Last Year, Losses Exceeding 5 Billion KRW Totaled 1.1289 Trillion KRW... Accounting for 75.6% of Total Claims

[Sejong=Asia Economy Reporter Kim Hyun-jung] It has been confirmed that the amount of national tax refunds returned to taxpayers due to acceptance of appeals has approached an average of 2 trillion won over the past five years. In the case of last year, the amount lost (accepted) in high-value appeal cases exceeded 1 trillion won.

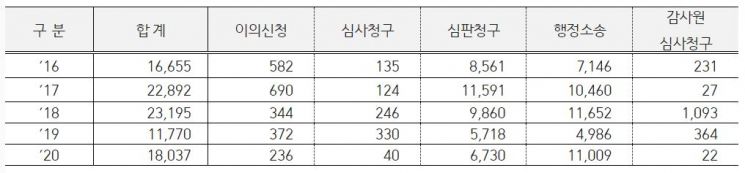

On the 28th, Kim Ju-young, a member of the National Assembly's Planning and Finance Committee from the Democratic Party of Korea, checked the National Tax Service's 'Acceptance rate of high-value lawsuits and adjudication cases over the past five years' and 'Annual lawsuit and adjudication claim status,' confirming an increase in the scale of lawsuit and adjudication claims and the rising amounts claimed. The loss rate also increased as the amounts became higher.

Looking at the 'Annual lawsuit and adjudication claim status,' although the number of appeal claims has fluctuated somewhat over the past five years, the amount claimed has been increasing. The lawsuit and adjudication claim amounts, which were 2.9403 trillion won (1,466 cases) and 4.8393 trillion won (5,237 cases) in 2017, respectively, increased every year, recording 2.15 trillion won (1,395 cases) and 6.6111 trillion won (8,712 cases) last year. As of June this year, the amounts claimed in lawsuits and adjudications reached 3.3386 trillion won (688 cases) and 2.2196 trillion won (3,563 cases), respectively.

Since the amount claimed in adjudication appeals (administrative review), which is the pre-litigation stage, is increasing, it is expected that the amount claimed in lawsuits will also show an increasing trend in the future.

The number of lawsuit and adjudication claims exceeding 10 billion won has also increased every year. The number of claims was 114 cases in 2016, rising to 122 cases in 2017, 153 cases in 2018, and 174 cases in 2019. Although it decreased to 129 cases last year, 66 cases have already been filed as of June this year.

The problem is that the loss rate related to high-value appeal cases exceeding 5 billion won is high. The amount accepted in high-value lawsuits and adjudications accounts for more than 70% of the total lawsuit and adjudication refund amounts, significantly impacting the increase in appeal refunds.

Looking at the appeal refunds from lawsuits and adjudications last year, out of the total lawsuit refund amount of 1.1009 trillion won, the amount lost in high-value cases exceeding 5 billion won reached 760.7 billion won. In the case of adjudications, out of the total appeal refund amount of 673 billion won, the high-value loss amount accounted for 368.2 billion won.

The loss (acceptance) rate for high-value lawsuit and adjudication cases has been very high at around 30-40% over the past five years. The five-year average loss rate for high-value lawsuits was 33.9%, three times the overall average of 11.2%, and the adjudication case loss rate was also 38.2%, far exceeding the overall adjudication case loss rate of 27.7%.

Assemblyman Kim Ju-young pointed out, "The scale of national tax refunds returned to taxpayers due to appeals is considerable, and the volume of appeal claims is increasing," adding, "Appeal claims cause taxpayers to bear significant costs for responding to appeals, causing psychological and economic difficulties." He continued, "If the appeal results in a final confirmation of incorrect taxation, trust in national tax administration is greatly undermined," and added, "Especially given the high loss rate in high-value lawsuits and adjudications, the National Tax Service must establish measures to reduce appeal refunds and the loss rate in high-value appeal cases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.