Consecutive Days of Sharp Rise '55 Dollars per Barrel'... Expected to Reach 65 Dollars in July

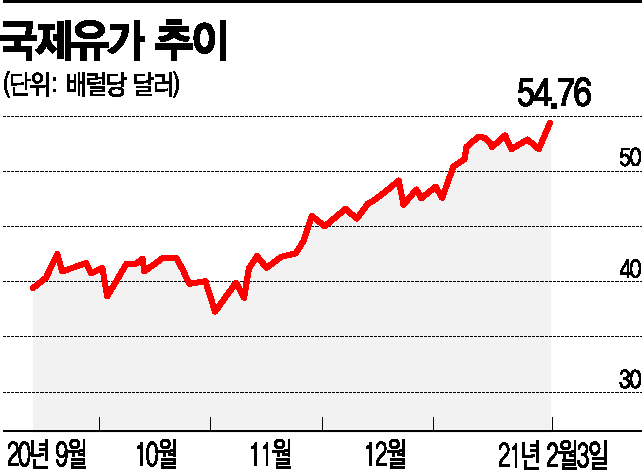

[Asia Economy Reporters Byunghee Park and Yujin Cho] International crude oil prices surged for the second consecutive day, reaching the $55 per barrel mark. On the 2nd (local time), West Texas Intermediate (WTI) crude oil futures traded on the New York Mercantile Exchange (NYMEX) closed at $54.76 per barrel, up $1.21 (2.26%) from the previous trading day. This is the highest level since January 23 of last year. Prices briefly exceeded $55 per barrel early in the session. Bloomberg reported that WTI futures prices surpassed the $55 per barrel mark again during after-hours trading following the regular session close.

Oil prices had fallen below $30 per barrel in April last year due to the spread of COVID-19. However, prices have been rising since the end of last year when COVID-19 vaccines began to be distributed. Expectations are growing that demand, which had been suppressed by COVID-19, will recover. On this day, news of a decrease in U.S. crude oil inventories further fueled the rise in oil prices.

Expectations for demand recovery are also increasing. British oil company Royal Dutch Shell reportedly placed a large purchase order in a North Sea crude oil auction on this day. According to market research firm S&P Global Platts, Shell's order volume was the largest single-company bid since 2008.

Asian crude oil demand has also been confirmed to have increased significantly since the beginning of the year. Bloomberg reported that the volume of crude oil exported from the port of Louisiana to the Asian region last month was the highest ever for January. It explained that the volume exported to South Korea, China, India, and others approached 15 million barrels.

It is analyzed that the oil production of the Organization of the Petroleum Exporting Countries (OPEC) does not meet market expectations. Market insiders expect OPEC to adjust production levels by mid-year to reduce excess supply. Gary Cunningham, director at Tradition Energy, said, "We are seeing major oil-producing countries adjusting production simultaneously with the distribution of COVID-19 vaccines," adding, "These two reasons are causing oil prices to continue rising." Goldman Sachs predicted that oil prices will rise to $65 per barrel by July.

Meanwhile, the refining industry has reportedly suffered large losses last year due to the previous oil price crash and the promotion of eco-friendly policies by various countries. The largest U.S. refiner, ExxonMobil, announced on this day that it recorded a loss of $22 billion last year. Bloomberg reported that this is the first annual loss in at least 40 years. The company posted losses for four consecutive quarters for the first time in its history and wrote down assets worth 19.3 billion dollars in the fourth quarter alone. On the same day, British refiner British Petroleum (BP) also announced a loss of $18.1 billion last year. Earlier, Chevron, the second-largest U.S. refiner, disclosed an annual loss of $5.5 billion last year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.