Debt-driven stock buying remains at record highs... Forced sales surge could peak volatility

High volatility correction inevitable... Individual investors shift strategy to 'wait and see'

Brokerage firms forecast correction bottom at 2800-2900 range... Caution advised

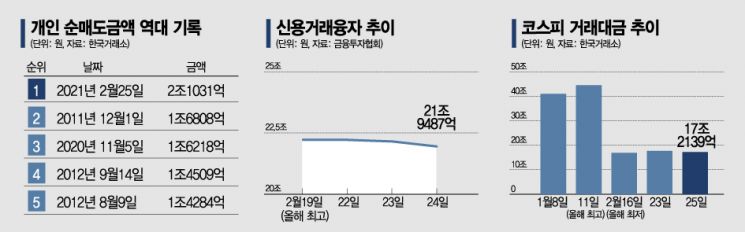

[Asia Economy Reporter Lee Seon-ae] "Has the full-scale bear market begun? I've sold all my profitable stocks, but I'm afraid that I should cut losses on the losing stocks now to minimize the damage. I can't sleep because of the stocks I bought on margin." Recently, internet communities have been flooded with posts from individual investors expressing anxiety about the stock market correction. Especially on the 24th, when the KOSPI index broke below 3000 points, many posts worried about whether the market had entered a bear phase and about forced liquidation of margin loan stocks. This anxious investor sentiment was clearly reflected on the 25th. As the market rebounded in a single day due to foreign investors' buying, individual investors unleashed a record-breaking trillion-won scale of sell orders. The net selling amount reached 2.1031 trillion KRW, breaking the previous record of 1.6808 trillion KRW set on December 1, 2011, after 9 years and 3 months. The securities industry explained that the intense fear of correction and forced liquidation among individual investors triggered the investment psychology of "selling when there is an opportunity."

Record High Margin Trading 'Forced Liquidation Concerns'

Concerns about forced liquidation are rising as the credit loan balance, an indicator of individual investors' 'debt investing (borrowing to invest in stocks),' remains at an all-time high. According to the Korea Financial Investment Association on the 26th, the credit loan balance was recorded at 21.9487 trillion KRW as of the 24th. The credit loan balance reached 19.3523 trillion KRW on January 4, the first trading day of this year, surpassed 20 trillion KRW on January 7, reaching 20.1223 trillion KRW. It then rose to the 21 trillion KRW level on January 14, recording 21.2826 trillion KRW. On the 10th, it hit an all-time high of 21.6354 trillion KRW and continued to break records for six consecutive trading days until the 19th (22.2232 trillion KRW). Although it slightly decreased afterward, it remained above 22 trillion KRW for two trading days.

The longer the correction period lasts, the greater the burden of margin trading becomes. Margin trading involves individuals borrowing money from securities firms to buy stocks, then repaying the principal and interest by realizing profits when stock prices rise. However, if the stock price falls below the collateral ratio, the securities firm forcibly sells the stocks through forced liquidation. The quantity to be sold is calculated at the lower limit price of the previous day's closing price and sold all at once during the pre-market call auction. Since stocks are sold at the lower limit price of the previous day's closing price, forced liquidation causes significant losses to investors. Consequently, when forced liquidations flood the market, volatility inevitably increases. Currently, the actual forced liquidation amount exceeds 20 billion KRW compared to the average daily unpaid balance in February. On the 22nd, it reached 30.1 billion KRW, 28 billion KRW on the 23rd, and 25 billion KRW on the 24th.

Kim Kwang-hyun, a researcher at Yuanta Securities, pointed out, "Credit trading is increasing rapidly compared to the sideways movement of the market index, which could be a factor that expands market volatility in the future." Lee Kyung-min, head of the investment strategy team at Daishin Securities, emphasized, "If the market correction continues, forced liquidation may occur by stock, and the burden of credit balance could increase the scale of the correction and selling pressure."

For the domestic stock market to end the correction and recover a clear upward trend, strong signals such as net buying by institutions and foreigners and improved earnings of domestic companies are necessary. Since it takes time to shift from a 'market driven by speculation' to a 'market driven by earnings,' conservative approaches rather than aggressive leverage (borrowing) are generally advised.

On the 26th, when the KOSPI index started with a sharp decline, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. On that day, the KOSPI opened at 3,089.49, down 10.20 points (-0.33%) from the previous trading day, showing a downward trend. Photo by Moon Honam munonam@

On the 26th, when the KOSPI index started with a sharp decline, dealers were working in the dealing room of Hana Bank in Euljiro, Seoul. On that day, the KOSPI opened at 3,089.49, down 10.20 points (-0.33%) from the previous trading day, showing a downward trend. Photo by Moon Honam munonam@

‘Donghak Ants’ Losing Momentum

The leading force in the stock market has shifted back from the 'Donghak Ants' (individual investors) to 'foreigners.' The influence of foreign investors on the market index direction has become clear. Since February, the market rose when foreign investors were net buyers and fell when they were net sellers. In fact, the stock price rose on 9 trading days this month, and except for one day, foreign investors' net buying perfectly matched the stock price movement. The recovery above 3100 on the 10th and the rebound after breaking below 3000 on the 25th were all thanks to foreign investors' net buying.

Individual investors' buying momentum has also weakened. As of the 25th this month, individual investors' net buying amount in KOSPI was only 5.2947 trillion KRW, compared to 24.4563 trillion KRW in January. They have shifted to a wait-and-see strategy rather than aggressive buying. In fact, KOSPI trading volume has remained below 20 trillion KRW, showing a loss of vitality. On the 25th, KOSPI market trading volume was recorded at 17.2139 trillion KRW. The trading volume, which reached 25.0113 trillion KRW on January 4, the first trading day of the year, surpassed 40 trillion KRW on January 8 with 40.9094 trillion KRW and soared to 44 trillion KRW on January 11, setting a record high of 44.4337 trillion KRW. However, as the market remained sideways, the trading volume stayed at about half that level. After falling to 19.7898 trillion KRW, it dropped to the year's lowest level of 16.8461 trillion KRW on February 17. Although the total trading volume reached a record high of nearly 65 trillion KRW last month, it has hovered around 30 trillion KRW since February. This indicates that investors are reluctant to invest actively. Kiwoom Securities researcher Seo Sang-young explained, "The decrease in trading volume is not good for the market, and individual investors are stepping back, showing a strong wait-and-see stance."

Individual investors appear to view the market negatively. This tendency is evident from the 2 trillion KRW worth of sell orders placed the previous day. Individual investors sold about 1.1111 trillion KRW worth of Samsung Electronics, making it the top net sold stock. Next were SK Hynix (344.7 billion KRW) and Hyundai Motor (104.3 billion KRW). They sold a large number of blue-chip stocks that had performed well. On the other hand, the most purchased stock was KODEX 200 Futures Inverse 2X, with 248.2 billion KRW bought. This was followed by KODEX Inverse with 66.7 billion KRW and Hyundai Glovis with about 44.7 billion KRW. They scooped up inverse and leveraged inverse products betting on the index decline.

The securities industry believes that although the market has not fully entered a bear phase, the volatile correction period will continue. Although Jerome Powell, Chairman of the U.S. Federal Reserve (Fed), declared that accommodative monetary policy would continue, concerns about rising U.S. Treasury yields have not subsided. Inflation fears due to rising oil and commodity prices are also dampening investor sentiment. Lee Kyung-soo, head of the Meritz Securities Research Center, explained, "The interest rate level is not alarming, but the faster-than-expected rise is causing significant investor anxiety." Oh Tae-dong, head of NH Investment & Securities Research Center, said, "The peak of Treasury yields is expected in April, so the market atmosphere is likely to remain sideways or in correction until then."

The bottom of this correction period is analyzed to be between 2800 and 2900 points. Kim Byung-yeon, head of investment strategy at NH Investment & Securities, said, "The short-term bottom is expected around 2900 points, but there is a possibility of further decline. However, the recent rapid rise in corporate earnings will support the downside." Lee emphasized, "As KOSPI earnings forecasts have been rapidly revised upward, the support level initially estimated at 2600 points has been adjusted upward to the high 2700s to low 2800s. The correction may not be deep, but caution and vigilance regarding market volatility should be maintained and strengthened for the time being."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.