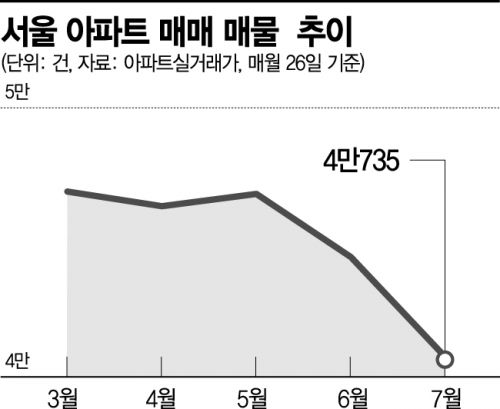

8.4% Decrease in One Month to 40,735 Cases

Gangseo, Geumcheon, Seocho See Over 10% Drop

Jeonse Instability and Supply Shortage Continue, Housing Prices Expected to Rise in Second Half

[Asia Economy Reporter Onyu Lim] The number of apartment listings in Seoul is showing signs of falling below 40,000 units. As soaring apartment prices have proven last year’s ‘panic buying’ to be ‘smart buying,’ buyer sentiment is stirring, leading to a sharp decrease in listings. Although the government continues to warn of a ‘housing price peak,’ the upward trend in housing prices is expected to persist due to rental insecurity and eased loan regulations.

According to real estate big data firm Apartment Real Transaction Price on the 26th, the number of apartment sale listings in Seoul was recorded at 40,735 units as of that day. This is an 8.4% decrease compared to 44,454 units a month ago. Compared to 46,800 units two months ago, it has decreased by 13%. Experts predict that if this trend continues, the number of apartment listings in Seoul is likely to drop to the 30,000 range. Seoul apartment listings have consistently remained in the 40,000 range since February.

By region, Gangseo-gu saw a sharp decline of 15.6%, dropping from 2,124 units to 1,793 units in one month. Following were △Geumcheon-gu (623 units → 537 units) △Seocho-gu (3,923 units → 3,402 units) △Yongsan-gu (854 units → 761 units) △Eunpyeong-gu (1,874 units → 1,685 units), all decreasing by more than 10%.

The rapid decrease in Seoul apartment listings is due to continuous price increases, with sellers willing to sell but buying demand remaining strong. According to the Korea Real Estate Board, the Seoul apartment sales supply-demand index for the third week of July was 107.7, up 2.6 points from 105.1 the previous week. The sales supply-demand index, which had been declining for five consecutive weeks since the first week of last month, rebounded after six weeks.

After the announcement of the 2·4 measures, Seoul housing prices, which had stalled, continued to rise centered on reconstruction and mid-to-low price complexes, leading the market to evaluate last year’s panic buying by the 20s and 30s generation as ultimately the right choice. Despite the government’s warnings of a housing price peak, the enthusiasm for homeownership shows little sign of calming down. In particular, the expansion of loan limits for non-homeowners is further stimulating this buying trend. From this month, the government increased the preferential mortgage loan benefit rate from the previous 10 percentage points to 20 percentage points and relaxed the eligibility from a combined couple income of 80 million KRW or less to 90 million KRW or less.

With buying demand concentrated on apartments priced below 900 million KRW benefiting from the policy change, housing prices in the outskirts of Seoul are also rising sharply. In the third week of July, the apartment sales price increase rate in Nowon-gu was 0.35%, maintaining the highest figure in Seoul for 15 consecutive weeks. Dobong-gu rose from 0.18% to 0.27%, and Gangbuk-gu from 0.12% to 0.18%, both showing increased growth rates. The rise rates in Dobong-gu and Gangbuk-gu are the highest in 2 years and 10 months since the third week of September 2018.

Experts expect that with slow supply of new apartments in Seoul and ongoing rental difficulties due to the new Lease Protection Act, buying demand will continue in the second half of the year and housing prices will rise. Ham Young-jin, head of the Zigbang Big Data Lab, said, "The phenomenon of rental prices pushing up sale prices is likely to continue," adding, "Ahead of next year’s presidential election, real estate pledges by presidential candidates could also stimulate housing prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.