Raw Material Prices Up 51.2% in 2 Years

Challenges Due to Unreflected Price Increases in Delivery Costs

SMEs to Hold Press Conference on Getting Fair Prices on the 11th

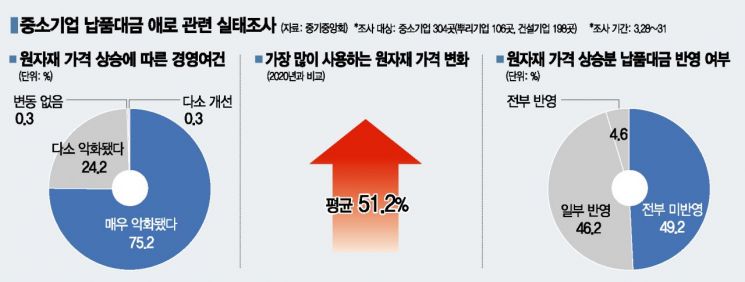

[Asia Economy Reporter Kim Bo-kyung] It has been revealed that the prices of raw materials purchased by small and medium-sized enterprises (SMEs) in the root and construction sectors for product manufacturing have risen by 51.2% over the past two years. Despite this, only 4.6% of SMEs reported that the increase in raw material prices was ‘fully reflected’ in their delivery prices, while 49.2% responded that it was ‘not reflected at all,’ indicating that the difficulties faced by SMEs have reached a peak. The industry has called for the introduction of a 'delivery price linkage system' that automatically reflects raw material price increases in delivery prices without separate measures.

SME Survey... Raw Material Prices Up 1.5 Times in Two Years

According to a survey conducted by the Korea Federation of SMEs last month targeting about 300 SMEs in the root and construction sectors, raw material prices have increased by an average of 51.2% compared to 2020. For the root industry, prices rose by 68.6%, and for the construction industry, by 41.6%.

During the same period, 75.2% of respondents reported that their business conditions had ‘greatly worsened’ due to the sharp rise in raw material prices. Including those who said conditions had ‘somewhat worsened,’ nearly all (99.4%) root and construction SMEs experienced deteriorated business conditions. Even when only partially reflected in delivery payments, the reflection rate was only 29.9% of the total increase. SMEs responded that if this situation continues, they plan to cope by reducing production volume (41.9%), cutting jobs (32.9%), and closing factories (9.6%).

Regarding the most necessary policies to receive fair delivery prices (multiple responses allowed), the introduction of a delivery price system was the highest at 91.7%. Next were periodic government surveys on delivery price reflection status (37.6%), formation and operation of private win-win councils by industry (17.8%), strengthening penalties for unfair price decisions (13.9%), and expanding incentives for primary contractors who raise delivery prices (10.2%). About changes in business conditions if a delivery price linkage system is introduced, 95.4% said conditions would improve, with 47.2% responding ‘greatly improved’ and 48.2% ‘somewhat improved.’

On the same day, 18 SME organizations including the Korea Federation of SMEs held a ‘Press Conference for Fair Delivery Prices’ at the Korea Federation of SMEs in Yeouido, Seoul, announcing the survey results and urging the new government to resolve the polarization between large and small-medium enterprises. In particular, SME groups advocated for the establishment of a presidential-level Win-Win Committee to address these issues.

Kim Ki-moon, chairman of the Korea Federation of SMEs, emphasized, "If SMEs have to bear the burden of skyrocketing raw material prices, it could become a matter of survival," and added, "The new government launching in May must resolve the polarization issue." He further stressed, "Until a culture of voluntary win-win cooperation is established, a legally mandated delivery price linkage system must be introduced promptly," and "The new government should establish a presidential-level Win-Win Committee to promote cooperation between large and small-medium enterprises and serve as a control tower to review and coordinate SME policies."

"Moves to Abandon Contract Fulfillment... Government Must Step In"

On the same day, SME representatives also shared on-site damage cases caused by non-reflection of delivery prices. Yoo Byung-jo, chairman of the Korea Window and Curtain Wall Association, said, "The contract period with construction companies is 1 to 3 years, but the price of aluminum, the main material for window and curtain wall frames, has doubled, causing enormous losses." He added, "Due to the price surge, some in the industry are even considering abandoning contract fulfillment," and urged, "We hope the delivery price linkage system will resolve these issues as soon as possible."

Bae Jo-ung, chairman of the Korea Ready-Mixed Concrete Industry Federation, lamented, "With rapid increases in material costs such as cement and aggregates, fuel costs, and transportation fees, small ready-mixed concrete companies are caught between purchasing construction companies and suppliers in the worst situation," and added, "Major cement companies are demanding an additional 19% price increase citing rising bituminous coal prices and are even pressuring to halt supply."

Jung Han-sung, director of the Korea Fastener Industry Cooperative, appealed, "Raw material suppliers unilaterally notify the timing and extent of price increases," and said, "Orders already received must be produced and supplied at a loss." He continued, "While raw material supplying large companies have recorded record-high operating profits, the operating profit margin of fastener SMEs is only 1%," and demanded, "It is not just talk about win-win cooperation; government-related ministries and large companies must take interest and help SMEs."

The press conference was attended by organizations including the Korea Women Entrepreneurs Association, Korea Specialty Contractors Association, Korea Mechanical Equipment Construction Association, Korea Window and Curtain Wall Association, and the National Reinforced Concrete Federation.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.