[Asia Economy Reporter Ji Yeon-jin] Used car platform K Car is set to enter the KOSPI market at the end of this month.

According to the financial investment industry on the 26th, K Car will conduct demand forecasting for institutional investors on the 27th and 28th of this month, and will accept public subscription from general investors on the 30th of this month and October 1st. The expected offering price is 34,300 to 43,200 KRW, with a public offering size of 577.3 billion to 727.1 billion KRW. The market capitalization is expected to be between 1.6494 trillion and 2.0773 trillion KRW.

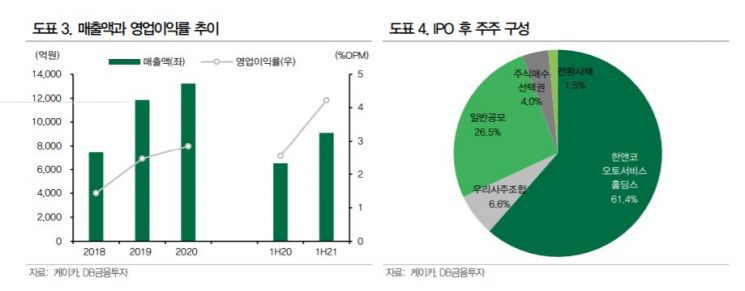

K Car is a company engaged in used car wholesale and retail as well as rental car business. It was launched in 2000 as Encar Network, the first company of SK Group's 'Vision 21 Project,' and in 2018, it was acquired by private equity firm Hahn & Company, changing its name from SK Encar Direct to K Car. Hahn & Company's subsidiary, Hahn & Co Auto Service Holdings Ltd., is the sole shareholder holding 100% of the company's shares.

Based on the certified used car model, it sells used cars to general consumers through both online and offline channels. It also operates an auction site for used car dealers. In 2020, Hahn & Company merged its affiliate Joy Rent-a-Car into K Car, expanding into the rental car business.

K Car's used car business segment purchases vehicles from its own platform, new car dealerships, and rental car companies, and sells them wholesale and retail. Last year, it sold about 90,000 certified used cars through its B2C channel and listed about 30,000 vehicles through its B2B auction channel. Although it is the number one company in the domestic used car market, its market share last year was only about 3.4%.

On the other hand, in the rapidly growing used car e-commerce market, it is estimated to handle more than 80% of the total transaction volume.

Unlike leading companies with a new car-centered sales structure, the rental car business segment focuses mainly on used car rentals (re-rentals). In the first half of this year, the sales composition by business segment was 97.5% for used cars (offline 53.0%, e-commerce 36.6%, auction 7.6%, others 0.3%) and 2.5% for rental cars.

Sales in the first half of this year reached 910.6 billion KRW, a 39.9% increase compared to the same period last year, and operating profit recorded 38.5 billion KRW, up 131.8%. DB Financial Investment analyst Yoo Kyung-ha said, "The expansion of used car demand due to delays in new car deliveries has positively impacted performance, and the increase in the proportion of relatively profitable e-commerce sales contributed to this growth,

and the rental car segment, which started contributing to this year's performance, also recorded an operating profit," he added.

Operating cash flow also surged from 16.5 billion KRW in the same period last year to 44.9 billion KRW in the first half of this year. Net borrowings increased from 83.7 billion KRW at the end of last year to 106.9 billion KRW at the end of this half-year, influenced by dividend payments of 34.7 billion KRW. However, since Hahn & Co Auto Holdings returned the full amount of dividends on the 19th of last month, it is expected that net borrowings will significantly decrease in the third quarter of this year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.