Anticipated Battle for 2nd Place with K Bank

Customer Acquisition and Product Competitiveness Are Key

[Asia Economy Reporter Kiho Sung] As Toss Bank is set to enter the internet-only banking market as early as next month, the internet banking market, which had been divided between Kakao Bank and K Bank, is expected to undergo significant changes. Industry insiders anticipate that with the emergence of a three-player structure, market competition will become even fiercer. In particular, while Kakao Bank is taking the lead, a fierce battle for second place is expected between K Bank and Toss Bank, both fighting for pride.

According to the financial sector on the 3rd, as of the end of last month, Kakao Bank had 17.17 million customers, with deposits and loans amounting to 27.7586 trillion KRW and 24.5133 trillion KRW, respectively. Although K Bank has been rapidly growing recently, it still lags far behind Kakao Bank with 6.45 million customers, 11.45 trillion KRW in deposits, and 5.72 trillion KRW in loans.

For this reason, the industry expects Toss Bank to compete with K Bank once it launches. The investment sector shares a similar view. Recently, global investment bank Morgan Stanley conservatively valued K Bank at 8 trillion KRW. This is similar to the 8.2 trillion KRW valuation investors gave to Toss Bank’s parent company, Viva Republica, in June.

To succeed, Toss Bank needs to focus on user acquisition, competitiveness of deposit products, and loan expansion strategies. The most urgent task is how many customers it can attract in a short period. The competitive landscape of internet banks is such that the number of customers directly translates into competitiveness.

Kakao Bank, which is currently in first place, had a monthly active user (MAU) count of 14.03 million in the second quarter of this year, the highest level in the financial sector. Toss also boasts 11 million MAUs, not far behind Kakao Bank. Therefore, the initial success of Toss Bank will likely depend on how many customers it can attract from Toss’s 11 million MAUs.

Along with this, the competitiveness of deposit and loan products is also crucial. Both Kakao Bank and K Bank attracted customers with highly competitive interest rates compared to other financial institutions immediately after their launches. Although rising interest rates may pose a burden, attractive interest rate products are essential to secure early competitiveness and appeal to customers.

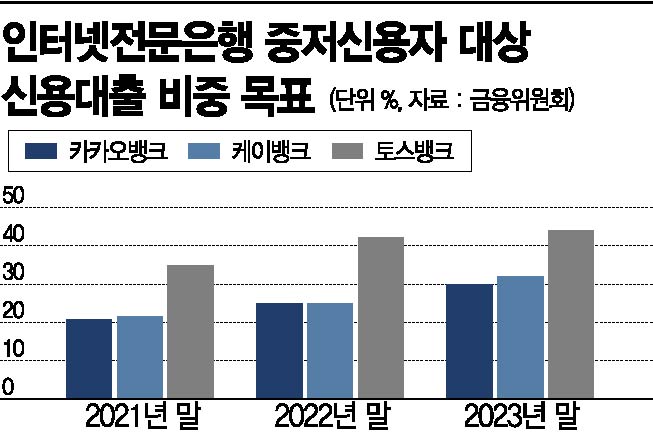

With tightening loan regulations, how much Toss Bank can attract loans from low- to mid-credit borrowers is also a challenge. Toss Bank has set a goal with the Financial Services Commission to achieve a 30% share of loans to low- and mid-credit borrowers this year, increasing to 44% by 2023. This far exceeds Kakao Bank’s 30% and K Bank’s 32%. Since the market for low- and mid-credit loans is not large, the industry is paying close attention to how Toss Bank will target this segment using advanced credit evaluation models.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.