Increased Investment in Bio·Medical, ICT, and Materials and Components Industries

Non-Face-to-Face Sector Grows by 5.1%, Accounting for 30% of Total

Last Year's Venture Fund Formation Also Hits Record High of 6.6 Trillion Won

Kang Sung-cheon, Vice Minister of the Ministry of SMEs and Startups / Photo by Kang Jin-hyung aymsdream@

Kang Sung-cheon, Vice Minister of the Ministry of SMEs and Startups / Photo by Kang Jin-hyung aymsdream@

[Asia Economy Reporter Kim Bo-kyung] Despite the crisis caused by the novel coronavirus infection (COVID-19), last year's venture investment performance recorded an all-time high of 4.3045 trillion KRW. The bio-medical, information and communication technology (ICT), and materials-parts-equipment related industries led the increase in venture investments.

The Ministry of SMEs and Startups announced on the 27th that the 2020 venture investment performance was recorded at 4.3045 trillion KRW, an increase of 26.8 billion KRW compared to the previous year. The number of investment cases (4,231) and the number of companies that attracted investment (2,130) also set record highs.

Kang Sung-chun, Acting Minister of the Ministry of SMEs and Startups, said at a briefing held at the Government Seoul Office on the same day, "Despite the COVID-19 crisis last year, the venture investment market was hot," and evaluated it as "a year that showed the resilience and future potential of our startup and venture ecosystem."

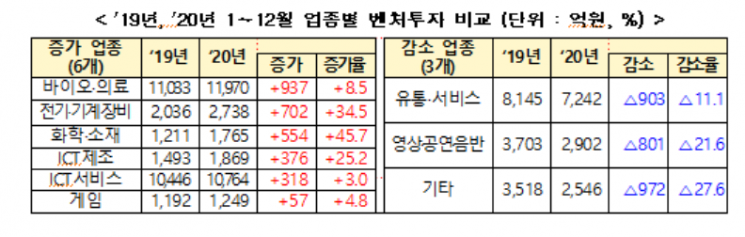

Looking at venture investments by industry, six sectors led the increase in venture investments: bio-medical, ICT fields, and materials-parts-equipment related industries (electricity, machinery, equipment, chemistry, materials, ICT manufacturing), which were highlighted due to the COVID-19 crisis. In particular, the bio-medical industry saw a significant increase in investment in the fourth quarter, becoming the largest portion of total venture investment (93.7 billion KRW, 8.5%).

On the other hand, industries such as distribution and services (-90.3 billion KRW, 11.1%) and video, performance, and music (-80.1 billion KRW, 21.6%), which were generally damaged by the COVID-19 impact, saw a decrease in investment compared to the previous year.

Last year, venture investment in non-face-to-face sector companies was recorded at 1.9982 trillion KRW. In particular, the third quarter saw an increase of nearly 50% (198 billion KRW) compared to the second quarter.

The growth rate of venture investment in the non-face-to-face sector from 2019 to 2020 was 5.1%, about 4.5 percentage points higher than the overall venture investment growth rate of 0.6%.

The top 10 venture capital (VC) firms with the highest investments recorded a total investment performance of 1.2793 trillion KRW, accounting for 29.7% of total venture investments.

Among the companies that attracted venture investments last year, a total of 75 companies secured large-scale investments of 10 billion KRW or more, setting a record high. The number of companies receiving investments of 10 billion KRW or more has been increasing annually, from 20 in 2016 to 54 in 2018, and 75 in 2020.

Last year, newly discovered first-time investments and follow-up investments amounted to 1.446 trillion KRW and 2.8585 trillion KRW respectively, with follow-up investments accounting for 66.4% of total investments.

By industry, the sectors where follow-up investments accounted for more than 70% were bio-medical (847.8 billion KRW, 70.8%) and ICT services (762 billion KRW, 70.8%).

Venture fund formation performance increased by 2.3243 trillion KRW (54.8%) from 2019 to 6.5676 trillion KRW. This is the highest formation figure ever, surpassing the previous record set in 2018 of 4.847 trillion KRW.

Acting Minister Kang Sung-chun explained the factors behind the increase in venture investments as ▲ increased investments in bio-medical, ICT fields, and materials-parts-equipment related sectors during the COVID-19 era ▲ rising expectations for investment recovery due to a booming stock market ▲ the positive market impact of continuous government efforts to create an innovative startup and venture ecosystem, such as the role of the Korea Fund of Funds and the K-Unicorn Project.

He stated, "Despite COVID-19, both venture funds and venture investments achieved record-high performances simultaneously," and added, "This year as well, startups and venture companies will play a key role in the recovery and leap forward of our economy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.