The Bank of Korea's Monetary Policy Committee Aligns with Expectations... Possibility of Another Rate Hike Early Next Year

Lee Ju-yeol, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee plenary meeting held on the morning of the 25th at the Bank of Korea in Jung-gu, Seoul.

Lee Ju-yeol, Governor of the Bank of Korea, is striking the gavel at the Monetary Policy Committee plenary meeting held on the morning of the 25th at the Bank of Korea in Jung-gu, Seoul. [Photo by Yonhap News]

[Asia Economy Reporter Minwoo Lee] The Bank of Korea's Monetary Policy Committee has indicated that it may raise the base interest rate again in early next year. This stance is based on the judgment that the move is part of a normalization process rather than tightening. The market analysis suggests that while there may be some reversal of the excessively reflected base rate hikes for the time being, it is unlikely to represent a trend change.

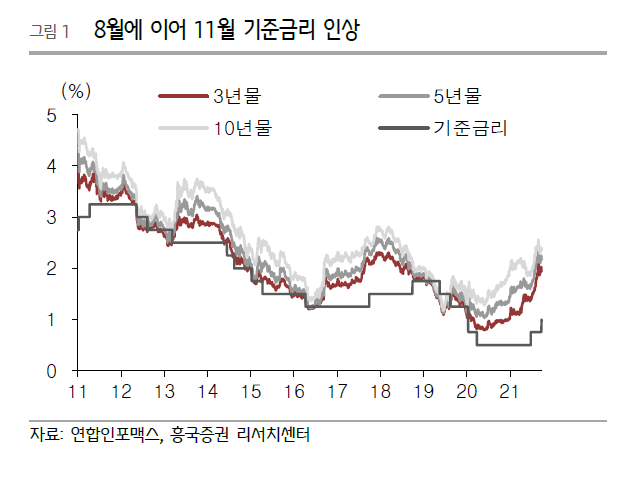

On the 27th, Heungkuk Securities analyzed the rate hike by the Bank of Korea's Monetary Policy Committee in this way. Previously, on the 25th, the Bank of Korea's Monetary Policy Committee held a monetary policy direction decision meeting at the main building in Jung-gu, Seoul, chaired by Governor Lee Ju-yeol, and raised the base interest rate from 0.75% to 1.00% per annum. This was the first rate hike by the Bank of Korea in three months, marking the first time in 10 years since March 2011 (3% → 3.25%).

Heungkuk Securities identified the key points of this Monetary Policy Committee meeting as ▲ the base interest rate still being accommodative ▲ the possibility of a rate hike in the first quarter of next year ▲ and the willingness to communicate if there is a gap with the market. In particular, attention was drawn to the view that this rate hike is part of a normalization process rather than tightening, and that there is less need to maintain low interest rates given the unusually large amount of money supply. Although the market has already factored in additional rate hikes, this was a further indication of that possibility.

Therefore, the possibility of a rate hike in the first quarter of next year has increased. Kim Jun-young, a researcher at Heungkuk Securities, said, "There was a statement that political schedules are not considered when judging the timing of rate hikes, and by removing the word 'gradual,' it implied that consecutive rate hikes are possible," adding, "Considering the next Monetary Policy Committee meeting in just over three months and the favorable private consumption trend, the weight is on rate hikes."

The part about communicating if there is a gap with market expectations was interpreted as advice to the market, which has been excessively reflecting the number of rate hikes. Researcher Kim explained, "The forward rate agreement (FRA) market was also excessively reflecting rate hikes, but after Governor Lee Ju-yeol's remarks, it adjusted significantly and showed a downward trend," adding, "This seems to mean that as the final base rate approaches, the Bank of Korea intends to resolve excessive market bias through communication, and it is possible that some internal discussions about the final base rate have taken place."

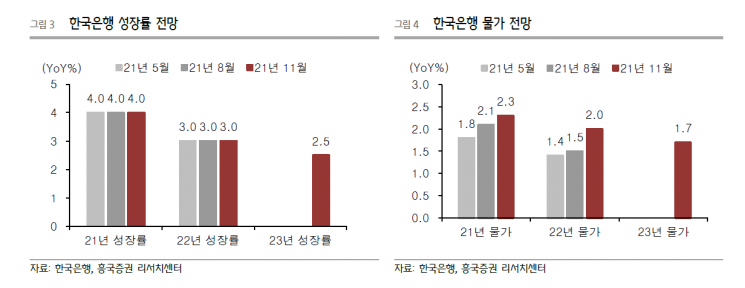

The Bank of Korea's economic outlook report forecasts growth and inflation rates of 4.0% and 3.0% for this year and next year, respectively, which is not far from market expectations. Ultimately, it was a comfortable Monetary Policy Committee meeting that both curbed market overheating and hinted at rate hikes. Researcher Kim said, "I maintain the view of a final base rate of 1.50% and rate hikes in the first and fourth quarters of next year," adding, "The market may somewhat reverse the excessively reflected base rate increases for the time being, but this Monetary Policy Committee meeting is unlikely to be the starting point of a strong upward trend."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.