KOSDAQ Rises 6.14% in One Month

Outperforms KOSPI's 3.31%

Financial Sector Soars 33.64%

Yoon Seok-yeol Political Theme Stocks Also Support Rally

[Asia Economy Reporter Song Hwajeong] Amid ongoing stock market adjustments, the KOSDAQ has shown relatively stronger performance compared to the KOSPI.

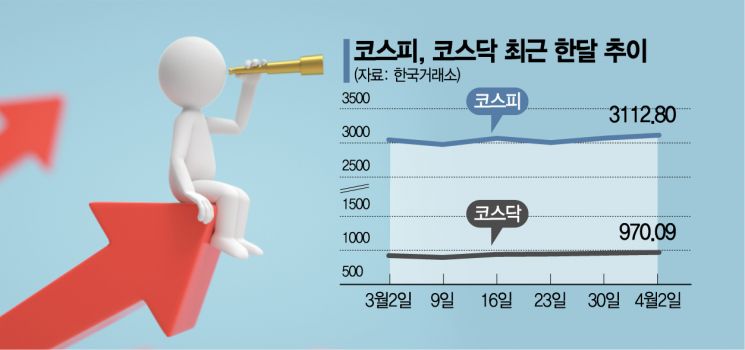

According to the Korea Exchange on the 5th, over the past month, the KOSDAQ rose by 6.14%, significantly outperforming the KOSPI, which increased by 3.31%. On the 2nd, the KOSDAQ surpassed the 970 level, reclaiming it for the first time in a month and a half since February 17.

By sector, all industries showed an upward trend, with the financial sector standing out. The financial sector rose 33.64% over the month. The KOSDAQ financial sector index is mostly composed of SPACs (Special Purpose Acquisition Companies). The recent SPAC investment boom in the U.S. and other countries is believed to have contributed to the strong performance of domestic SPACs. Other sectors with significant gains included Publishing & Media Replication (16.78%), Non-metallic Minerals (15.77%), Paper & Wood (14.56%), and Metals (14.32%).

By individual stocks, the strength of political theme stocks supported the KOSDAQ's rise. NE Neungyul, classified as a Yoon Seok-yeol theme stock, surged 411.81% over the month, marking the highest increase among KOSDAQ stocks. iCraft rose 158.92%, ranking third in growth. Atinum Invest, which surged on rumors of Dunamu's U.S. listing, increased by 168.82%, placing second.

The differing fortunes of the KOSDAQ and KOSPI were driven by supply and demand. Over the past month, individual investors net bought 532.6 billion KRW in the KOSDAQ market, while foreigners and institutions net sold 139.5 billion KRW and 40.4 billion KRW, respectively. In contrast, on the KOSPI, individuals purchased 5.576 trillion KRW, while foreigners and institutions sold 101.5 billion KRW and 5.3821 trillion KRW, respectively. In the KOSDAQ, the net selling by foreigners and institutions was far less than the net buying by individuals, whereas in the KOSPI, the net selling by foreigners and institutions was similar in scale to the net buying by individuals, which is interpreted as limiting the KOSPI's rise. Notably, institutional selling was strong in the KOSPI. Foreigners recorded similar sales of around 100 billion KRW in both KOSPI and KOSDAQ, but institutions sold over 5.3 trillion KRW in the KOSPI compared to about 40 billion KRW in the KOSDAQ.

However, it remains to be seen whether the KOSDAQ's relative strength will continue. The first quarter earnings announcements and the start of short selling in May are likely to be variables. According to financial information provider FnGuide, the market consensus for KOSPI's operating profit in the first quarter of this year is 42.7705 trillion KRW, expected to increase by 82.53% compared to the same period last year. The KOSDAQ's first quarter operating profit is estimated at 1.6322 trillion KRW, a 68.39% increase. Roh Nok-gil, a researcher at NH Investment & Securities, said, "The potential rise of large IT stocks and expectations for the first quarter earnings season create an environment that enables betting on the index itself," adding, "The domestic stock market is likely to gradually shift from small and mid-cap stocks to large-cap stocks."

The resumption of short selling is also a variable. From May 3, short selling will resume only for the KOSPI 200 and KOSDAQ 150. Researcher Roh said, "The supply and demand effect after the short selling ban was greater in small and mid-cap stocks," and analyzed, "In the past, foreign demand worked favorably for the KOSPI when short selling resumed. The resumption of short selling will likely have a relatively greater impact on the KOSDAQ than on the KOSPI."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.