Instagram '#daechul' Hashtag Hits 1.52 Million

Changing Numbers and Deleting Posts to Conduct Irregular Operations

Financial Supervisory Service to Shorten Cooperation Cycle with Related Agencies and Enhance AI

[Asia Economy Reporter Song Seung-seop] Lee Seon-je (29), who borrowed money at high interest rates from secondary financial institutions due to urgent financial needs, came across an advertisement for refinancing loans on Instagram last month. The advertisement page featured photos of the loan consultant’s face and daily life, along with conversations with customers. After seeing the post and thinking it did not seem like an illegal loan, Lee sent his ID card, resident registration transcript, and financial transaction history for the past three months through KakaoTalk open chat to the consultant. A few days later, a 10 million won overdraft account under Lee’s name was opened, but the money disappeared, leaving only an empty account, and the consultant vanished without a trace. It was only then that Lee realized it was all a scam.

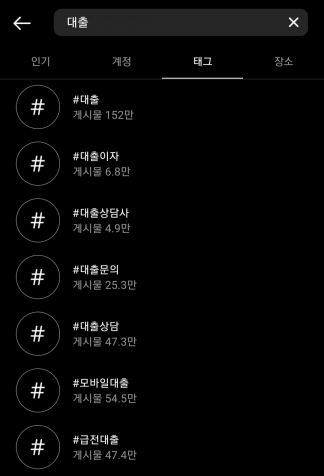

Loan scams that deceive people in urgent situations like Lee by saddling them with debt and stealing money are rampant on social networking services (SNS). On the 22nd, searching for the word “loan” on Instagram yielded as many as 1.52 million hashtags. Keywords such as “loan for unemployed” or “urgent loan” also returned hundreds of thousands of results. On Facebook, entering the same search terms produced posts claiming that even unemployed or low-credit individuals born in 2002 or later could get loans up to 30 million won on the same day.

Illicit Loans Sneak into SNS Subtly... Targeting Thin Filers

They mainly disguise themselves as guides for government-supported low-income financial products like 햇살론 (Haetsal Loan) or pretend to be consultants affiliated with financial cooperative organizations. They use images of the Taegeukgi (Korean flag) that resemble government logos or cleverly alter names like “Seomin Financial Integrated Support Center” to “Integrated Seomin Financial Support Center” to lure users. Some even partially use financial company names like “IBK Loan” or “Complete OK Loan” to appear as legitimate businesses.

Recently, many have started posting not only money-related content but also casual daily life photos to lower users’ guard. Online communities have been flooded with complaints from victims saying things like “I didn’t suspect it was a scam because they showed their face.” Some illegal loan companies even brazenly operate with disclaimers warning about the prevalence of voice phishing scams these days. Given that voice phishing texts and calls are already rampant, SNS has become a hotbed for illegal loan advertisements.

The targets of illegal loan scammers operating on SNS are financially vulnerable groups such as the unemployed, military veterans, and housewives?so-called thin filers who lack sufficient financial history. They find it difficult to borrow money from mainstream banks and formal financial institutions, making them easy prey for illegal loans.

With SNS usage rates rising among middle-aged and older adults, there are concerns that voice phishing scams targeting the elderly, which were once rampant offline, may spread to SNS. Professor Choi Jin-bong of the Department of Journalism and Broadcasting at Sungkonghoe University warned, “As exposure increases even among the elderly, smartphones and SNS have become familiar tools. Phishing that approaches in a friendly and meticulous manner inevitably increases risks and damages.”

The reason illegal loans thrive on SNS is “convenience.” For scammers, posting on SNS is cheaper and more efficient than distributing flyers or making individual calls to promote loans. Moreover, algorithms can naturally lure customers who are already searching for loans on mobile devices. Even if a page disappears or posts are deleted, they quickly recreate them within hours to continue their operations.

Flood of Illegal Loan Advertisements... Financial Authorities Reduce Coordination Cycle and Enhance AI

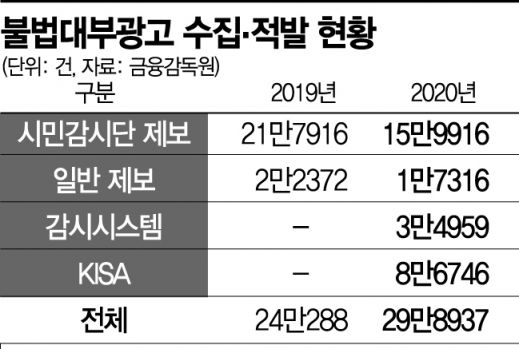

According to the Financial Supervisory Service (FSS), last year, 298,937 illegal loan advertisements were collected and detected, an increase of 58,649 cases (24.4%) from 240,288 the previous year. The FSS suspended 11,188 phone numbers used in these ads and requested the deletion of 5,225 internet posts. The number of deletion requests decreased by 34.8% compared to the previous year. The FSS explained that the main reasons are fewer reports and increasingly sophisticated methods making it difficult to secure evidence.

It is also challenging for financial authorities to strongly block these scams in advance due to the lack of clear legal authority. Under current law, the FSS does not have the power to delete posts or suspend phone numbers posted on the internet and SNS. Post deletions are handled by the Korea Communications Standards Commission, and phone number suspensions fall under the Ministry of Science and ICT. After receiving reports of illegal loan ads, it inevitably takes time to verify and request actions.

When the authorities begin verification to confirm illegal loan ads and request suspension of the numbers used by the accounts, they often receive replies such as “My number was stolen.” It is common for the numbers to be changed before any action is taken. Some posts are set to secret and shown only to certain users as a trick. However, indiscriminately deleting posts is difficult and may provoke backlash and complaints from companies.

The financial authorities are preparing measures to respond to these deceptive illegal loan advertisements. To counter illegal operations that change numbers and links rapidly, they plan to shorten the coordination cycle with the Korea Internet & Security Agency (KISA). They are also upgrading an artificial intelligence (AI) monitoring system, targeted for introduction within this year, to increase detection rates.

The FSS explained that illegal loan ads often use phrases that defy common sense, such as “Anyone can get a loan.” In such cases, it is essential to verify whether the lender is a formal financial company or a registered loan business. Any contract exceeding the legal maximum interest rate is invalid. To prevent further damage, illegal loan advertisements should be promptly reported to the FSS, local governments, or the police upon discovery.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.