Single-price trading cycle changed from 10 minutes to 30 minutes

[Asia Economy Reporter Minwoo Lee] Preferred stocks priced more than 50% higher than common stocks will be designated as short-term overheated stocks and subject to single-price trading.

The Korea Exchange announced on the 24th that, as a follow-up measure to the "Investor Protection Measures Related to Preferred Stocks" announced by the Financial Services Commission on July 9, starting from the 7th of next month, preferred stocks with a premium rate exceeding 50% compared to common stocks will be designated as short-term overheated stocks and single-price trading will be applied.

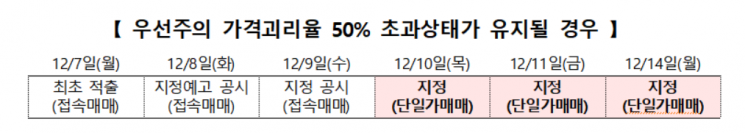

The premium rate is calculated by dividing the difference between the preferred stock price and the common stock price by the common stock price. A premium rate of 50% means that the preferred stock price is 1.5 times that of the common stock. When a stock first shows a premium rate exceeding 50%, the exchange will announce a designation notice. Within the next 10 trading days, the exchange will re-evaluate, and if the premium rate still exceeds 50%, the stock will be designated as a short-term overheated stock and single-price trading will be applied for 3 trading days. If the premium rate does not fall below 50% afterward, the single-price trading will be extended in 3 trading day increments without limit.

For example, if a preferred stock exceeds a 50% premium rate on the 7th and does not fall below 50%, it may be designated as a short-term overheated stock and single-price trading applied as early as the 10th.

As of the 20th, there are a total of 43 stocks (41 KOSPI, 2 KOSDAQ) that meet the designation criteria for short-term overheated stocks due to a premium rate exceeding 50%. Among them, 23 stocks including Samsung Heavy Industries Preferred have already been subject to 30-minute interval single-price trading since September 28 due to insufficient listed shares (less than 500,000 shares). However, whether these stocks will be designated as short-term overheated stocks after the 7th of next month may change depending on future premium rate trends.

Additionally, to increase liquidity through order concentration in low-liquidity stocks, the single-price trading execution interval (for both regular market and after-hours single-price market) will be changed from 10 minutes to 30 minutes starting from the 7th. However, stocks excluded from single-price trading due to designation as liquidity providers (LP) or other reasons will not be affected.

As of the 20th, there are a total of 34 low-liquidity stocks (32 KOSPI, 2 KOSDAQ) scheduled to have their single-price trading interval changed to 30 minutes. Among them, 8 stocks including Samyang Holdings Preferred have already been subject to 30-minute interval single-price trading since September 28 due to insufficient listed shares (less than 500,000 shares). However, the actual stocks subject to 30-minute interval single-price trading may change depending on the monthly evaluation and LP contracts at the end of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.