[Asia Economy Reporter Lee Seon-ae] 'Manufacturer of golden eggs.' This is how Masayoshi Son, chairman of SoftBank Group, defined the business model of Vision Fund, the world's largest venture capital (VC) under the group. He described the process of taking portfolio companies public as turning white eggs into golden eggs. Coupang is a key portfolio company of Vision Fund, a $100 billion technology investment fund created by SoftBank and Saudi Arabia's Public Investment Fund (PIF), which contributed $28.1 billion and $45 billion respectively to invest in tech startups. Based on the successful NYSE listing of Coupang in March, Vision Fund is actively seeking promising domestic companies. The company drawing attention as the 'second Coupang' is the comprehensive leisure platform Yanolja. Yanolja plans to actively pursue a listing on the U.S. Nasdaq market, leveraging Vision Fund's investment.

According to the VC industry on the 26th, Yanolja is confirmed to be in discussions with SoftBank Vision Fund for an investment of around 1 trillion KRW. The proposal values Yanolja at 9 trillion KRW, with an investment of 1 trillion KRW for a 10% stake. An insider from Yanolja said, "Yanolja and Vision Fund are negotiating and advancing the investment," adding, "However, the investment amount has not been finalized yet, and the planned initial public offering (IPO) is directed at the U.S. Nasdaq market, not the domestic market."

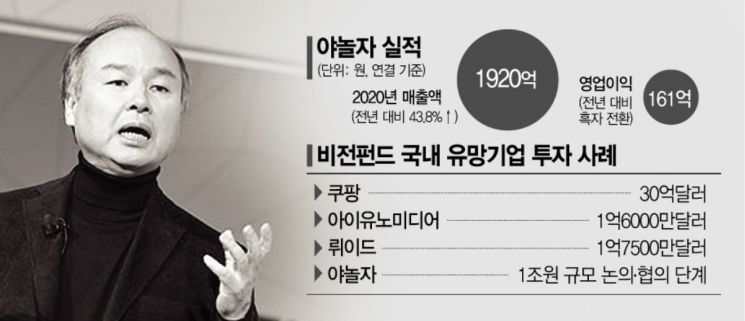

If the investment is successfully secured, Yanolja will become the fourth domestic company to receive investment support from Vision Fund. Previously, Vision Fund invested $3 billion in Coupang, $160 million in iU-NO Media, and $175 million in Riiid.

It is reported that Chairman Son has a strong will regarding investment in Yanolja. In a previous interview, he expressed regret over not investing in the U.S. lodging sharing company Airbnb, which is often compared when discussing Yanolja's valuation. Furthermore, he revealed plans to double the portfolio of startups invested through Vision Fund to about 500 companies and to generate profits by taking dozens of companies public each year.

Yanolja also hopes to attract investment from Vision Fund. Although it has weighed domestic and overseas listings, it is dissatisfied with the lower valuation of Yanolja in the domestic market compared to overseas markets. Securing large-scale investment from Vision Fund means there is no urgent need to list on the domestic stock market, and it is more advantageous to strengthen fundamentals and list on overseas stock markets for better valuation. Domestic securities firms estimate Yanolja's valuation at around 4 to 5 trillion KRW, but Yanolja expects a valuation of at least 10 trillion KRW through a U.S. listing. This expectation is based on the fact that Airbnb, a shared lodging platform with ten times Yanolja's revenue, has a market capitalization of 131 trillion KRW.

Moreover, further investment attraction domestically is becoming difficult. Yanolja became a unicorn (a startup valued at over 1 trillion KRW) in 2019 by surpassing a valuation of 1 trillion KRW. It raised $180 million (about 203 billion KRW) from Singapore's sovereign wealth fund GIC and Booking Holdings. As its valuation soared to the trillion KRW level, the industry consensus is that adjusting investment prices with domestic VCs is challenging. Existing investors in Yanolja include Partners Investment, Murex Partners, AJU IB Investment, SBI Investment, SL Investment, and Skylake Investment.

Last year, Yanolja acquired India's Easy Technosys, which holds the second-largest global market share in the hotel management system (PMS, Property Management System) sector, pushing its B2B transaction volume beyond 11.6 trillion KRW. Despite the impact of COVID-19, it achieved its first operating profit. Last year, it recorded separate sales of 192 billion KRW and operating profit of 16.1 billion KRW. Sales increased by 43.8% year-on-year, and operating profit turned positive from a 6.2 billion KRW loss the previous year. This was the result of enhancing global capabilities by providing cloud-based PMS and other SaaS (Software as a Service) to about 26,000 clients, including hotels, leisure facilities, and restaurants operating in 170 countries worldwide. Consequently, it is evaluated as having diversified its revenue structure through leisure platforms and software services.

An investment banking (IB) industry official said, "Yanolja initially pursued a two-track strategy to list simultaneously in Korea and the U.S., but has currently halted domestic listing efforts," adding, "They plan to successfully complete investment attraction with Vision Fund and proceed with a Nasdaq listing in the U.S." He further noted, "Since there is no precedent for a unicorn company listing domestically with a valuation in the tens of trillions of KRW, conservative valuations are inevitable, making a move to the U.S. a natural step."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.