since 2020. The company aims to obtain product approval next year after completing Phase 3 trials.

ATGC’s ‘ATGC-110,’ approved for Phase 3 clinical trials on April 30, is being developed as a Pure-type botulinum toxin product. It is a product from which non-toxic proteins causing resistance have been removed. Clinical trials are being conducted at Nowon Eulji University Hospital, Kyung Hee University Hospital, and Gangdong Kyung Hee University Hospital. ATGC plans to apply for product approval immediately after completing Phase 3 trials and aims to launch the product next year.

Latecomers Accelerate... Early Entrants Respond Actively

Three companies?InnoBio, UbioLogics, and PharmaResearch Bio?that completed Phase 3 clinical trials last year are now pursuing product approval. PharmaResearch Bio applied for product approval for ‘Lientox Injection’ in December last year. Lientox Injection had only received export approval in 2019. UbioLogics also applied for product approval in April for ‘Ubitox Injection 100 Units,’ co-developed with ATGC. InnoBio completed a Phase 3 clinical trial comparing ‘INI101’ with Botox in January this year and is expected to submit the approval application as early as this month.

Six companies currently leading the domestic botulinum toxin market with MFDS approval?Medytox, Hugel, Daewoong Pharmaceutical, Huons Biopharma, Humedics, and Chong Kun Dang?are working to widen the gap with latecomers. Medytox recently applied for product approval for its next-generation toxin product ‘NEWLUX.’ NEWLUX features a new manufacturing process that reduces the possibility of contamination by impurities. Daewoong Pharmaceutical’s ‘Nabota’ and Huons Biopharma’s ‘Liztox’ are seeking to expand indications to treat benign masseter hypertrophy, commonly known as square jaw. Nabota successfully completed Phase 3 trials and submitted the product approval application in April, while Liztox has completed Phase 2 trials.

The intensifying competition is driven by the growth of the domestic botulinum toxin market. According to a Samsung Securities healthcare report, the market size is expected to exceed 200 billion KRW next year, up from 157 billion KRW in 2020. In the first quarter of this year, Daewoong Pharmaceutical’s Nabota sales surged 98% year-on-year to 30.7 billion KRW, and Hugel also recorded sales of 28.5 billion KRW (including HA filters), a 6.6% increase.

An industry insider said, "As the COVID-19 situation improves, interest in medical aesthetics, which had been suppressed, is growing stronger," adding, "Competition in the domestic botulinum toxin market will become even fiercer in terms of price and quality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.